My own 2013 book Catalyst: A Techno-Liberation Thesis offered a prediction of the political future, viewing the near-term future as a time of crisis shaped by the nature of technology and the slowness of states to adjust to it. As this struggle becomes more acute, guarded new technologies will also get stolen and overflow across borders, going global and penetrating every country before they were intended to. States and large companies will react with bans and lies as they try to save their monopolies. Ultimately, over a longer time-frame, the nation-state system will collapse because of this pressure and an uncertain successor system of governance will emerge. It will look like “hell on earth” for a time, but it will stabilize in the end. We will become new political animals with new allegiances, shaped by the crisis, much as the Thirty Years’ War brought about our Westphalian nation-state model. Six years on from my book, are we any closer to what I predicted?

- The internet is “liberating” and “empowering” in a political sense (pp. 2, 3)

- Uncertain outcome. Will current habits of censorship, de-platforming and other techno-enslavement as a result of controversies like “Russiagate” persist or are they temporary? If the economically or commercially favorable course is one of freedom and the removal of all filters and bans, will we see a reversal in the next few years? As younger politicians replace the old, will the internet become a sacred anarchy again?

- “Duplicitous policies” preserve the status of rich countries as exploiters and bullies (p. 11)

- Yes, and it is increasingly obvious. Such policies became exposed and visible under the Trump administration, which openly declares its national interest to lie in the economic deprivation of others and sabotage of their tech. This has been criticized as harmful to free trade, and has been described as “de-globalization”. Even Russian President Vladimir Putin remarked that the tech war complicates the issue of global inequality (a rare observation seemingly asserted only in the Catalyst Thesis before recently).

- “Nano” and “bio” appliances will be in the household and will “shrink” production processes, abridging these processes so they are not corporate or state controlled and are in the “hands of the people” (p. 15)

- This is uncertain. If there has been progress towards this outcome, it is not visible and has not had a major impact on world events. The possibility of it has started to cause concern for states and monopolistic schemes, but this is more in the ‘alarm’ stage rather than the ‘ban’ stage. More time may be needed, before this trend has a deeper impact on society.

- The nation-state system is being weakened by technology, media and globalization (p. 16), anti-state forces are “winning”

- Well, not really. As of 2019, unless everything we just saw was a hiccup in the grand plan of history, the “ideological mask” of exploitation and division — the nation-state system — has reasserted itself. In almost every policy area in every country, the clock is running backward towards nationalism, censorship, borders, walls, and deep paranoia. Almost everyone on the political left and right is part of the problem, wittingly or unwittingly. Whether you support Trump or think he’s a Russian asset, or even care, your views and values are right out of the Nineteenth Century. We have seen the defeat of net neutrality, along with the passive acceptance of censorship on social media in the foolish assumption it will only be used on targets we dislike or who went too far. There seems to have been a lack of any major follow-up disclosures of government abuses on the scale of Edward Snowden’s, and whether it will ever happen again is questionable. With all these things considered, “losing” might be a better description of the situation for anti-government techno-politics as of 2019. If what is happening is not a minor disruption in the flow of history, it is consequential for the Catalyst Thesis and severely undermines its value. If the “soft” battle is lost as described above, and we revert to a society dominated entirely by strong states and corporations, the “hard” battle of techno-liberation may never start in our lifetimes.

- Historical transitions are “dark and filled with reaction” (p.23)

- Yes. This appears to still be the case. The reaction may be what we are already facing, as all elites invested in the old system desperately try to suppress the global political will, motivated by fear of a new world order in which they are demoted.

- “Open-borders global political will” will form as a result of the internet, translation software, and the difficulty of statists in managing the overflow of popular technologies and their users (pp. 24, 25)

- Yes. Almost every attempt by the media conglomerates and/or state to create a uniform public opinion about an election, a global issue, a scandal, etc. is failing because of alleged foreign “trolls”. They cannot be stopped because the internet’s circulatory system is not for one nation, but completely open to the world. That is the whole point of it, the reason it is the internet. The US 2016 election was the most visible example of the loss of control. Repressive and paranoid statements ensued. But, as of 2019, governments and media still gasp at the results they are getting.

- We will see new or experimental technologies shared illegally, the way information is leaked (p. 37)

- Uncertain. Edward Snowden and Wikileaks do not seem to have captured as many imaginations as they should have, given how central they have been in the story of the internet. It is difficult to argue that the next generation will be even more rebellious, if they are to grow up in a much more monitored and conformist society. If the anarchy of the internet is going to be stopped and the smallest infractions punished as treason, this will damage the thinking of younger people who should have grown up noticing the contradictions in society. If, on the other hand, younger people are increasingly trained to be highly capable in the cyber-world (e.g. coding classes), we may see an even bigger generation of cypherpunk rebels accidentally raised by the state.

Catalyst is read in less than a day, and can be found on Kindle as well as in print. It was written to bring together a number of ideas and predictions I presented in articles at the IEET website, h+ Magazine, and other websites and includes full lists of sources. If you prefer to see more first, follow @CatalystThesis on Twitter or sign up to the email newsletter.

They state that doing this fulfills Jihad and prophecy and is sanctioned by the Holy Qur’an. With this in mind, I the choice of poll responses is political, selfish and offensive. It assumes that readers are idiots…

They state that doing this fulfills Jihad and prophecy and is sanctioned by the Holy Qur’an. With this in mind, I the choice of poll responses is political, selfish and offensive. It assumes that readers are idiots…

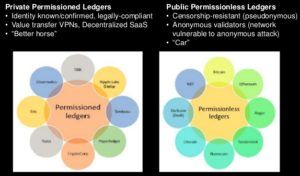

▪Open-source

▪Open-source After all, doesn’t there have to be someone who authenticates a transaction, guarantees redemption, or at least someone who enforces a level playing field?

After all, doesn’t there have to be someone who authenticates a transaction, guarantees redemption, or at least someone who enforces a level playing field? But not the transaction itself. (Ah-hah!). These outside authorities only become involved (and only tax the system), when there is a dispute.

But not the transaction itself. (Ah-hah!). These outside authorities only become involved (and only tax the system), when there is a dispute.