Singapore-based ST Aerospace has collaborated with US-based precision control components provider Moog to explore and develop blockchain and 3D printing-enabled total digital transaction for the global aerospace sector.

“Lloyds Banking Group Plc said on Sunday it would ban its credit card customers from buying Bitcoin and other cryptocurrencies.”

Puerto Rico 09:15 A History of Virtual Currency and Digital Payments Rod Garratt UCSB 09:30 Transparency and the Transformative Nature of Blockchain Technology Gerardo Trevino Paybook 10:00 Living on the Ledger And The Coming Licensing Revolution Matt Clemenson Lottery.com Scott Picken WealthMigrate.com 10:30 Coffee Break 11:00 New Money, New Internet, New World Alena Vranova Satoshi Labs 11:15 Crypto Trading Panel Jared Geata Blockchain Industries, Inc.

“To encourage exploration and eventual use of this technology in support of climate action, the UN Climate Change secretariat initiated and facilitated the creation of the Climate Chain Coalition and contributed to the writing of its charter of principles and values … ”

Back in April of 2017 Bitcoin.com launched a notary service that was based on top of the bitcoin core (BTC) blockchain. However, due to the transaction bottleneck and extremely high fees, the notary service became unsustainable. Now Bitcoin.com has re-launched the notary using the bitcoin cash (BCH) blockchain, and anyone in the world can prove ownership for only 0.0005 BCH (about $0.97).

Also read: Lots of Optimism at the Miami Bitcoin Conference This Week

This week Bitcoin.com has re-launched the blockchain-based notary service that was once tethered to the bitcoin core blockchain. Unfortunately, the service did not work correctly because of transaction backlog, and high network fees to verify documents. Now the infrastructure is tied to the bitcoin cash blockchain making document verification extremely cheap, and fees are practically non-existent. Right now a user can upload a document for only 0.0005 BCH ($0.97), and the network transaction fee is less than a penny. (It’s important to note that records don’t actually “exist” on the chain per say, it is merely timestamped encrypted data that is tied to the file that’s processed into a valid BCH transaction.) Not only that but the proof will be verified in less than ten minutes, and you can rest assure the notarization service will be validated.

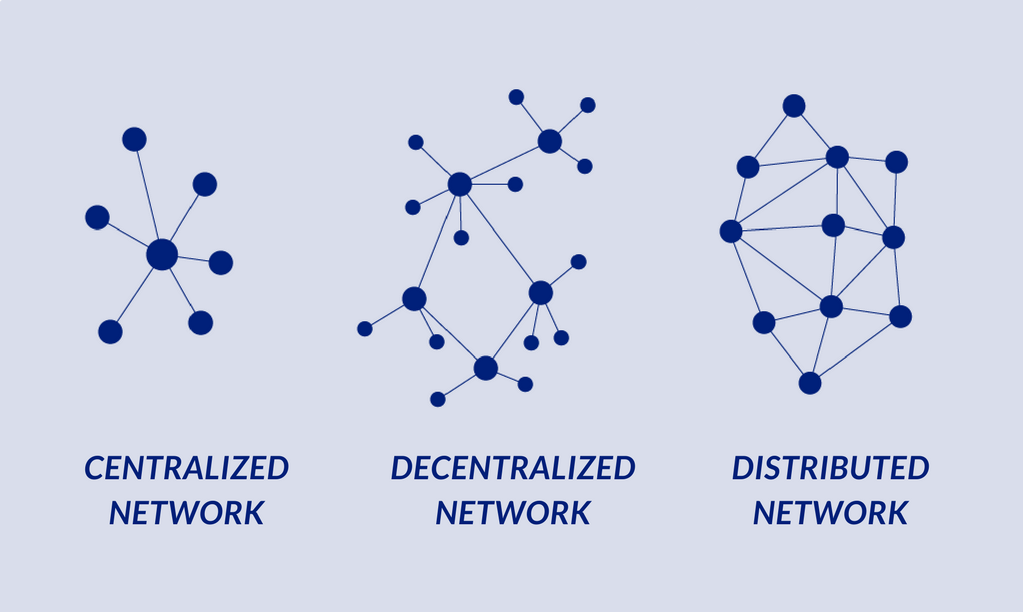

You can start getting pumped about the next generation of graphics cards, as Samsung has announced that it’s building the first-ever 16-gigabit GDDR6 chips using its 10-nanometer class technology. The news isn’t a complete surprise, as Samsung previously said that GDDR6 was coming when it unveiled 8-gigabit DDR4 RAM chips last month and won a CES 2018 Innovation Award in November.

“Beginning with this early production of the industry’s first 16Gb GDDR6, we will offer a comprehensive graphics DRAM line-up, with the highest performance and densities, in a very timely manner,” said Samsung’s Senior VP Jinman Han. The company also did a minor tease, saying the chips “will play a critical role in early launches of next-generation graphics cards and systems.”

The voracious demand from bitcoin mining has pushed the GeForce GTX 1070 from a $380 suggested retail price to $890.

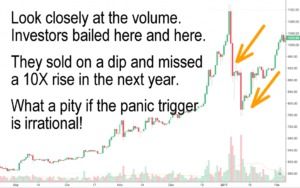

If you are reading this on January 16, 2018, then you are aware that Bitcoin (and the exchange rate of most other coins) fell by 20% today. Whenever I encounter a panic sell-off, the first thing that I do is try to ascertain if the fear that sparked the drop is rational.

But what is rational fear? How can you tell if this is the beginning of the end, or simply a transient dip? In my book, rational fears are fundamental facts like these:

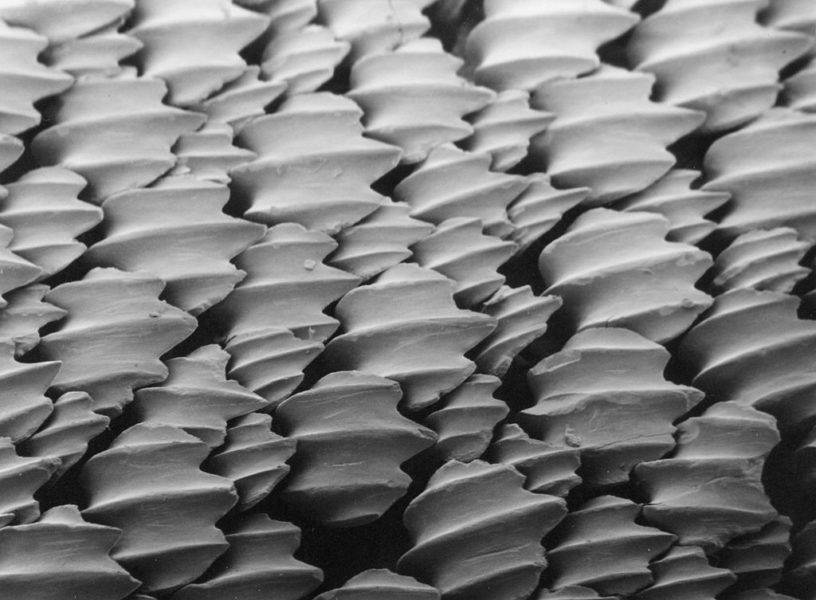

Conspicuously missing from this list is “government bans” or any regulation that is unenforceable, because it fails to account for the design of what it attempts to regulate. Taxes, accounting guidelines, reporting regulations are all fine! These can be enforced. But banning something that cannot be banned is not a valid reason for instilling fear in those who have a stake in a new product, process, or technology.

Rule of Acquisition #1:

Drops triggered by false fears present buying opportunities

At times like this, you must make a choice: If you can’t afford to stay in the market and risk a bigger drop, then cash out and live with it. But if you believe in crypto and the potential for a digital future that dis-intermediates your earning, spending and savings, then this drop in dollar value presents opportunity.

At times like this, you must make a choice: If you can’t afford to stay in the market and risk a bigger drop, then cash out and live with it. But if you believe in crypto and the potential for a digital future that dis-intermediates your earning, spending and savings, then this drop in dollar value presents opportunity.

This downturn will pass, because the cryptocurrency fundamentals have not changed or been undermined by recent events. There is no new technical flaw or hack. The potential for cash transactions and future applications get rosier every day (let’s assume that Bitcoin will finally add Lightning Network and that miners will stop fighting with developers)*

The current 20% drop is not a big deal. It takes us back to an exchange rate that we saw just one month ago in early December. It was triggered by saber rattling in South Korea. But, let’s face it: Governments have as much influence over trading or spending cryptocurrency as they do over the mating of squirrels in your backyard. Do you think fewer squirrels would mate, if the government banned them from mating?

If you can answer that question—and if you can afford to stay in the game—then relax. 1 BTC has the same value today as it had yesterday and the day before. It is worth exactly one bitcoin. The current dip in exchange rate with other currencies was sparked by fear; and that fear is misguided or irrational.

[click below for perspective]…

* Bitcoin has a serious limitation in transaction throughput and transaction cost. The problem is serious and it frustrates users, developers, miners and vendors. But it is not new, and the consensus about its likelihood of being corrected has not suddenly changed. These limitations are unrelated to today’s large drop in exchange value.

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He is keynote speaker at the Cryptocurrency Expo in India this month. Click Here to inquire about a presentation or consulting engagement.

Some blogs and news outlets eschew long titles. Publishers want readers to scan a list of topics that fit on one-line each. But, a better title for this article would be:

“Massive electric consumption by cryptocurrency mining:

An unfortunate environmental nightmare will soon pass!

… Proof-of-Work alternatives are on the horizon”

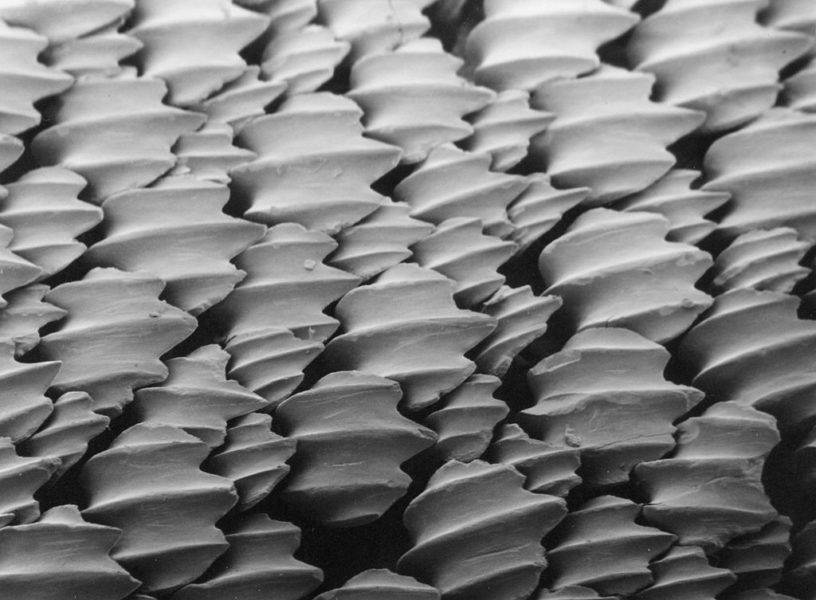

A considerable amount of electricity is used in the process of mining Bitcoin and other cryptocurrencies. Miners are effectively distributed bookkeepers, and this use of resources is part of a system called “proof-of-work”. It keeps the books fair, honest, and without an ability for the miners to collude (In other words, they cannot ‘cook the books’).

What makes the process unique and exciting is that this “distributed consensus” does not require a trusted authority, like a bank. In fact, the whole point of the blockchain revolution is that users trust a mechanism rather than a bank, government or even each other.

But, for any network that hopes to become part of the financial fabric, it must be ubiquitous and in constant motion. Proof-of-work just doesn’t make the grade, because it doesn’t scale. The need for miners to prove that they did something complex sucks up too much power. If Bitcoin or any proof-of-work currency were to be adopted for even a small fraction of commercial and personal transactions, it would overwhelm the world’s energy services.

One reader suggests the problem will be solved by the recent boom in shale fracking and renewable, non-polluting energy. He points out that crypto mining may even drive a market for distributed, clean electric production.

One reader suggests the problem will be solved by the recent boom in shale fracking and renewable, non-polluting energy. He points out that crypto mining may even drive a market for distributed, clean electric production.

Unfortunately, clean and cheap power makes the problem worse. Even if electric capacity were to rise dramatically and experience a great cost reduction, cryptocurrency networks would automatically demand all the extra electricity. It is a no-win game, because mining incentives escalate with an increase in supply or drop in cost.

Will large-scale, blockchain-based networks fail, because of enormous electric demand? Fortunately, the future is not so bad, after all. Although networks, like Bitcoin, currently use proof-of-work to ensure honesty and fairness, it is only one of many possible measurement and enforcement mechanisms. Eventually, developers and miners will swap in another proof mechanism to keep the network humming—and without creating an environmental catastrophe.

Will Change in Proof Come in Time?

The political process for changing the fairness mechanism (“forking the code”) is complex and fraught with infighting, but the problem will eventually be addressed, and it will be solved before electricity becomes a critical issue. Despite a messy voting process, the miners have too much at stake to ignore this problem much longer.

Various proof alternatives are already being used in altcoins. Since Bitcoin is perfectly free to steal these techniques (none can be protected by patent or trade secrecy), we can think of these other coins as beta-tests for Bitcoin. How so? As the first and biggest elephant in the room, Bitcoin will likely reign supreme, as long as it doesn’t wait too long before grabbing the best technology and tucking it into its quiver.

Proof-of-Work Alternatives

These aren’t the only alternatives to proof-of-work. Ultimately, one or more of these fairness enforcement mechanisms will make its way into Bitcoin and other currencies and blockchain services. In my opinion, the electrical crisis is a genuine threat, but it is one that with a solution that will be implemented soon—perhaps even this year.

Related:

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He is keynote speaker at the Cryptocurrency Expo in India this month. Click Here to inquire about a presentation or consulting engagement.