I love clearing the air with a single dismissive answer to a seemingly complex question. Short, dismissive retorts are definitive, but arrogant. It reminds readers that I am sometimes a smart a*ss.

Is technical analysis a reasoned approach for

investors to predict future value of an asset?

In a word, the answer is “Hell No!”. (Actually, that’s two words. Feel free to drop the adjective). Although many technical analysts earnestly believe their craft, the approach has no value and does not hold up to a fundamental (aka: facts-based) approach.

One word arrogance comes with an obligation to substantiate—and, so, let’s begin with examples of each approach.

Investment advisors often classify their approach to studying an equity, instrument or market as either a fundamental or technical. For example…

- Fundamental research of a corporate stock entails the analysis of the founders’ backgrounds, competitors, market analysis, regulatory environment, product potential and risks, patents (age and legal challenges), track record, and long term trends affecting supply and demand.A fundamental analysis may study the current share price, but only to ascertain the price-to-earnings ratio compared to long term prospects. That is, has the market bid the stock up to a price that lacks a basis for long term returns?

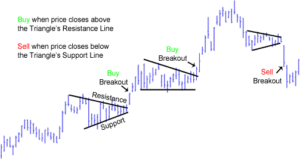

. - On the other hand, a technical approach tries to divine trends from recent performance—typically charting statistics and pointing to various graph traits such as resistance, double shoulders, and number of reversals. The approach is more concerned with assumptions and expectations of investor behavior—or hypotheses and superstition related to numerology—than it is with customers, products, facts and market demand.

Do you see the difference? Fundamental analysis is rooted in SWOT: Study strengths, weaknesses, opportunities, and threats. Technical analysis dismisses all of that. If technical jargon and approach sound a bit like a Gypsy fortune teller, that’s because it is exactly that! It is not rooted in revenue and market realities. Even if an analyst or advisor is earnest, the approach is complete hokum.

I have researched, invested, consulted and been an economic columnist for years. I have also made my mark in the blockchain space. But until now, I have hesitated to call out technical charts and advisors for what they are…

Have you noticed that analysts who produce technical charts make their income by working for someone? Why don’t they make a living from their incredible ability to recognize patterns and extrapolate trends? This rhetorical question has a startlingly simple answer: Every random walk appears to have patterns. The wiring of our brain guarantees that anyone can find patterns in historical data. But the constant analysis of patterns by countless investors guarantees that the next pattern will be unrelated to the last ones. That’s why short term movement is called a “random walk”. Behaviorists and neuroscientists recognize that apparent relationships of past trends can only be correlated to future patterns in the context of historical analysis (i.e. after it has occurred).

Decisions based on a technical analysis—instead of solid research into fundamentals—is the sign of an inexperienced or gullible investor. Some advisors who cite technical charts know this. Technicals have no correlation to long term appreciation, asset quality or risks. They only point to short term possibilities.

The problem with focusing on short-term movement is that you will certainly lose to insiders, lightning-fast program traders, built in arbitrage mechanisms and every unexpected good news/bad news bulletin.

If you seek to build a profit in the long run, then do your research up front, enter gradually, and hold for the long term. Of course, you should periodically reevaluate your positions and react to significant news events from trusted sources. But you should not anguish over your portfolio every day or even every month.

- Know your objectives

- Set realistic targets

- Research by reading contrarians and skeptics (They help you to avoid confirmation bias)

- Study comparables and reason through the likelihood that another technology or instrument poses a threat to the asset that interests you

- Then, invest only what you can afford to lose and don’t second guess yourself frequently

- Dollar-cost-average

- Revaluate semi-annually or when meeting with direct sources of solid, fundamental information

Finally, if someone tries to dazzle you with charts of recent performance and talk of a “resistance level” or support trends, smile and nod in approval—but don’t dare fall for the Ouija board. Send them to me. I will straighten them out.

Who says so? Does the author have credentials?

I originally wrote this article for another publication. Readers challenged my credentials by pointing out that I am not a academic economist, investment broker or financial advisor. That’s true…

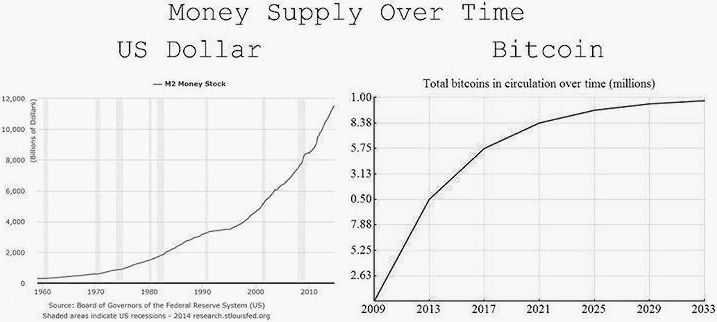

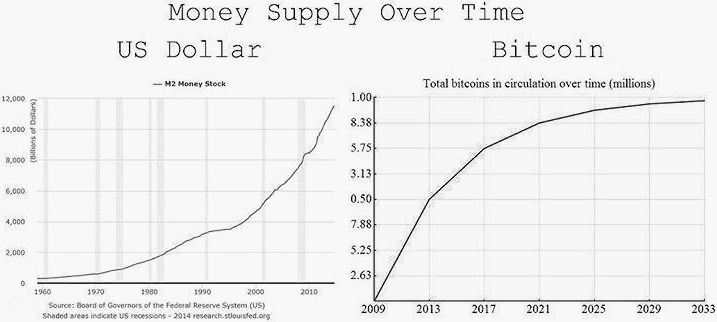

I am not an academic economist, but I have certainly been recognized as a practical economist. Beyond investor, and business columnist, I have been keynote speaker at global economic summits. I am on the New Money Systems Board at Lifeboat Foundation, and my career is centered around research and public presentations about money supply, government policy and blockchain based currencies. I have advised members of president Obama’s council of economic advisors and I have recently been named Top Writer in Economics by Quora.

I am not an academic economist, but I have certainly been recognized as a practical economist. Beyond investor, and business columnist, I have been keynote speaker at global economic summits. I am on the New Money Systems Board at Lifeboat Foundation, and my career is centered around research and public presentations about money supply, government policy and blockchain based currencies. I have advised members of president Obama’s council of economic advisors and I have recently been named Top Writer in Economics by Quora.

Does all of this qualify me to make dismissive conclusions about technical analysis? That’s up to you! This Lifeboat article is an opinion. My opinion is dressed as authoritative fact, because I have been around this block many times. I know the score.

Related:

Philip Raymond co-chairs CRYPSA, hosts the Bitcoin Event and is keynote speaker at Cryptocurrency Conferences. He sits on the Lifeboat New Money Systems board. Book a presentation or consulting engagement.