At the end of 2017 and the first months of 2018, we witnessed a surge of interest in Initial Coin Offerings or ICOs. Perhaps the word “interest” gives too much credit to ICOs. Most are scams. ICOs are pushed through by vendor hype, rather than pulled through by investor research. They are almost all pump-and-dump schemes.

But what about Bitcoin? It is not a scam, but questions remain about regulation, intrinsic value* and its likelihood to be superseded by something better. Bitcoin skeptics point to two facts: (1) Bitcoin is open source, and so anyone can create an equally good altcoin. (2) Newer coins incorporate improvements that overcome governance and scaling issues: cost, transaction speed, the burgeoning electric needs of miners, or whatever…

While both statements are true, they miss the point. This is not a VHS-vs-Beta scenario. Bitcoin has achieved a 2-sided network and it is free to fold in every vetted improvement that comes along. For Bitcoin, all those other coins are simply beta tests.

Even the functional tokens will unwittingly feed their “improvements” into Bitcoin. For this reason, it is a safe bet that Bitcoin will reign supreme for years to come—perhaps even long enough for the dominos to fall.

Why I rarely consult to ICOs or prospective ICO investors

I recently presented at cryptocurrency expos in Dubai and Gujarat. As a result of these presentations, my organization now receives ICO pitch decks, white papers and business summaries—15 or 20 each week. About ⅔ are sent by investors asking for advice as an investment opportunity, while ⅓ are from issuers seeking accreditation from CRYPSA or at least a quote than can be used as a comfort statement.

The market potential for consulting to issuers and high-rolling investors is very alluring. Figuring that we could certify gems and advise the dogs (help them to create a more legitimate token), we put together a business plan to address a massive new consulting opportunity. But guess what?

… They are ALL dogs! That’s right! ICOs are scams. They are not the same as ‘altcoins’, which is a term more commonly used for open source forks of legitimate cryptocurrency platforms.

Now, the SEC has begun to investigate ICOs and for good reason. Most are thinly veiled scams to fleece widows and orphans by ducking under securities regulations. Others are MLM scams, proprietary mechanisms (in which founders or early partners hold all the cards), or they are simply poor/fake implementations of Blockchain services.

How to spot an ICO scam (Hint: They are almost all scams!)

What fraction of ICOs are scams? More than 97% according CRYPSA. To preserve our reputation, we have suspended a high profit project to endorse the hidden gems. Despite scores of applicants, we simply cannot find any worthy of accreditation, with the exception of a few Bitcoin forks. But, these forks are altcoins, and not really ICOs.

Nearly all ICOs that we analyzed fall into one of these categories…

- Veiled securities offerings, designed to duck under securities regulations

- Created for the express purpose of pump & dump (without clearly disclosing caps, reserves or pre-mined stakeholders)

- A non-functioning coin that can only gain value through MLM. (This is not necessarily criminal, but outside our research and advisory mandate. Such coins are unlikely to provide value without quick, speculative trades and market timing that amounts to “dumb luck”).

So, what are the signs that an ICO is a scam? Is there anything you can do—short of hiring an expert—to evaluate each new proposal that comes along?

So, what are the signs that an ICO is a scam? Is there anything you can do—short of hiring an expert—to evaluate each new proposal that comes along?

We don’t advise or recommend holding such risky tokens—but for those attracted to the siren call of ICOs, here are six common tale tell signs that you are dealing with a scam:

- If you received an announcement of an ‘Air drop’ or a coupon to get 25 or 50% bonus coins, it is a scam

- If the value of coins is influenced by your ability to find new investors, it is a scam

- If the coin is not based on Satoshi’s blockchain reference code, or is not open source, peer-to-peer and permissionless, then it is very likely a scam. (There are certain, limited exceptions)

- If the coin is based on Tangle, then it is a scam—or at least, it is functionally useless—and therefore it is a bad investment risk

- If the coin was pre-mined, then it is a scam. All mining by principals, insiders and early buyers must be disclosed and must be at least a full month after the first widely available public announcements

- If any advertisement, announcement, affiliate contact or press release ends up in the hands of someone who did not independently contact the issuer for information and a prospectus, it is most definitely a scam

Are you like me?

Because most initial coin offerings exhibit these traits, I pass on opportunities to consult or present at organizations and conferences that cozy up to ICOs. This decision limits my participation at many crypto venues, but my conscience is clean and my Bitcoin future is secure.

Resist the siren call and keep your wits about you. You, too, can also avoid the illusory trap of ICOs. Run, hide or just ignore them. “These are not the coins that you are looking for.” (with apologies to Obi-Wan Kenobi and Alec Guinness).

* Related:

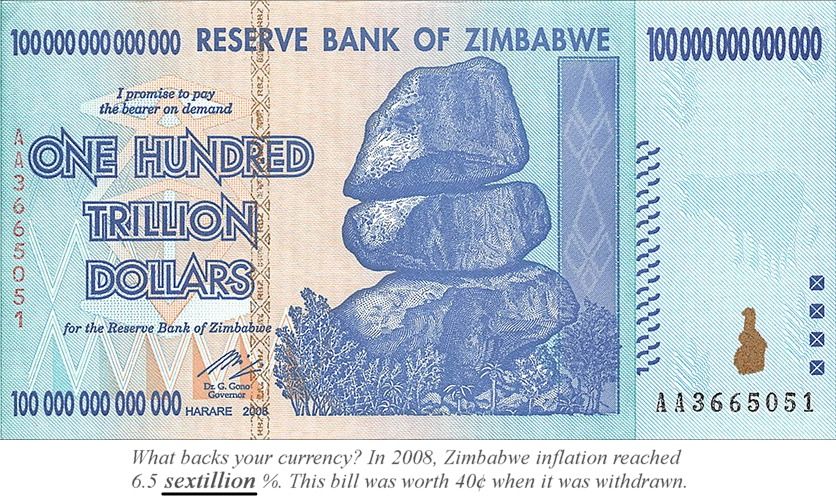

- Spell it Out: What backs Bitcoin?

- ICO’s –vs– Value: Tale of two Bitcoins

- Can Bitcoin be Defeated by Legislation?

Philip Raymond chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He was featuerd at cryptocurrency conferences in Dubai, South Africa and India. Click Here to inquire about a presentation.

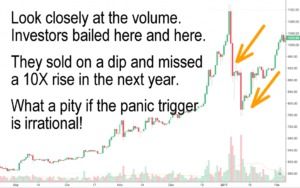

At times like this, you must make a choice: If you can’t afford to stay in the market and risk a bigger drop, then cash out and live with it. But if you believe in crypto and the potential for a digital future that dis-intermediates your earning, spending and savings, then this drop in dollar value presents opportunity.

At times like this, you must make a choice: If you can’t afford to stay in the market and risk a bigger drop, then cash out and live with it. But if you believe in crypto and the potential for a digital future that dis-intermediates your earning, spending and savings, then this drop in dollar value presents opportunity.

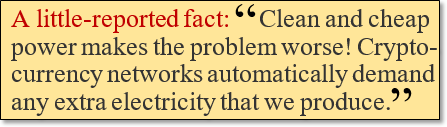

One reader suggests the problem will be solved by the recent boom in shale fracking and renewable, non-polluting energy. He points out that crypto mining may even drive a market for distributed, clean electric production.

One reader suggests the problem will be solved by the recent boom in shale fracking and renewable, non-polluting energy. He points out that crypto mining may even drive a market for distributed, clean electric production.

When I hear of such “bans” (or learn about Jamie Dimon claiming that Bitcoin is a ‘pyramid scheme’ before having all the facts), I become confused and excited…

When I hear of such “bans” (or learn about Jamie Dimon claiming that Bitcoin is a ‘pyramid scheme’ before having all the facts), I become confused and excited…

Bitcoin addresses are currently generated via an algorithm called RIPE-MD160. This further limits the number of possible wallet addresses to 2160 = 1.4×1048). But this reduction is caught when sending, because the checksum uses the same algorithm to validate against a properly formed address.

Bitcoin addresses are currently generated via an algorithm called RIPE-MD160. This further limits the number of possible wallet addresses to 2160 = 1.4×1048). But this reduction is caught when sending, because the checksum uses the same algorithm to validate against a properly formed address.

Printing out a paper wallet does not change your wallet ID. The paper wallet is simply another method of storing and retrieving the proof that you own a part of a mathematical solution set—That is, you know the solution to a problem.

Printing out a paper wallet does not change your wallet ID. The paper wallet is simply another method of storing and retrieving the proof that you own a part of a mathematical solution set—That is, you know the solution to a problem.