“They begin by pointing out the extraordinary successes of human computation. One of the most notable is the Fold.it project in which participants are asked to fold virtual proteins in the most efficient way possible. The goal is to solve one of the most important outstanding problems in molecular biology: how proteins fold so rapidly and efficiently. The project has had some impressive successes. Soon after it began, it discovered the tertiary structure of a regulatory protein for the pros-simian immunodeficiency virus, a problem the research community had puzzled over for decades and one that that could lead to new ways of tackling the AIDS virus.” Read more

Get the latest international news and world events from around the world.

Pet Peeve #4: Time zones are for locals

Have you ever made a list of pet peeves? I’m not referring to the behavioral quirks that couples develop over years of cohabitation. That’s part of every relationship and it is only addressed through give and take and a lot of patience. Rather, I refer to the little things that have become institutionalized all around us—and yet, we know that they are just plain idiotic. The problem is that they are too small to be picked up by the national news and too common to believe that they can be avoided.

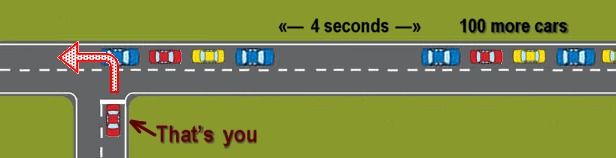

Let’s say that you are driving along a road that comes to an end by forming a ‘T’ at the side of a much busier road. The cross street is busy, but it’s not divided. You plan to make a left turn after clearing a string of high-speed cars approaching from the right.

Conditions are good and there are no obstructions. There is no one coming from the left. Looking to the right, you can see a mile down the road. There are 4 cars speeding toward you, a long space and then a major throng of cars that will tie up the intersection for minutes. You get ready to drop the hammer as soon as that 4th car passes the intersection. You are patient, in a good mood and your car is well tuned.

What’s the dumbest thing that the driver in car #4 could do? Does he have the power to ruin your day and raise your blood pressure while trying to be a nice guy? He sure does!

He can hesitate—slowing just enough to get honked by the parade behind him and just enough to close your window of opportunity. If you are in a hurry to get somewhere, he will ruin your morning faster than you can mime “Move your friggin’ tailpipe!!”. He is oblivious to the fact that his gesture of good will has backfired.

Cross street drivers who let up on the gas are one of my three pet peeves. But today, I was reminded of another minor irritation. From now on, I will call it “Pet Peeve #4”.

I have a good friend in Germany. He is a high tech entrepreneur and tends to move about the globe. His businesses are in Australia and New Zealand, and he spent a long part of the past year in Shanghai. I never know where he will be. But he is currently in Germany and he knows that I am in America.

Realizing that we need to discuss an important matter, he asks me if I will be available during my weekday mornings, between 9 and 11 AM my time. Noting that he has already contemplated the time difference, I check my calendar. “Sure. That works for me,” I tell him… “Why don’t you set the schedule? Any morning this week is good.” He commits to have a colleague figure out the final date.

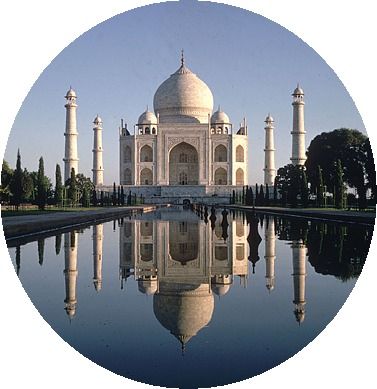

Minutes later, I receive a Google Calendar link for my approval. It asks that our meeting be scheduled for next Wed from 21:30 to 22:00, India Standard Time. I was unprepared for the involuntary groan that arose from the pit of my stomach. Here, is an open letter to my buddy and the colleague who scheduled our conference to be held on India Time…

Minutes later, I receive a Google Calendar link for my approval. It asks that our meeting be scheduled for next Wed from 21:30 to 22:00, India Standard Time. I was unprepared for the involuntary groan that arose from the pit of my stomach. Here, is an open letter to my buddy and the colleague who scheduled our conference to be held on India Time…

C’mon guys / gals… The Internet works on “Internet Time”, also known as UTC or GMT. It is effectively Earth time. It never changes with seasons, war, edict, accidents or daylight savings. It just moves forward as the universal heartbeat of the Internet.

Please don’t make me translate your Indian Standard Time. I will get it wrong. I always do.

Please don’t make me translate your Indian Standard Time. I will get it wrong. I always do.

And please don’t figure it out in “USA-Eastern Standard Time”. Here in the US, politicians shift Daylight Savings dates, sometimes splitting it by local counties. In some areas, they change it by only 30 minutes for border towns. (Yes! We are that nuts).

So please: Just tell me the time in UTC. It is the only time that should ever be cited when dealing with anyone that you can’t reach with a personal handshake.

P.S. Don’t take insult when I post your suggested meeting time (and this sarcastic response) to Lifeboat. Sure, you helped me to discover a new peeve—But you have also hit upon my funny bone!

Faithfully yours, ~Phil

Philip Raymond is Co-Chair of The Cryptocurrency Standards Association. He sits on the New Money Systems Board at Lifeboat and advises banks & brokers on new age currencies. Raymond was master of ceremonies and speaker at The Bitcoin Event in New York.

What does Bilderberg have in common with Camp Alphaville? | FT Alphaville

Fun article below on upcoming Financial Times event. Transhumanism and AI will be a part of the discussions at the event. They’re going to have lots of weird technology there, as well as robots wandering around.

Bitcoin Adoption: Series of reactions

What is Bitcoin?

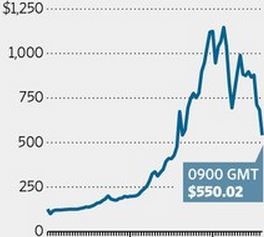

Sure—You know the history. As it spread from the geeky crypto community, Bitcoin sparked investor frenzy. Its “value” was driven by the confidence of early adopters that they hitched a ride on an early train, rather than commercial adoption. But, just like those zealous investors, you realize that it may ultimately reduce the costs of online commerce, if and when if it becomes widely accepted.

But what is Bitcoin, really? To what class of instruments does it belong?

• Ardent detractors see a sham: A pyramid scheme with no durable value; a house of cards waiting to tumble. This is the position of J.D, an IRS auditor who consults to The Cryptocurrency Standards Association. As devil’s advocate, he keeps us grounded.

• This week, MasterCard was only slightly less dour. They claim that the distributed nature of Bitcoin will ultimately cause it to unravel. They want us to believe in the necessity of a trusted authority as broker/guarantor/arbiter. I get it! After all, the block chain is a serious threat to the legacy model for moving money

• Many people recognize that it can be a useful transaction medium—similar to a prepaid gift card, but with a few added kicks: Decentralized, low cost and private.

• Or is it an equity asset, traded by a community of speculative investors, and subject to bubble psychology? If so, do the wild swings in its exchange rate diminish its potential to be used as a payment mechanism?

• Full-fledged ehthusiasts say that Bitcoin has the potential to be a full-fledged currency with a “real value” that floats based on supply and demand. Can something that lacks intrinsic value or the backing of a bank or government replace national currency?

Regardless of your opinion about Bitcoin, it does one thing that few pundits dispute: Sure, the exchange value fluctuates—but for those who don’t plan to retain holdings as an asset, it reduces transaction costs to —nearly zero. This characteristic, alone, is a dramatic breakthrough.

Peering Into the Future?

Removing friction is certainly what it is all about. As a transaction medium, Bitcoin achieves this, but so does any debit instrument, or any account in which a buyer has retained house “credit”.

Currently, there is a high bar to get money exchanged into and out of Bitcoin. It’s a mess: costly, time consuming and a big hassle. Seriously! Have you tried using an exchange? Even the most trusted one (Coinbase of San Francisco) makes it incredibly difficult to get money in and out of BTC, prior to establishing your account, identity and banking history. Fortunately, this situation is gradually improving.

Currently, there is a high bar to get money exchanged into and out of Bitcoin. It’s a mess: costly, time consuming and a big hassle. Seriously! Have you tried using an exchange? Even the most trusted one (Coinbase of San Francisco) makes it incredibly difficult to get money in and out of BTC, prior to establishing your account, identity and banking history. Fortunately, this situation is gradually improving.

Where Bitcoin really shines (or more accurately, when it will shine), occurs at the time when more vendors choose to leave revenues in BTC, pending their own purchases from suppliers, shareholder payouts, or simply as retained savings.

When this happens, all sorts of good things will follow…

• A growing fraction of sellers leave their bitcoin in their wallets, realizing that they will need to spend it for their own labor and materials.

• Gradually, wild exchange-rate gyrations diminish—not because fewer people are exchanging money, but because the Bitcoin supply/demand value is driven more by actual commerce than it is by speculation.

• Sellers begin pricing merchandise in Bitcoin rather than national currencies—because they are less anxious to exchange out of BTC immediately after each sale.

When sellers begin letting a fraction of bitcoin revenues ride—and as they begin pricing goods and services in BTC—a phenomenon will follow. I call it the tipping point…

• If goods and services are priced in BTC, then everyone involved saves money and engages in transactions more efficiently.

• If goods and services are priced in BTC, then the public will begin to perceive exchange rate volatility as a changing dollar rather than a changing bitcoin.*

• If buyers also begin to save their BTC (i.e. they do not worry about immediately moving it back to national currency), it means that Bitcoin is being perceived as a stored value—not just an exchange chit. That may seem to be a subtle footnote, but the ramifications are earth shaking. That earthquake is the world gradually moving away from centralized treasury-issued bank notes and toward a unified and currency that we can all trust.

People, everywhere, will one day place their trust in a far more robust and trustworthy mechanism than paper promissory notes printed by regional governments. A brilliantly crafted mechanism that is fully distributed, p2p, transaction verified (yet private), has a capped supply and is secure.

What Then?

O.K. So we believe that Bitcoin is the future of money and not just a replacement for credit cards. But what does this really mean? Can the series of cause-and-effect be extrapolated beyond widespread user adoption? Absolutely! …

Adoption of Bitcoin as a stored value (that means as a currency) leads to the gradual realization among governments that Bitcoin is not a threat to sovereignty nor even to tax policy. Instead it presents unbounded opportunity: The opportunity to stabilize markets, eliminate inflation, reduce costs and restore public trust. In short, Bitcoin will ultimately level the playing field, revive entire economies, transform the role of government, and save consumers and businesses billions of dollars each year.

Did I mention that Bitcoin is the future of commerce and a very possible successor to legacy currencies? Aristotle must be smiling.

* We tend to think of the dollar as more ‘real’ than Bitcoin. It is not! It has only one advantage. At the end of the day, taxpayers must settle their debts in the currency demanded of their nation. But as Bitcoin adoption gains traction—even if only as a transmitting medium—fiat currencies will gradually become marginalized as play money. That’s because they are susceptible to inflation, politics and manipulation. Bitcoin is held to a higher standard. It is governed by pure math. Despite high-profile news of the day, Bitcoin will even become more resistant to loss and theft than dollars, once tools and practices become well established.

Philip Raymond is Co-Chair of The Cryptocurrency Standards Association. He advises banks on new

age currency. Raymond was master of ceremonies and 1st speaker at The Bitcoin Event in New York.

Related:

United Nations Committee on the Peaceful Uses of Outer Space: 2015

“The fifty-eighth session of the Committee on the Peaceful Uses of Outer Space will be held from 10–19 June 2015 at the United Nations Office at Vienna, Vienna International Center, Vienna, Austria.”

Stanford engineers develop a computer that operates on water droplets — By Bjorn Carey | Stanford News

[youtube_sc url=“https://www.youtube.com/watch?v=m5WodTppevo” loop=“1”]

” “Following these rules, we’ve demonstrated that we can make all the universal logic gates used in electronics, simply by changing the layout of the bars on the chip,” said Katsikis. “The actual design space in our platform is incredibly rich. Give us any Boolean logic circuit in the world, and we can build it with these little magnetic droplets moving around.”

The current paper describes the fundamental operating regime of the system and demonstrates building blocks for synchronous logic gates, feedback and cascadability – hallmarks of scalable computation. A simple-state machine including 1-bit memory storage (known as “flip-flop”) is also demonstrated using the above basic building blocks. ”

The quest to save today’s gaming history from being lost forever — Kyle Orland | Ars Technica

“‘When you’re seeking to preserve a historic house, there may be layers, it may have been lived in by many different people. Mount Vernon had been lived in by George Washington’s descendants, so they made a decision to restore it to George Washington’s time and erase this later history. Do you make the same kind of decision with games?’” Read more

Open Sourcing Is No Longer Optional, Not Even for Apple — Klint Finley Wired

The biggest round of applause at Apple’s Worldwide Developers Conference keynote yesterday didn’t come when the company announced new versions of iOS and OS X, or even the new Apple Music service. It came when Apple’s vice president of engineering Craig Federighi announced that the company will open source the next version of its programming language Swift.

Why the excitement? Developers have demonstrated a growing preference for open source tools and platforms over the past 15 years. Apple, meanwhile, has pushed iOS developers towards its own in-house development technologies and away from third-party tools, such as Adobe Flash, that it deems inefficient. But even Apple can only risk alienating the developers on whom it relies for so many third-party apps and services so far. Coders have myriad options available to let them do their jobs the way they want; to keep them in-house, it turns out, Apple has to open up. Read more

Oculus Rift, Magic Leap, and the Future of Reality … By Ava Kofman | The Atlantic

Vannevar Bush’s prediction, half a century later, rings true: “The world has arrived at an age of cheap complex devices of great reliability; and something is bound to come of it.”

Just as Stephen Hawking warned? Here comes ‘the world’s angriest robot’ — CNET

Technically Incorrect: A New Zealand-based company says it’s building a very, very angry robot to help companies deal with angry customers.