Some blogs and news outlets eschew long titles. Publishers want readers to scan a list of topics that fit on one-line each. But, a better title for this article would be:

“Massive electric consumption by cryptocurrency mining:

An unfortunate environmental nightmare will soon pass!

… Proof-of-Work alternatives are on the horizon”

A considerable amount of electricity is used in the process of mining Bitcoin and other cryptocurrencies. Miners are effectively distributed bookkeepers, and this use of resources is part of a system called “proof-of-work”. It keeps the books fair, honest, and without an ability for the miners to collude (In other words, they cannot ‘cook the books’).

What makes the process unique and exciting is that this “distributed consensus” does not require a trusted authority, like a bank. In fact, the whole point of the blockchain revolution is that users trust a mechanism rather than a bank, government or even each other.

But, for any network that hopes to become part of the financial fabric, it must be ubiquitous and in constant motion. Proof-of-work just doesn’t make the grade, because it doesn’t scale. The need for miners to prove that they did something complex sucks up too much power. If Bitcoin or any proof-of-work currency were to be adopted for even a small fraction of commercial and personal transactions, it would overwhelm the world’s energy services.

One reader suggests the problem will be solved by the recent boom in shale fracking and renewable, non-polluting energy. He points out that crypto mining may even drive a market for distributed, clean electric production.

One reader suggests the problem will be solved by the recent boom in shale fracking and renewable, non-polluting energy. He points out that crypto mining may even drive a market for distributed, clean electric production.

Unfortunately, clean and cheap power makes the problem worse. Even if electric capacity were to rise dramatically and experience a great cost reduction, cryptocurrency networks would automatically demand all the extra electricity. It is a no-win game, because mining incentives escalate with an increase in supply or drop in cost.

Will large-scale, blockchain-based networks fail, because of enormous electric demand? Fortunately, the future is not so bad, after all. Although networks, like Bitcoin, currently use proof-of-work to ensure honesty and fairness, it is only one of many possible measurement and enforcement mechanisms. Eventually, developers and miners will swap in another proof mechanism to keep the network humming—and without creating an environmental catastrophe.

Will Change in Proof Come in Time?

The political process for changing the fairness mechanism (“forking the code”) is complex and fraught with infighting, but the problem will eventually be addressed, and it will be solved before electricity becomes a critical issue. Despite a messy voting process, the miners have too much at stake to ignore this problem much longer.

Various proof alternatives are already being used in altcoins. Since Bitcoin is perfectly free to steal these techniques (none can be protected by patent or trade secrecy), we can think of these other coins as beta-tests for Bitcoin. How so? As the first and biggest elephant in the room, Bitcoin will likely reign supreme, as long as it doesn’t wait too long before grabbing the best technology and tucking it into its quiver.

Proof-of-Work Alternatives

- One method, already used by some altcoins, is called “proof-of-stake”. It’s a bit like getting voting rights based on how much land you own. This method does not demand lots of electricity—but some analysts feel that is not as fair, because it cedes network control to the wealthiest members.

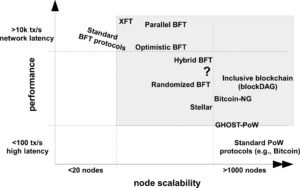

- Another method, called BFT Replication was developed by Marko Vukolić, at the IBM Blockchain Group in Zurich Switzerland. It might be exactly what we need.

- Yet another method was proposed by C.V. Alkan, an amateur analyst with a passion to solve this problem. He calls it Distributed Objective Consensus.

These aren’t the only alternatives to proof-of-work. Ultimately, one or more of these fairness enforcement mechanisms will make its way into Bitcoin and other currencies and blockchain services. In my opinion, the electrical crisis is a genuine threat, but it is one that with a solution that will be implemented soon—perhaps even this year.

Related:

- Distributed Consensus: Beyond POW or POS

- Blockchain Scalability: Proof-of-Work vs BFT Replication

- Incentivize Bitcoin Miners After All 21M BTC Are Awarded

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He is keynote speaker at the Cryptocurrency Expo in India this month. Click Here to inquire about a presentation or consulting engagement.

Regarding the first elephant, scalability, Bitcoin urgently needs to grow its Blockchain dynamics into something that is living and manageable. To that end, Vukolić refers to a transaction bookkeeping mechanism that works as a “fabric”. That is, it does not require every miner to access the history-of-the-world and append each transaction onto the same chain in serial fashion. Rather than growing an ever bigger blockchain—with ever bigger computers—we need a more 3D approach that uses relational databases in a multi-threaded, transactional environment, while still preserving the distributed, p2p trust mechanisms of the original blockchain.

Regarding the first elephant, scalability, Bitcoin urgently needs to grow its Blockchain dynamics into something that is living and manageable. To that end, Vukolić refers to a transaction bookkeeping mechanism that works as a “fabric”. That is, it does not require every miner to access the history-of-the-world and append each transaction onto the same chain in serial fashion. Rather than growing an ever bigger blockchain—with ever bigger computers—we need a more 3D approach that uses relational databases in a multi-threaded, transactional environment, while still preserving the distributed, p2p trust mechanisms of the original blockchain.