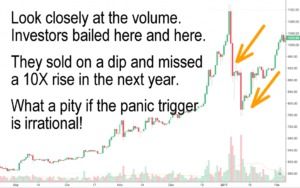

Join me for a quick review of the spikes & dips in the Bitcoin exchange rate. This time, it’s all about one very simple chart…

The chart below shows a history of BTC price spikes, dips and recovery. Click to enlarge, then start at the top—and move down.

- Consider the percent-pullback after each spike (red label)

- Think about the stellar rebound after each drop (green label)

This is why I do not get too worked up over the plunge in the BTC exchange rate. There are no fundamental flaws in Bitcoin math or mechanisms. The market need for the benefits conveyed by Bitcoin is terrific, and the most popular arguments against Bitcoin are severely flawed. Skeptics and Critics typically say something like this:

“Even if blockchain currencies are beneficial and inevitable, Bitcoin can be displaced by another, better cryptocurrency.”

—OR—

“A viable crypto may emerge—but it will be one that is backed by a tangible asset or issued/sanctioned by government.”

These arguments are false. They are made by individuals who don’t yet fully appreciate the mechanism and its relationship with trust, money, government and free markets.

What Bitcoin currently lacks is education, familiarity, standards, simple commercial tools (built upon clear analogies), definitive best practices, a widespread understanding of multisig & security, and limited recourse for certain commercial & retail transactions. But Bitcoin is still an infant, just like the early TV or the early telephone. All of these are under development—without a hint of significant obstacles. Even the messy process of democracy among the various stakeholders is heading toward harmony (miners, developers, vendors, exchanges and consumers).

Of course, I am bullish on Bitcoin, and this may color my analysis. But, I try hard to keep an open mind. There have been moments in its history where I have questioned the market need or the potential for a setback in politics, legislation, or the mechanism itself. Those doubts are in the past. Bitcoin has demonstrated the elegance and value of the blockchain—and the ability to evolve beyond the blockchain with SegWit and Lightning Network. It has achieved a fluid, robust and growing two-sided market.

No one holding assets likes to see a big price pullback. It’s natural to look at the market as if we each got in at the peak—and then tally the “losses”. But I, for one, am not glancing toward the exit. I see the future and I sleep well at night. I am comfortable participating in the Bitcoin era.

Philip Raymond co-chairs CRYPSA, hosts the Bitcoin Event and is keynote speaker at Cryptocurrency Conferences. He sits on the New Money Systems board of Lifeboat Foundation and is a top writer at Quora. Book a presentation or consulting.

At times like this, you must make a choice: If you can’t afford to stay in the market and risk a bigger drop, then cash out and live with it. But if you believe in crypto and the potential for a digital future that dis-intermediates your earning, spending and savings, then this drop in dollar value presents opportunity.

At times like this, you must make a choice: If you can’t afford to stay in the market and risk a bigger drop, then cash out and live with it. But if you believe in crypto and the potential for a digital future that dis-intermediates your earning, spending and savings, then this drop in dollar value presents opportunity.

they had

they had  I believe that they will give me my forked coins—eventually. They have already acknowledged to conspiracy theorists that they will not keep the forked BCH, in the event that they create a conversion mechanism. In that case, they will allow withdrawal by the owner of the associated BTC. Now that they see dramatic fractional value, how could they not complete the fork?!

I believe that they will give me my forked coins—eventually. They have already acknowledged to conspiracy theorists that they will not keep the forked BCH, in the event that they create a conversion mechanism. In that case, they will allow withdrawal by the owner of the associated BTC. Now that they see dramatic fractional value, how could they not complete the fork?!