What is Bitcoin?

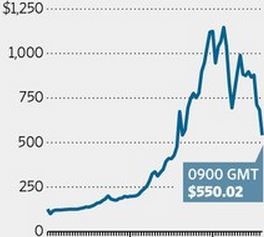

Sure—You know the history. As it spread from the geeky crypto community, Bitcoin sparked investor frenzy. Its “value” was driven by the confidence of early adopters that they hitched a ride on an early train, rather than commercial adoption. But, just like those zealous investors, you realize that it may ultimately reduce the costs of online commerce, if and when if it becomes widely accepted.

But what is Bitcoin, really? To what class of instruments does it belong?

• Ardent detractors see a sham: A pyramid scheme with no durable value; a house of cards waiting to tumble. This is the position of J.D, an IRS auditor who consults to The Cryptocurrency Standards Association. As devil’s advocate, he keeps us grounded.

• This week, MasterCard was only slightly less dour. They claim that the distributed nature of Bitcoin will ultimately cause it to unravel. They want us to believe in the necessity of a trusted authority as broker/guarantor/arbiter. I get it! After all, the block chain is a serious threat to the legacy model for moving money

• Many people recognize that it can be a useful transaction medium—similar to a prepaid gift card, but with a few added kicks: Decentralized, low cost and private.

• Or is it an equity asset, traded by a community of speculative investors, and subject to bubble psychology? If so, do the wild swings in its exchange rate diminish its potential to be used as a payment mechanism?

• Full-fledged ehthusiasts say that Bitcoin has the potential to be a full-fledged currency with a “real value” that floats based on supply and demand. Can something that lacks intrinsic value or the backing of a bank or government replace national currency?

Regardless of your opinion about Bitcoin, it does one thing that few pundits dispute: Sure, the exchange value fluctuates—but for those who don’t plan to retain holdings as an asset, it reduces transaction costs to —nearly zero. This characteristic, alone, is a dramatic breakthrough.

Peering Into the Future?

Removing friction is certainly what it is all about. As a transaction medium, Bitcoin achieves this, but so does any debit instrument, or any account in which a buyer has retained house “credit”.

Currently, there is a high bar to get money exchanged into and out of Bitcoin. It’s a mess: costly, time consuming and a big hassle. Seriously! Have you tried using an exchange? Even the most trusted one (Coinbase of San Francisco) makes it incredibly difficult to get money in and out of BTC, prior to establishing your account, identity and banking history. Fortunately, this situation is gradually improving.

Currently, there is a high bar to get money exchanged into and out of Bitcoin. It’s a mess: costly, time consuming and a big hassle. Seriously! Have you tried using an exchange? Even the most trusted one (Coinbase of San Francisco) makes it incredibly difficult to get money in and out of BTC, prior to establishing your account, identity and banking history. Fortunately, this situation is gradually improving.

Where Bitcoin really shines (or more accurately, when it will shine), occurs at the time when more vendors choose to leave revenues in BTC, pending their own purchases from suppliers, shareholder payouts, or simply as retained savings.

When this happens, all sorts of good things will follow…

• A growing fraction of sellers leave their bitcoin in their wallets, realizing that they will need to spend it for their own labor and materials.

• Gradually, wild exchange-rate gyrations diminish—not because fewer people are exchanging money, but because the Bitcoin supply/demand value is driven more by actual commerce than it is by speculation.

• Sellers begin pricing merchandise in Bitcoin rather than national currencies—because they are less anxious to exchange out of BTC immediately after each sale.

When sellers begin letting a fraction of bitcoin revenues ride—and as they begin pricing goods and services in BTC—a phenomenon will follow. I call it the tipping point…

• If goods and services are priced in BTC, then everyone involved saves money and engages in transactions more efficiently.

• If goods and services are priced in BTC, then the public will begin to perceive exchange rate volatility as a changing dollar rather than a changing bitcoin.*

• If buyers also begin to save their BTC (i.e. they do not worry about immediately moving it back to national currency), it means that Bitcoin is being perceived as a stored value—not just an exchange chit. That may seem to be a subtle footnote, but the ramifications are earth shaking. That earthquake is the world gradually moving away from centralized treasury-issued bank notes and toward a unified and currency that we can all trust.

People, everywhere, will one day place their trust in a far more robust and trustworthy mechanism than paper promissory notes printed by regional governments. A brilliantly crafted mechanism that is fully distributed, p2p, transaction verified (yet private), has a capped supply and is secure.

What Then?

O.K. So we believe that Bitcoin is the future of money and not just a replacement for credit cards. But what does this really mean? Can the series of cause-and-effect be extrapolated beyond widespread user adoption? Absolutely! …

Adoption of Bitcoin as a stored value (that means as a currency) leads to the gradual realization among governments that Bitcoin is not a threat to sovereignty nor even to tax policy. Instead it presents unbounded opportunity: The opportunity to stabilize markets, eliminate inflation, reduce costs and restore public trust. In short, Bitcoin will ultimately level the playing field, revive entire economies, transform the role of government, and save consumers and businesses billions of dollars each year.

Did I mention that Bitcoin is the future of commerce and a very possible successor to legacy currencies? Aristotle must be smiling.

* We tend to think of the dollar as more ‘real’ than Bitcoin. It is not! It has only one advantage. At the end of the day, taxpayers must settle their debts in the currency demanded of their nation. But as Bitcoin adoption gains traction—even if only as a transmitting medium—fiat currencies will gradually become marginalized as play money. That’s because they are susceptible to inflation, politics and manipulation. Bitcoin is held to a higher standard. It is governed by pure math. Despite high-profile news of the day, Bitcoin will even become more resistant to loss and theft than dollars, once tools and practices become well established.

Philip Raymond is Co-Chair of The Cryptocurrency Standards Association. He advises banks on new

age currency. Raymond was master of ceremonies and 1st speaker at The Bitcoin Event in New York.

Related: