The future of the legal industry is being reshaped by a number of rapidly advancing technologies and the disruptive ideas they enable. Today’s lawyers are being advised to learn to code, develop an artificial intelligence (AI) application, and outsource discovery to machines. Of the many new technological drivers impacting law firms is the secure information exchange platform known as blockchain. Some see it as a the basis for the reinvention of economies while others simply see it as means of secure and incorruptible information exchange between counterparties. This cloud-based distributed ledger technology provides a source of irrefutable record of every transaction. In legal it is enabling fully automated self-executing “smart” contracts, and has the potential to help attorneys provide new services and create new value for clients and law firms. Blockchain is known as the structure underlying Bitcoin and other digital currencies, but its applications in the legal sector are still evolving. This article provides an overview of the technology, highlights example applications and case studies, and presents a possible timeline of future developments over the next decade or so.

Overview: Blockchain and Bitcoin

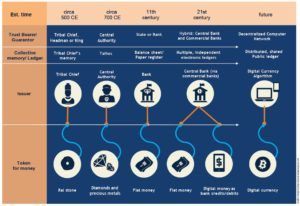

Blockchain and Bitcoin have gained notoriety lately as a potential solution to an outdated and burdensome system for managing financial transactions between counterparties. Today most financial transactions between counterparties are settled via financial intermediaries which adds time and cost to the settlement process. Blockchain offers a distributed ledger model whereby the parties settle directly with each other, the transactions are recorded, secure, and immutable, and the counterparty identities remain anonymous. The goal is to enable a simplified and trustworthy financial ecosystem- but these digital peer-to-peer networks, also challenge the authority of institutions (banks, regulators, and governments) and are thus creating disruption.

According to its advocates, the decentralized nature of blockchain and Bitcoin will cause much-needed disruption, with reverberations far beyond the financial realm. There is an element of social revolution in blockchain, thus it is often portrayed as a conduit for challenging the status quo. Though Bitcoin, a digital currency, is an explicitly financial innovation (i.e., for payments, transfer of funds) blockchain is far less specific. Blockchain serves a critical role in the administration of Bitcoin, and that of other digital currencies, but it can actually be used to complete other objectives and track the movement, transfer, and ownership of all sorts of things besides money (examples include luxury goods, education credits, property titles, and patents, to name a few). Though blockchain is structured like a traditional accounting tool—it’s fundamentally a ledger that tracks deposits in and payments out, and maintains a running balance—its uses go far beyond counting coins.

Lest we assume blockchain and Bitcoin are solely the tools of the far-left, libertarian, anarchists, and socialists among us, this technology has captured the attention of global business and industry to the tune of millions of dollars. Among banks alone, one source projects spending on blockchain solutions to grow to over $200 million in 2017, $300 million in 2018, and $400 million in 2019. Perhaps ironically, a great wave of enthusiasm for blockchain now emanates from the business establishment, including stalwarts like banking, finance, real estate, and law.

Applications to Law Firms

While the basic metaphor for blockchain is an automated checkbook register that instantly reconciles transactions, several concepts are inherent to blockchain which are ideally suited for applications to law firms. Current legal industry activity around blockchain ranges from the simple—payment for services rendered, verification of contracts, representing companies conducting business on the blockchain—to the highly complex—formulation of an entirely new legal system altogether. Regarding the latter, which would usurp local or national laws to create a globally agreed upon set of codes that govern rights during a dispute, one can see how incredibly large-scale blockchain’s legal applications could potentially become. In terms of contracts and payments, though, the firms now adopting blockchain are attracted to its practicality: it reduces the resources needed to complete day-to-day operations. For example, Goldman Sachs estimates that $11 to $12 billion per year could be saved with blockchain-based clearing and settlement of cash securities, and $2 to $4 billion yearly savings from moving real estate titles to distributed ledgers.

A growing number of industry examples demonstrate the diversity of applications of blockchain and bitcoin to legal services:

- International law firm Steptoe & Johnson helps clients in all industries manage application of the blockchain in their businesses, and accepts Bitcoin as payment for fees.

- King & Wood Mallesons (headquartered in Hong Kong) has more than a few dozen lawyers who have a focus on blockchain, including smart contracts.

- Perkins Coie LLP partner Dax Hansen (US) launched the first blockchain legal industry practice in 2013, which has grown to over 40 lawyers focused on blockchain technology, digital currencies, and distributed applications of all types.

- Selachii (UK) will implement self-executing smart contracts on blockchain, starting with wills, title registries, and shareholder agreements.

- Allens (Australia) wrote a report suggesting that the future of the legal business model, which profits from an absence of trust between organizations, is imperiled by the rise of blockchain technology.

Outside of law firms themselves, the startup ecosystem is packed with examples of services geared toward marrying procedural business practices with blockchain:

- Juro uses blockchain technology to underpin the creation and signing of legal contracts.

- The Decentralised Arbitration and Mediation Network (DAMN) operates as a network of smart contracts on the Ethereum blockchain creating an “opt-in justice system for commercial transactions” as a new form of cross-border dispute resolution.

- CommonAccord is creating global codes of legal transactions, automating legal documents such as master service agreements.

- DAO.LINK is an initiative which facilitates brick-and-mortar business interactions with blockchain-based organizations.

Timeline of Possible Future Blockchain Developments in Law

Next 3 years

- DAOs: Distributed autonomous organizations with no workers and no bosses, just algorithms.

- Merger and acquisition on “auto pilot”.

- Elimination of some jobs and roles (banker, advisor, lawyer).

- Merging AI and blockchain; robolawyers on blockchain.

Next 5 years

- DAMN – a global legal system for international dispute resolution.

- Automated arbitration, dispute resolution, and various legal and banking processes eliminating more roles in law firms and banks.

- Creation of new professional roles to deal with legal ramifications of blockchain.

5–10 years

- Algocracy: Law is code, code is law.

- DAS: distributed autonomous societies with automation of services, justice, rights, and laws.

Blockchain and cryptocurrency have gained unprecedented ground. The central bank of China is piloting a blockchain-based cryptocurrency, a very loud signal about the rising status of the technology which will legitimize its use. Another recent indicator came in the form of headlines screaming about Bitcoin’s price trends, earning investors millions. As futurists, we expect that for every big wave of change there are dozens of small ripples; the revolutionary nature of Bitcoin and blockchain means it will disrupt businesses of all kinds. Because it involves money, contracts, and ownership, this is a special consideration for lawyers and firms.

Starting now, law firms owe it to their staffs and teams to begin a conversation about blockchain, Bitcoin, and other digital currencies. Information, in this case, is power—blockchain’s distributed disruption of banks, laws, and most traditional social institutions will generate new conflicts, anxieties, and tensions for which legal remedy will be the only solution. It is a likely topic of future legal matters.

Keep in mind that the best way of describing blockchain is “distributed,” in other words, absent of central authority. A lot of the projects in the works seek to apply this thinking to society at large through distributed autonomous societies (DAS) and distributed legal systems. If a distributed mindset prevails, this will concern lawyers, judges, law enforcement, and anyone in occupations that rely on a centralized legal system.

Furthermore, the entire basic model of business conduct stands to be disrupted on the same scale as it was during the rise of the internet as a business tool—blockchain, in combination with other technologies like artificial intelligence and cloud computing—will eventually transform the very basis of business and productivity, possibly even money itself. By decentralizing the powers that be, blockchain seems to be the high-tech disruption that will challenge law at every level and function.

ABOUT FAST FUTURE

Fast Future publishes books from future thinkers around the world exploring how developments such as AI, robotics, and disruptive thinking could impact individuals, society, and business and create new trillion-dollar sectors. Fast Future has a particular focus on ensuring these advances are harnessed to unleash individual potential and enable a very human future. See: www.fastfuture.com

Rohit Talwar is a global futurist, keynote speaker, author, and CEO of Fast Future where he helps clients develop and deliver transformative visions of the future. He is the editor and contributing author for The Future of Business, editor of Technology vs. Humanity and co-editor of a forthcoming book on Unleashing Human Potential—The Future of AI in Business.

Alexandra Whittington is a futurist, writer, faculty member on the Futures programme at the University of Houston, and foresight director at Fast Future. She is a contributor to The Future of Business and a co-editor for forthcoming books, Unleashing Human Potential—The Future of AI in Business and 50:50—Scenarios for the Next 50 Years.

2. Deciding Factor

There are few individuals for whom direct and private ownership makes sense. In fact, until this month, it did not make sense for me. I am only now configuring my first hardware wallet. I still trust Coinbase to host and control most of my assets. The reasons boil down to security, forgetfulness, errors, legacy ownership and instant access. The ONLY factor that is arguably better with personal custody & control is privacy.

Due to a lack of education, standards, and definitive best practices, this option makes sense for fewer than 5% of Bitcoin owners. Take me, for example… I have been involved with Bitcoin since the first years of its existence, and have been a Bitcoin educator since shortly after Satoshi’s original bombshell. Today, I am a keynote presenter at blockchain and cryptocurrency conferences. I teach blockchain seminars, design courseware for colleges, and am co-chair of the Cryptocurrency Standards Association and partner in Blockchain Research Council.

Yet, I am only now configuring my first hardware wallet. I still trust Coinbase to host and control most of my cryptocurrency.

How do I know if I am a candidate for full / private control?

Using an exchange hosted wallet service is best for most individuals. But, for some, it makes sense to maintain private, local control of blockchain assets. If all criteria in the bulleted list below applies to you, then local and private ownership might make sense. But if you fail even one criteria, then WAIT! Wait until multisig becomes uniform and ubiquitous — and wait until a larger fraction of society is comfortable with the concept and practice of managing private keys. These are gradually becoming new norms. But, it will take a few more years for the world to become comfortable with an unfamiliar concept: personal control of a decentralized asset. You are a candidate for using a personal wallet if you plan to control and secure your own private keys, and if you meet all conditions listed below. The technical criteria will not be requisite in the future—but they are necessary today, because the market currently lacks simple, standardized, widespread tools and uniform practices for safely securing, accessing and passing on these credentials to your heirs. Do all of these criteria apply to you?

2. Deciding Factor

There are few individuals for whom direct and private ownership makes sense. In fact, until this month, it did not make sense for me. I am only now configuring my first hardware wallet. I still trust Coinbase to host and control most of my assets. The reasons boil down to security, forgetfulness, errors, legacy ownership and instant access. The ONLY factor that is arguably better with personal custody & control is privacy.

Due to a lack of education, standards, and definitive best practices, this option makes sense for fewer than 5% of Bitcoin owners. Take me, for example… I have been involved with Bitcoin since the first years of its existence, and have been a Bitcoin educator since shortly after Satoshi’s original bombshell. Today, I am a keynote presenter at blockchain and cryptocurrency conferences. I teach blockchain seminars, design courseware for colleges, and am co-chair of the Cryptocurrency Standards Association and partner in Blockchain Research Council.

Yet, I am only now configuring my first hardware wallet. I still trust Coinbase to host and control most of my cryptocurrency.

How do I know if I am a candidate for full / private control?

Using an exchange hosted wallet service is best for most individuals. But, for some, it makes sense to maintain private, local control of blockchain assets. If all criteria in the bulleted list below applies to you, then local and private ownership might make sense. But if you fail even one criteria, then WAIT! Wait until multisig becomes uniform and ubiquitous — and wait until a larger fraction of society is comfortable with the concept and practice of managing private keys. These are gradually becoming new norms. But, it will take a few more years for the world to become comfortable with an unfamiliar concept: personal control of a decentralized asset. You are a candidate for using a personal wallet if you plan to control and secure your own private keys, and if you meet all conditions listed below. The technical criteria will not be requisite in the future—but they are necessary today, because the market currently lacks simple, standardized, widespread tools and uniform practices for safely securing, accessing and passing on these credentials to your heirs. Do all of these criteria apply to you?

For me, Smart Contracts are one of the most exciting and potentially explosive opportunities. As a groupie and cheerleader, I am not alone. Catering to the Smart Contract community is rapidly becoming a big business. Until this week, I thought it was the conference venue that yielded the biggest thrills. That is, until I learned about the Disruption Experience…

For me, Smart Contracts are one of the most exciting and potentially explosive opportunities. As a groupie and cheerleader, I am not alone. Catering to the Smart Contract community is rapidly becoming a big business. Until this week, I thought it was the conference venue that yielded the biggest thrills. That is, until I learned about the Disruption Experience… The Disruption Experience team is populated by blockchain developers, educators and trainers who take issue with existing events that focus on monetization. The purity of intention was overrun by greed. And so, they set out to form an event with a more altruistic purpose: Build technology, relationships, mechanisms and educational tools that better mankind. The focus at this event and the conferences that follow is to educate, expose and innovate. The focus is squarely on disruptive technology.

The Disruption Experience team is populated by blockchain developers, educators and trainers who take issue with existing events that focus on monetization. The purity of intention was overrun by greed. And so, they set out to form an event with a more altruistic purpose: Build technology, relationships, mechanisms and educational tools that better mankind. The focus at this event and the conferences that follow is to educate, expose and innovate. The focus is squarely on disruptive technology. Bitcoin and the blockchain were introduced simultaneously in a 2009 whitepaper. It’s a bit like explaining the engine and the automobile together—for the very first time. One is a technology with a myriad of applications and the potential to that drives innovation. The other is an app. Sure, it’s useful and important, but it’s just an app.

Bitcoin and the blockchain were introduced simultaneously in a 2009 whitepaper. It’s a bit like explaining the engine and the automobile together—for the very first time. One is a technology with a myriad of applications and the potential to that drives innovation. The other is an app. Sure, it’s useful and important, but it’s just an app. Likewise, 2019 is likely to be the breakout year for blockchain applications, careers, products and—perhaps most importantly—public awareness, understanding and appreciation. Just as motors and engines are not limited to automobiles, the blockchain has far more potential than serving as an engine for decentralized cash. It is too important to be just a footnote to disruptive economics. It will disrupt everything. And we are the beneficiaries.

Likewise, 2019 is likely to be the breakout year for blockchain applications, careers, products and—perhaps most importantly—public awareness, understanding and appreciation. Just as motors and engines are not limited to automobiles, the blockchain has far more potential than serving as an engine for decentralized cash. It is too important to be just a footnote to disruptive economics. It will disrupt everything. And we are the beneficiaries.