Ledger SAS, a startup that makes electronic wallets for Bitcoin and other cryptocurrencies, has raised 61 million euros ($75 million) from investors including Draper Esprit Plc.

If you are reading this on January 16, 2018, then you are aware that Bitcoin (and the exchange rate of most other coins) fell by 20% today. Whenever I encounter a panic sell-off, the first thing that I do is try to ascertain if the fear that sparked the drop is rational.

But what is rational fear? How can you tell if this is the beginning of the end, or simply a transient dip? In my book, rational fears are fundamental facts like these:

Conspicuously missing from this list is “government bans” or any regulation that is unenforceable, because it fails to account for the design of what it attempts to regulate. Taxes, accounting guidelines, reporting regulations are all fine! These can be enforced. But banning something that cannot be banned is not a valid reason for instilling fear in those who have a stake in a new product, process, or technology.

Rule of Acquisition #1:

Drops triggered by false fears present buying opportunities

At times like this, you must make a choice: If you can’t afford to stay in the market and risk a bigger drop, then cash out and live with it. But if you believe in crypto and the potential for a digital future that dis-intermediates your earning, spending and savings, then this drop in dollar value presents opportunity.

At times like this, you must make a choice: If you can’t afford to stay in the market and risk a bigger drop, then cash out and live with it. But if you believe in crypto and the potential for a digital future that dis-intermediates your earning, spending and savings, then this drop in dollar value presents opportunity.

This downturn will pass, because the cryptocurrency fundamentals have not changed or been undermined by recent events. There is no new technical flaw or hack. The potential for cash transactions and future applications get rosier every day (let’s assume that Bitcoin will finally add Lightning Network and that miners will stop fighting with developers)*

The current 20% drop is not a big deal. It takes us back to an exchange rate that we saw just one month ago in early December. It was triggered by saber rattling in South Korea. But, let’s face it: Governments have as much influence over trading or spending cryptocurrency as they do over the mating of squirrels in your backyard. Do you think fewer squirrels would mate, if the government banned them from mating?

If you can answer that question—and if you can afford to stay in the game—then relax. 1 BTC has the same value today as it had yesterday and the day before. It is worth exactly one bitcoin. The current dip in exchange rate with other currencies was sparked by fear; and that fear is misguided or irrational.

[click below for perspective]…

* Bitcoin has a serious limitation in transaction throughput and transaction cost. The problem is serious and it frustrates users, developers, miners and vendors. But it is not new, and the consensus about its likelihood of being corrected has not suddenly changed. These limitations are unrelated to today’s large drop in exchange value.

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He is keynote speaker at the Cryptocurrency Expo in India this month. Click Here to inquire about a presentation or consulting engagement.

Some blogs and news outlets eschew long titles. Publishers want readers to scan a list of topics that fit on one-line each. But, a better title for this article would be:

“Massive electric consumption by cryptocurrency mining:

An unfortunate environmental nightmare will soon pass!

… Proof-of-Work alternatives are on the horizon”

A considerable amount of electricity is used in the process of mining Bitcoin and other cryptocurrencies. Miners are effectively distributed bookkeepers, and this use of resources is part of a system called “proof-of-work”. It keeps the books fair, honest, and without an ability for the miners to collude (In other words, they cannot ‘cook the books’).

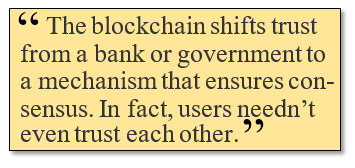

What makes the process unique and exciting is that this “distributed consensus” does not require a trusted authority, like a bank. In fact, the whole point of the blockchain revolution is that users trust a mechanism rather than a bank, government or even each other.

But, for any network that hopes to become part of the financial fabric, it must be ubiquitous and in constant motion. Proof-of-work just doesn’t make the grade, because it doesn’t scale. The need for miners to prove that they did something complex sucks up too much power. If Bitcoin or any proof-of-work currency were to be adopted for even a small fraction of commercial and personal transactions, it would overwhelm the world’s energy services.

One reader suggests the problem will be solved by the recent boom in shale fracking and renewable, non-polluting energy. He points out that crypto mining may even drive a market for distributed, clean electric production.

One reader suggests the problem will be solved by the recent boom in shale fracking and renewable, non-polluting energy. He points out that crypto mining may even drive a market for distributed, clean electric production.

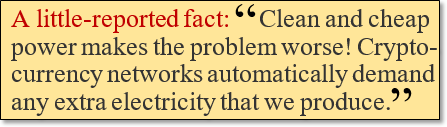

Unfortunately, clean and cheap power makes the problem worse. Even if electric capacity were to rise dramatically and experience a great cost reduction, cryptocurrency networks would automatically demand all the extra electricity. It is a no-win game, because mining incentives escalate with an increase in supply or drop in cost.

Will large-scale, blockchain-based networks fail, because of enormous electric demand? Fortunately, the future is not so bad, after all. Although networks, like Bitcoin, currently use proof-of-work to ensure honesty and fairness, it is only one of many possible measurement and enforcement mechanisms. Eventually, developers and miners will swap in another proof mechanism to keep the network humming—and without creating an environmental catastrophe.

Will Change in Proof Come in Time?

The political process for changing the fairness mechanism (“forking the code”) is complex and fraught with infighting, but the problem will eventually be addressed, and it will be solved before electricity becomes a critical issue. Despite a messy voting process, the miners have too much at stake to ignore this problem much longer.

Various proof alternatives are already being used in altcoins. Since Bitcoin is perfectly free to steal these techniques (none can be protected by patent or trade secrecy), we can think of these other coins as beta-tests for Bitcoin. How so? As the first and biggest elephant in the room, Bitcoin will likely reign supreme, as long as it doesn’t wait too long before grabbing the best technology and tucking it into its quiver.

Proof-of-Work Alternatives

These aren’t the only alternatives to proof-of-work. Ultimately, one or more of these fairness enforcement mechanisms will make its way into Bitcoin and other currencies and blockchain services. In my opinion, the electrical crisis is a genuine threat, but it is one that with a solution that will be implemented soon—perhaps even this year.

Related:

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He is keynote speaker at the Cryptocurrency Expo in India this month. Click Here to inquire about a presentation or consulting engagement.

Today, editors at Quora asked me to answer a seemingly simple question:

This is a terrific question, and one that I write about frequently. The question gives me a chance to summarize the key facets of widely mistaken fears. But, here, in the Lifeboat Blog, there is room to elaborate a bit.

In the first phase of cryptocurrency adoption (we are in the midst of this now), there is an abundance of skepticism: Misunderstanding, mistrust, historical comparisons that aren’t comparable, government bans & regulatory proposals—and a lot of questions about intrinsic value, lack of a redemption guaranty, risky open source platforms, tax treatment, etc, etc.

Out of the gate, few individuals and governments paid attention to Bitcoin. That was when it traded under $100. It was complicated to understand, and it seemed to be nothing more than gaming money coveted by nerds and geeks. But with each wave of adoption, or the crash of a major exchange, or the shutdown of Silk Road, public interest has piqued. And, of course, the price of Bitcoin has shot up from nothing to almost $20,000 in the past few years.

It’s natural that governments watch developments closely, and sometimes weigh in with guidance, licensing or regulations. But consider the underlying concerns: Why should governments care about this activity? Is cryptocurrency good for government?

Very often, we hear of government restrictions or “bans” on trading bitcoin. The justification typically hinges on a belief that cryptocurrency leads to bad things:

The first three concerns are patently false and the last three concerns raise an interesting question: Might it benefit a government to surrender control over its own monetary policy? We’ll explore this, below…

Let’s look at each of these fears. I won’t try to analyze or defend each statement below. You can find the justifications throughout Lifeboat.

1. Gradually, governments are coming to recognize that the first three concerns are false. If cryptocurrency gains widespread traction as a payment instrument—or even as cash itself—governments are not weakened in their ability to tax, spend, or enforce tax collection. This myth arises from a lack of education, experience and familiarity.

2. We have seen some spectacular news stories involving very serious criminal activity that accepts bitcoin. In each case, the bad guys were caught—and they were caught because they foolishly accepted bitcoin.

In fact, cash is a far better tool of crime than cryptocurrency. Pre-paid debit cards are even worse.

Bitcoin is not anonymous. It is what cryptographers call pseudo-anonymous. I call it “a fool’s anonymity”! Although Bitcoin allows users to create anonymous wallets, anyone selling drugs or committing a notorious deed can be tracked. A million armchair analysts (anyone who uses and follows Bitcoin), can follow the money trail—through VPNs and mixers—all the way until something is spent in the real world. At some point, someone buys a tennis ball or gets braces for their kid, or buys a book at Amazon. That’s when it all unwinds.

3. Far from cryptocurrency undermining trust in government, it does just the opposite. It demonstrates to citizens that the government shares an obligation to balance its books, just like every individual, corporation, NGO, city or state.

In effect, governments must raise the dollars that they intend to spend. In an emergency, they can borrow, of course, but only if they can find creditors that truly believe in their ability to repay the debt.

This trust yields phenomenal results:

4, 5 and 6: Now, we arrive at the least understood concerns…

#4 and #5 are true. But as we discuss in #3, loss of control over monetary policy is a very different thing than losing control over fiscal policy.

It took decades to discover that decoupling a country from its delivery service and telephone companies resulted in a remarkable boost to industries, services and productivity. Likewise, decoupling a nation from its currency is a really, really good thing. No one can play games, trust is restored. Our kids aren’t born into debt of the nations that purchase our government bonds.

#6 is perhaps the most difficult to accept. Some economists still insist that a small amount of inflation is critical to getting people to spend and invest. But a growing number of experts are discovering that this just isn’t so. Deflation is often associated with unemployment, war, recession and a loss of liquidity and investment. In fact, deflation can be triggered by these things, but when it is the result of a trusted and capped-but-divisible money supply, it doesn’t lead to any of these things.

The concern about people not spending is a linguistic trick. Another way to say the same thing is that a capped money supply encourages people to save for big expenses and for retirement. Since when is that a bad thing?

I have been answering questions about Bitcoin and cryptocurrency since Satoshi was at the helm. Talk to me. Ask about it! Then, think for yourself. Stay engaged.

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He is keynote speaker at the Cryptocurrency Expo in India this month. Click Here to inquire about a presentation or consulting engagement.

By now, every interested news-junkie is aware that Bitcoin plummeted from $15,000 to $13,000 (USD exchange rate) on January 11, 2018. This morning, every news outlet and armchair analyst attributes the drop to the Korean government signaling that it will ban Bitcoin trading among its citizens.

With Donald Trump and Kim Jong Un butting heads over nuclear missile tests and the upcoming Winter Olympics, you would think that South Korea has other priorities than banning Bitcoin.

As with all news—except accidents—the Korean plans were known by a few insiders (in this case, government bureaucrats), and so the influence on value was bigger than the drop that occurred after the news story. In the days before this “event”, it was probably responsible for a drop of about $4500 in exchange value.

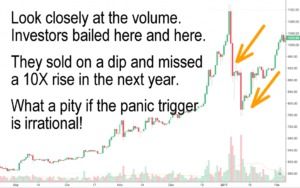

Listen up Wild Ducks! We have heard this before. On Sept 11, China announced the exact same thing. I wrote about it in the most popular article of my 7 years as Blogger: Bad News is Good News for Bitcoin Investors.

As an investor, am I worried? Not on your sweet bippy. I am ecstatic! There are some things that governments cannot ban: the mating of feral cats; water from seeping into cellars; communications networks that are distributed and permissionless. Ineffective and unenforceable regulation always spells opportunity.  When I hear of such “bans” (or learn about Jamie Dimon claiming that Bitcoin is a ‘pyramid scheme’ before having all the facts), I become confused and excited…

When I hear of such “bans” (or learn about Jamie Dimon claiming that Bitcoin is a ‘pyramid scheme’ before having all the facts), I become confused and excited…

Investors often fail to recognize the way in which toothless government edicts work. I am confused that anyone would act on such flawed information. I am excited that they do. Why?—Because each time Bitcoin makes a quick dive due to crazy or irrelevant news, it makes an even bigger upward jump within days. In this case, the reverse correction has already begun.

I created the chart, below, for my presentation at the Cryptocurrency Expo in Dubai during the last days of October. During this 3 day conference, Bitcoin jumped from $6000 to 6500 because these days followed a hard fork that scared analysts. Within 5 weeks of the conference, Bitcoin touched $20,000, depending on the exchange from which you get quotes. But here’s an odd thing (not so odd, to me): With sudden market accessibility in the past 30 days, why is Bitcoin falling? [continued below]…

In the past month (Dec 10 2017~Jan 10 2018), Bitcoin and Bitcoin futures are finally becoming accessible to traditional brokers using familiar investment instruments. As a result of market accessibility, everyone and his brother is getting into Bitcoin. Since it is still difficult to take a negative position, you might expect this fresh interest to drive up value. This expectation is reinforced by my own anecdotal observation: Based on the large number of old acquaintances asking me to help them buy Bitcoin, it certainly feels like the sentiment is bullish. But no! Existing stakeholders are dumping their positions!

It’s not just because of yesterday’s news. Rather, it’s because anyone who has seen Bitcoin triple in just 3 months, feels that their personal stake experienced a “lucky” gain. They want to turn that paper gain into a profit before it tanks.

But then, there are the cognoscenti. That’s us…We are the individuals who have a feel for the natural, intrinsic value of Bitcoin. We understand that value does not require a redemption guarantee from Caesar. We have a reasonable vision of currency, inflation, economics, history, the role of government—and especially, of distributed trust. Just as important, we understand why an altcoin is unlikely to replace Bitcoin—even if it solves some of Bitcoin’s frustrating technical and governance issues.

Governments tend to react to perceived threats before understanding opportunities, motives and that which is fait accompli. There is a role for government in all of this, but it is not to ban what cannot be banned. That is simply good news for us stakeholders.

Related Reading:

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He is keynote speaker at the Cryptocurrency Expo in India this month. Click Here to inquire about a presentation or consulting engagement.

I get this question a lot. Today, I answered it at Quora.com. But, here, in the Lifeboat Blog, I have more bandwidth to elaborate.

Question:

What if I make a typo when sending Bitcoin. The recipient address

may be invalid or it may belong to another individual. —But there

is a third possibility. Couldn’t it be a valid address, but without any

wallet that can receive it? I bet the blockchain catches these errors

—Right? Will I always get my money back?

The short answer: “Don’t worry, it cannot happen. That won’t happen either. Sure, it’s possible. That’s wrong, and You’re screwed!”

But let’s look at this a bit closer. A little knowledge goes a long way!

Incidentally, this answer gets into some gritty, esoteric details. It may lead you to believe that cryptocurrency is complicated, risky or not worthwhile. But, it only seems this way. With any new technology, standards and practices gradually flow into gadgets, apps and services. Early televisions required an expert operator. The next generation of owners dealt with vertical hold, contrast and antennae bolted onto the chimney. If your older than 55, you schlepped to a pharmacy with Dad to test a dozen or more vacuum tubes, just to find out if the circuitry was getting weak.

No one does these things anymore. TVs are flat and with a perfect picture. They are almost as easy to use as a toaster. (Except for the five remotes needed to choose a source and set up the sound! These ridiculous gadgets are only now being replaced with voice control and other smart technologies).

Back to square one: Can you send money to an invalid Bitcoin address due to a typing error? If you do, will you get it back?

It is not likely that you would do so in a hundred lifetimes. But if you succeed at creating what appears to be a valid address, you are screwed. Only a hundred million trillionths of valid addresses will ever have a wallet behind it. The blockchain does not record the creation of wallets. No one can know if there is anyone with the address and the keys to the apparently valid wallet address that you sent money into.

Addresses transfer things from one place to another. You enter a street address into your GPS expecting to be transported to a location. But, with everything else, an address moves value or sensitive information. So, let’s start with an absolute, inviolate rule: Never type an “address” into any system!

Instead, cut & paste the address from the source or—at least—from the message that delivered it. After all, you don’t want a note to your lover ending up on the mobile phone of your boss.

But you didn’t ask about best practices—you asked about checksums…

1. Invalid Address (No wallet could exist for what you typed)

Bitcoin addresses include a 32 bit checksum, which makes the possibility of typing a valid address by mistake about 1 in 4.3 billion. So don’t worry, a mistyped address will be caught by your own wallet or service, before anyone even peeks at the blockchain.

But what if—somehow—you manage to enter an address that seems valid (it passes the checksum test), but there is not yet a wallet created with that address?

2. Address Appears Valid (But there is no wallet, or they belong to the wrong person)

You might think that the transaction gets staged, but eventually fails, because the wallet address is unlikely to have ever been created. But there is a problem with that theory: Wallets can be created off-line and remain dormant for years. The block chain does not know which wallet addresses exist. It only knows which appear to be valid addresses.

For this reason, sending bitcoin to an address that is entered in proper form, but does not belong to anyone will result in permanent loss. Technically, the money exists, but no one has the private keys to spend it. Any effort to recover the loss would better be spent on a good therapist and searching for a job in the sunset years of your life.

It would be nice if you could create a wallet that matched the receiving address. Sadly, this is impossible, because wallets are created through a random one-way process.

This ends an answer to a straightforward question. But, now, let’s have some fun…

Let’s figure out what are the chances that someone actually does have a wallet that matches a valid address that you typed by accident. (After all, you already beat odds of 1-in-4.3 billion by typing an address that satisfied the checksum!)

A Bitcoin wallet address is a string of 34 characters (letters and numbers).* From the full set of 10 digits and of 52 upper/lower case western characters, four are excluded to reduce the chance of entry error (O, 0, I, L). This means that the number of possible wallet addresses is 5834 = 1060 *

The human brain has between 100 and 1000 trillion synapses. Yet, 1060 is:

Even if everyone on earth creates a new Bitcoin wallet every single minute and all wallets are valid for life, the chances of accidentally typing the valid address of another user is very nearly zero.

* Interesting caveats and notes:

Bitcoin addresses are currently generated via an algorithm called RIPE-MD160. This further limits the number of possible wallet addresses to 2160 = 1.4×1048). But this reduction is caught when sending, because the checksum uses the same algorithm to validate against a properly formed address.

Bitcoin addresses are currently generated via an algorithm called RIPE-MD160. This further limits the number of possible wallet addresses to 2160 = 1.4×1048). But this reduction is caught when sending, because the checksum uses the same algorithm to validate against a properly formed address.Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He is keynote speaker at the Cryptocurrency Expo in India this month. Click Here to inquire about a presentation or consulting engagement

Titles are chosen by editors and not journalists or experts. I fought my editor over the above title. Yes, I address the teaser—and I explain a solid altcoin investment model. But, that comes after the break. The first part of this article should be titled “Why would anyone quote cost or value in Bitcoin?”. The subjects are highly related, so bear with me…

Today, a reader asked this question:

Some financial sites discuss value in Bitcoin terms, rather

than dollars or Euros. Why would I calculate the value of a

new car, my rent or an investment in this way? It’s hard to

understand how much money I need!

Answer: Your right! It’s difficult to estimate the value of a car or your rent in terms of Bitcoin. You are paid in dollars or Euros—and your landlord quotes rent in the same currency.

On the other hand, it’s natural to gauge the value of something by comparing it to a commodity that you earn and spend at a steady or predictable rate. Therefore, your assumption that it makes more sense to determine value on a dollar-basis is absolutely correct. No one determines the value of a new car by comparing the cost with a government’s national debt—or the number of donuts you would need to sell (unless you are a donut maker).

But, this assumption is transitory. It is based on a historical paradigm that is gradually changing. We are entering a bold new era. A big debate is shaping up over How gradual is the change? But make no mistake: This change is occurring in our lifetimes…

That change will eventually lead you to estimate, earn, spend and value things in Bitcoin or a similar cryptocurrency. One day soon, fluctuations in the value of the US dollar or Euro will cause you to wonder “What is happening with the dollar?” rather than shake your confidence in Bitcoin. Bitcoin (or something similar) will integrate into your mindset as the exchange medium, rather than fiat currency of a nation state.

Naturally, a series of dominos must fall, before you realize that Bitcoin is the money. I predicted this four years ago, and the process is already occurring. It is retarded by two unfortunate events, but these are both temporary setbacks:

Both of these problems have solutions, and we have already seen the solutions at work in altcoins. Think of forks and altcoins as beta tests…Bitcoin will fold in the best of these technical improvements and will very likely continue to inch toward becoming the world’s de facto currency.

Revenue Neutral Investing

To answer the question in the title, let’s look at this from a completely different angle. The individual who asked the original question went on to ask this:

Cryptocurrency sites compare and track the cost of altcoins in

terms of Bitcoin rather than dollars. What’s with that?! Do they

assume that we will all be selling Bitcoin to buy the new altcoin?

It actually makes sense to value altcoins in terms of Bitcoin—even today. How so?…

This growing trend provides very useful information. This method of quotation helps the reader to determine the relative change in value between the two currencies and compare it to fundamentals that they learn from news and research. The information can then be used to hedge an investment or even craft a revenue-neutral investment strategy. Allow me to explain…

I am long on Bitcoin. This is not likely to change. So I keep a significant fraction of my wealth in this form.

But, I also understand that the use and market for cryptocurrencies is young and very immature. A very few other forks and altcoins are the real deal. They have solved some major technical flaws with Bitcoin and they have the potential to become a credible, functional currency. This isn’t the place to explain my favorite coins, but the strategy is relevant.

Since I already have a substantial position in Bitcoin, I wish to avoid further exposure in the market. Therefore, I invest long and short at the same time (for example, using puts and calls)* on certain coins that are likely to perform better than other coins. This reduces risk, by leaving me without a loss, if the entire market rises or falls. The only way I might lose is if I get it exactly wrong! That is, if the coins that I believe are scams do better than the ones that I feel are well-designed and with a solid adoption trend. (Remember: The risk reduction strategy is to invest on the difference between an overvalued dog and an under-performing beauty).

To avoid the downside scenario (i.e. getting it exactly wrong), focus on fundamentals and not the cost of a unit, short term trends, emotional zeal, or other technical issues. Don’t follow the crowd! Bet on value and bet against hype. (TIP: The take-away, here, is to do both at once!). Investors who consider only asset cost and trends are in a craps shoot. The smart money determines which coins are likely to be a better functional instrument than other coins and then sticks with a dollar cost averaging plan for months at a time.

Want to learn more? Want to know which coins I admire? Reach out. Let’s talk. I don’t bite.

* A regulated financial exchange for puts and calls does not exist for altcoins. But, with a little research, you can create an nearly equivalent futures contract or options instrument. You may need to be a bit creative.

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck, hosts the Bitcoin Event and kicked off the Cryptocurrency Expo in Dubai. Click Here to inquire about a live presentation or consulting engagement.

Oh, Cheez…We’re back to this question, again!

As a Bitcoin columnist, I get this question a lot. Today, an answer was requested at Quora.com, where I am the lead contributor on cryptocurrencies:

“Clearly, some people value Bitcoin. But How can

this be? There is nothing there to give it value!”

Many individuals, like the one who asked this question, suspect that Bitcoin was pulled out of thin air—and that it is not backed by gold, a government, or an authoritative redemption guaranty. After all, it is just open source code. What stops me from creating an ElleryCoin using the same code?!

Let’s start with the short answer:

A More Complete Answer: What is value?

Bitcoin has more intrinsic value than a government printed paper bill. The value arises from a combiation of fundamental properties:

Downside and Risks

But wait! What about the long transaction delay and high cost? There are sharp disagreements anong miners, users and developers concerning block size, transaction malleability, and replay issues. Aren’t these a deal killers? And what about wild volatility in the exchange rate? Doesn’t this retard adoption as a functional currency?

These are transient issues associated with a new technology. Although Bitcoin is weathering growth pains that arise from a new and distributed governance technology (democracy can be messy!), all of these issues have sound solutions. We have already witnessed and tested the solyutions with various forked coins. Think of them as beta tests. Even if current problems delay the day when you can spend bitcoin at every retail establishment—it is already sucking liquidity from national currencies and becoming the world’s de facto reserve currency.

Many individuals find all of this hard to accept. That is because we have been conditioned to think that ‘value’ arises from assets with ‘intrinsic’ value, the promise of redemption, or by edict. This is not true. In all things, (including gold, a Picasso painting, or your labor) value arises from simple supply and demand.

Some individuals claim that all other factors are secondary. But, even this statement is false. All other factors are irrelevant. They may be related, but they are not the source of value.

I recognize that this answer may seem smug or definitive. So, allow me to suggest related questions with answers that are a bit more interesting, because they are subtle. Unlike the question of value, these two questions are open to analysis and opinion: (1) “Will people continue to value bitcoin in the future?” — And (2) “When will Bitcoin stop swinging wildly in value?” (measured by its exchange rate with other currencies).

This is fun! Let’s explore…

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. Last month, he kicked off the Cryptocurrency Expo in Dubai. Click Here to inquire about a live presentation or consulting engagement.

Let’s say that you no longer trust your currency exchange to host your Bitcoin wallet and you don’t trust a Trezor or Nano hardware wallet. You don’t trust your memory and you don’t trust your kids. And you certainly know better than to keep your wealth in your PC or phone. That would be downright crazy—right? What can you do?!

A growing number of people are printing paper wallets. It is the ultimate form of security. Some individuals even delete their cloud wallet, leaving everything to a string of hex characters or a QR code printed onto a slip of paper. (NB. You had better be certain that you and a few trusted individuals know how to find that piece of paper!)

But here’s an interesting mystery. If you print the paper wallet off-line and delete your other wallets, then how can the blockchain ‘know’ that you have changed wallets? The short answer: It doesn’t and you haven’t!

Let’s explore a bit deeper…

But, in both cases, the fact that you made a photocopy of your deed or corporate bond is not of any consequence to others. It is the same with a Bitcoin wallet. (In this case, the ownership record is netiher in a government warehouse nor in your posession. It is crowd-sourced).

Printing out a paper wallet does not change your wallet ID. The paper wallet is simply another method of storing and retrieving the proof that you own a part of a mathematical solution set—That is, you know the solution to a problem.

Printing out a paper wallet does not change your wallet ID. The paper wallet is simply another method of storing and retrieving the proof that you own a part of a mathematical solution set—That is, you know the solution to a problem.

Your paper wallet is just a copy the keys to your wealth. Of course, you may choose to destroy the other keys, that’s your business. No one knows or verifies that you still have access to your stored knowledge or how you stored it. It’s up to you to maintain access to the “document”. The blockchain only records a transfer of ownership from one wallet to another at the time of a payment transaction.

Got it? I hope you like the metaphors. I am fairly proud of myself for this explanation.

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. Last month, he kicked off the Cryptocurrency Expo in Dubai. Click Here to inquire about a live presentation or consulting engagement.

Everyone likes a good mystery. After all, who isn’t fascinated with Sherlock Holmes or the Hardy Boys? The thirst to explore a mystery led us to the New World, to the ocean depths and into space.

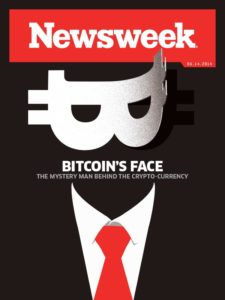

One of the great mysteries of the past decade is the identity of Satoshi Nakamoto, the inventor of Bitcoin and the blockchain. Some have even stepped forward in an effort to usurp his identity for fame, infamy or fortune. But in this case, we have a mystery in which the subject does not wish to be fingered. He prefers anonymity.

This raises an interesting question. What could be achieved by discovering or revealing the identity of the illusive Satoshi Nakamoto?…

The blockchain and Bitcoin present radically transformative methodologies with far ranging, beneficial impact on business, transparency and social order.

How so? — The blockchain demonstrates that we can crowd-source trust, while Bitcoin is much more than a payment mechanism or even a reserve currency. It decouples governments from monetary policy. Ultimately, this will benefit consumers, businesses and even the governments that lose that control.

Why Has Satoshi Remained Anonymous?

I believe that Satoshi remains anonymous, because his identity, history, interests and politics would be a distraction to the fundamental gift that his research has bestowed. The world is still grappling with the challenge of education, adoption, scaling, governance, regulation and volatility.

Some people are still skeptical of Bitcoin’s potential or they fail to accept that it carries intrinsic value (far more than fiat currency, despite the absence of a redemption guaranty). Additionally, we are still witnessing hacks, failing exchanges and ICO scams. Ignorance is rampant. Some individuals wonder if Satoshi is an anarchist—or if his invention is criminal. (Of course, it is not!).

Outing him now is pointless. He is a bright inventor, but he is not the story. The concepts and coin that he gave us are still in their infancy. Our focus now must be to understand, scale and smooth out the kinks, so that adoption and utility can serve mankind.

Related Ruminations:

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He was keynote at the Cryptocurrency Expo in Dubai. Click Here to inquire about a live presentation or consulting.