“A report outlining how blockchain technology will usher in a new era of the internet has been published by the World Economic Forum at its 11th Annual Meeting of the New Champions, taking place on 27–29 June in Dalian, People’s Republic of China.”

“A report outlining how blockchain technology will usher in a new era of the internet has been published by the World Economic Forum at its 11th Annual Meeting of the New Champions, taking place on 27–29 June in Dalian, People’s Republic of China.”

Lifeboat Foundation readers are aware that the world has become progressively more chaotic. Part of the danger comes from centralized points of failure. While large institutions can bear great stress, they also cause more harm when they fail. Because there are so few pillars, if one collapses, the whole system is destroyed.

For instance, prior to the federal reserve system, bank runs we extremely common. However, since the financial system consisted of small, competing institutions, failure was confined to deficient banks. So while failure was frequent, it was less impactful and systemic. In contrast, after the establishment of the federal reserve, banks became fewer and larger. Failures, while more infrequent, were large scale catastrophes when they occurred. They affected the whole economy and had longer impact.

This is even more important in political systems, which are the foundation of how a society operates. In order to have a more robust, antifragile social order, systems must be decentralized. Rather than a monopolistic, static political order, there must be a series of decentralized experiments. While failures are inevitable, it can be localized to these small experiments rather than the whole structure.

We call these small, experimental governments “startup societies”. Examples include smart cities, seasteading, eco-villages, special economic zones, intentional communities, microstates, private cities, Ect. The Startup Societies Foundation studies these experiments, promotes them to the public, and hold conferences.

The Startup Societies Foundation is partnering with D10e to host our biggest conference yet. The Startup Societies Summit is a trade show that unites 300–500 engineers, policy experts, technologists, urban planners, economists, entrepreneurs, and investors interested in building new societies. Attendees with startups related to new societies can engage with investors to push their ideas to fruition. By networking together and sharing valuable information, our guests will be at the forefront starting new societies. The Summit will take place in City College San Francisco on August 11th-12th. If you are interested in buying tickets or becoming a sponsor, here is a link to our crowdfunding campaign.

Like a startup, a startup society begins small and scales when it produces a better service through technology. 65% of the earth’s population will live in cities by 2040. This presents an unprecedented opportunity for entrepreneurs. They can become innovators of the greatest wealth creation tool: cities. Join us and gain an edge in the growing, exciting field of innovative governance.

The International Economic Forum, which just wrapped up in St. Petersburg, reportedly resulted in more than €30 bln of investments. The final and the most important result, however, is measured not in numbers, but in the mood and attitude of those who attended the Forum and who was keeping an eye on the events and meetings held in the North “capital” of Russia.

The cryptocurrency community is for sure left stunned by the recent meeting between Russian President Putin and the founder of Ethereum Vitalik Buterin.

As commented by Kremlin Press Secretary Dmitry Peskov, during the meeting, Putin and Buterin discussed the application of technologies in the country. Reportedly, the president supported the idea of establishing new business relationships following the road paved by Blockchain technology.

3½ years ago, I wrote a Bitcoin wallet safety primer for Naked Security, a newsletter by Sophos, the European antivirus lab. Articles are limited to just 500 hundred words, and so my primer barely conveyed a mindset—It outlined broad steps for protecting a Bitcoin wallet.

In retrospect, that article may have been a disservice to digital currency novices. For example, did you know that a mobile text message is not a good form of two-factor authentication? Relying on SMS can get your life savings wiped out. Who knew?!

With a tip of the hat to Cody Brown, here is an online wallet security narrative that beats my article by a mile. Actually, it is more of a warning than a tutorial. But, read it closely. Learn from Cody’s misfortune. Practice safe storage. If you glean anything from the article, at least do this:

Exchange and cloud users want instant response. They want to purchase things without delay and they want quick settlement of currency exchange. But online wallets come with great risk. They can be emptied in an instant. It is not as difficult to spoof your identity as you may think (Again: Read Cody’s article below!)

Some privacy and security advocates insist on taking possession and control of their wallet. They want wealth printed out and tucked under the mattress. Personally, I think this ‘total-control’ methodology  yields greater risk than a trusted, audited custodial relationship with constant updates and best practice reviews.

yields greater risk than a trusted, audited custodial relationship with constant updates and best practice reviews.

In case you want just the basics, here is my original wallet security primer. It won’t give you everything that you need, but it sets a tone for discipline, safety and a healthy dollop of fear.

Philip Raymond co-chairs Crypsa & Bitcoin Event, columnist & board member at Lifeboat, editor

at WildDuck and will deliver the keynote address at Digital Currency Summit in Johannesburg.

For the first time ever since bitcoin’s invention, a new digital currency has reached higher trading volumes, Ethereum. The currency is now trading $11 million more than bitcoin.

Ethereum has further risen above 50% of bitcoin’s market cap, reaching a high of 54%, less than two years since its invention in 2015, in a remarkable rise that has never been seen before in this space and even beyond consdering the timeframe.

The currency has now taken almost 25% market share of all digital currencies, while bitcoin has fallen to around 45% from a near dominance of 95% just months ago when it was the center of the entire ecosystem.

Individuals who mine Bitcoins needn’t be miners. We call them ‘miners’ because they are awarded BTC as they solve mathematical computations. The competition to unearth these reserve coins also serves a vital purpose. They validate the transactions of Bitcoin users all over the world: buyers, loans & debt settlement, exchange transactions, inter-bank transfers, etc. They are not really miners. They are more accurately engaged in transaction validation or ‘bookkeeping’.

There are numerous proposals for how to incentivize miners once all 21 million coins have been mined/awarded in May 2140. Depending upon the network load and the value of each coin, we may need to agree on an alternate incentive earlier than 2140. At the opening of the 2015 MIT Bitcoin Expo, Andreas Antonopolous proposed some validator incentive alternatives. One very novel suggestion was based on game theory and involved competition and status rather than cash payments.

I envision an alternative approach—one that also addresses the problem of miners and users having different goals. In an ideal world the locus of users should intersect more fully with the overseers…

To achieve this, I have proposed that every wallet be capable of also mining, even if the wallet is simply a smartphone app or part of a cloud account at an exchange service. To get uses participating in validating the transactions of peers, any transaction fee could be waived for anyone who completes 1 validation for each n transactions. (Say one validation for every five or ten transactions). In this manner, everyone pitches in a small amount of resources to maintain a robust network.

A small transaction fee would accrue to anyone who does not participate in ‘mining’ at all. That cost will float with supply and demand. Users can duck the fee by simply participating in the validation process, which continues to be based on either proof-of-work, proof-of-stake — or one of the more exotic proof theories that are being proposed now.

Philip Raymond co-chairs Cryptocurrency Standards Association. He produces

The Bitcoin Event, edits A Wild Duck and is a frequent contributor to Quora

Quantum computing and the blockchain both get plenty of attention in 2017, and now researchers in Russia have combined the two to create what they claim is an unhackable distributed-ledger platform.

The new technology, described as the “first quantum-safe blockchain,” promises to make it secure for organizations to transfer data without the fear of hacking from even the most powerful computers, in this case, the emerging field of quantum computing. Quantum computers make use of the quantum states of subatomic particles to store information, with the potential to do some calculations far faster than current computers. There’s some dispute whether we have actually reached that point yet, but companies such as Google Inc. are promising that true quantum computing is just around the corner.

“Quantum computers pose a major threat to data security today and could even be used to hack blockchains, destroying everything from cryptocurrencies like bitcoin to secure government communications,” a spokesperson for the Russian Quantum Center told SiliconANGLE. “Because quantum computers can test a large number of combinations at once, they will be able to destroy these digital signatures, leaving the blockchain vulnerable.”

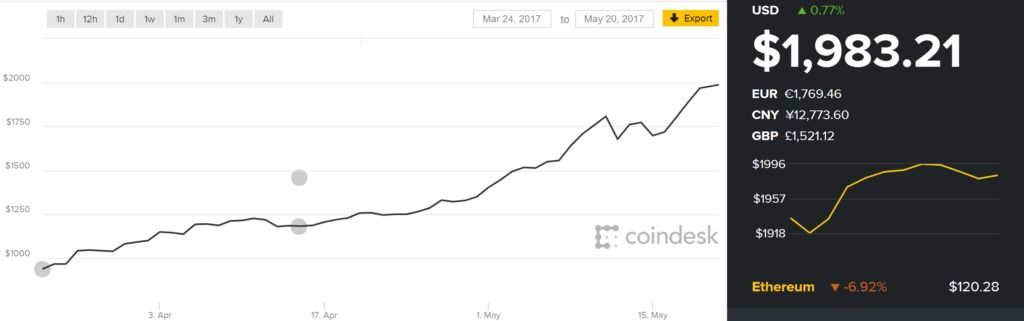

At the beginning of 2016, Bitcoin was fairly steady at $430. Richelle Ross predicted that it would finish the year at $650. She would have been right, if the year had ended in November. During 2016, Bitcoin’s US dollar exchange rose from $433 to $1000. In the past 2 months (March 24~May 20, 2017), Bitcoin has tacked on 114%, rising from $936 to $2000. [continue below image]…

If this were stock in a corporation, I would recommend liquidating or cutting back on holdings. But the value of Bitcoin is not tied to the future earnings or property value of an organization. In this case, supply demand is fueled—in part—by speculation. Yes, of course. But, it is also fueled by a two-sided network built on the growing base of utilitarian adoption. And not just an adoption fad,  but adoption that mirrors the shift in our very understanding of bookkeeping, trust and transparency.

but adoption that mirrors the shift in our very understanding of bookkeeping, trust and transparency.

Despite problems of growth, governance and regulation, Bitcoin is more clearly taking its place as the future of money. Even if it never becomes “legal tender” in any country—and is used only as a mechanism of payments and settlement, it is still woefully undervalued. $2000 is not an end-game. It is a beginning.

Philip Raymond co-chairs Crypsa & The Bitcoin Event. He is columnist & board member at Lifeboat Foundation,

editor at WildDuck and is delivering the keynote address at the 2017 Digital Currency Summit in Johannesburg.

Technology has the power to improve people’s lives — and not just by supplying flying cars to millionaires. The computer networks that brought us Bitcoins are advancing in ways that will make humanitarian giving simpler and more secure than ever.

Blockchain, which serves as the underlying infrastructure for Bitcoin, is form of cryptocurrency that has become increasingly popular and experienced all-time high values in the last few months. One blockchain developer, Ethereum, has seen an all-time high in value: in recent weeks it’s topped out trading at over $40 per share.