Kenyan banks are seeking regulatory approval to use distributed-ledger technology, also known as blockchain, to distribute payments and create credit-scoring models to rate potential borrowers.

Let us frame the question, by reviewing what miners really do…

Miners play a critical role in the Bitcoin network. Their activity (searching for a nonce) results in assembling an immutable string of blocks that corroborate and log the universal transaction record. They are the distributed bookkeepers that replace old-school banks in recording and vouching for everyone’s purchase or savings.

From the perspective of a miner, there is no obvious connection between their activity and the worldwide network of bitcoin transactions and record keeping. They are simply playing an online game and competing against thousands of other miners in an effort to solve a complex and ongoing math problem. As they arrive at answers to small pieces of the problem, they are rewarded with bitcoin, which can be easily translated into any currency.

What is the Problem?

One day, mining for rewards will no longer be possible. The fundamental architecture of Bitcoin guarantees that mining will end. The pool of rewards that were held in abeyance as incentives is small and will run out in 2140—about 120 years from now. So, this raises the question: How will we incentivize miners when there is no more reward? (Actually, they won’t really be miners anymore…They will more accurately be bookkeepers or ‘validators’)

Is there a Solution?

Fortunately, there are many ways to offer incentives to those who validate transactions and maintain the books. Here are just a few:

I believe in this last solution and I have proposed it as the path forward at crypto/blockchain conferences.

I believe in this last solution and I have proposed it as the path forward at crypto/blockchain conferences.

Today, this idea seems implausible, because of the memory and computational requirements for running a full node. But, there have been big advancements in the effort to support micro-mining—which does not require such resources. Additionally, it is likely that the current proof-of-work mechanism used to arrive at a distributed consensus will be replaced by another mechanism that does not result in a competition to see who can consume the most electricity.

More about the sunset of mining incentives:

Philip Raymond co-chairs CRYPSA, hosts the New York Bitcoin Event and is keynote speaker at Cryptocurrency Conferences. He sits on the New Money Systems board of Lifeboat Foundation and is a top Bitcoin writer at Quora. Book a presentation or consulting engagement.

Looking to attend or speak at an event about Blockchain?

Join us at Navy Pier in Chicago on August 24th & 25th in bringing the LEADERS in blockchain, government, and business together with the VOICES to learn what is possible from the BUILDERS. 50+ Leaders (Speakers) 100+ Voices (Bloggers, Podcasters, Youtubers) 250+ Builders (Blockchain Projects) 5,000 Attendees.

Today, economist and Nobel laureate, Paul Krugman, wrote in the New York Times, that Bitcoin is taking us back 300 years in monetary evolution. As a result, he predicts all sorts of bad things.

A significant basis for Mr. Krugman’s argument is that the US dollar has value because men with guns say it does.

Is Bitcoin erasing 300 years of monetary evolution?

Running with the metaphor that fundamental change to an economic mechanism represents ‘evolution’, I think a more accurate statement is that Bitcoin is not erasing the lessons of history. Rather, it is the current step in the evolution of money. Of course, with living species, evolution is a gradual process based on natural selection and adaptation. With Bitcoin, change is coming up in the rear view mirror at lightning speed.

The Evolution of Money

When a medium of exchange is portable, fungible, divisible, unforgeable and widely accepted, it becomes money. For at least six millennia, barter was gradually replaced by various mediums of exchange.

But what backs these forms of money? What gives them value?

The first 3 currencies above were accepted as money on 5 continents. They were backed by their scarcity and unique characteristic properties (Aristotle called this intrinsic value). But even gold cannot serve as a widely used currency today. Although it is portable and scarce, it is not easily tested or subdivided in the field; it is risky to transport and difficult to track; and it is not suited to instant electronic settlement. But what about Fiat money. What backs it?

What Backs National Currencies?

Fiat has been backed by various different things throughout history. They are all compromised attempts to establish confidence and trust. They are compromised, because the fall short of one or more facets of trust.

In the list below, monetary backings in Red are what Mr. Krugman calls “men with guns”. That is, he claims that government demands give value to the dollar:

Unfortunately, the transition away from a trustworthy basis and the constant temptation of kings, dictators and politicians to print money based on credit (or nothing at all—as in the case of our fractional reserve system), has created a house of cards that few people believe is sustainable.

Bitcoin changes all this.

Finally, a crowd-sourced trust basis was invented (or discovered). It is unhackable, un-inflatable, unforgeable and immutable. Most important, it allows a government to be decoupled from its own monetary policy and supply. This is a remarkably good thing for businesses, consumers, creditors, trading partners—and especially for governments.

And Bitcoin is backed by something better than guns, gold or promises. It is provably scarce, capped in supply, completely fair, and built on a massive, crowd-sourced network of bookkeepers and auditors. It is the first currency—and quite probably the last—built on genius math and indisputable trust.

Despite the gross misunderstandings and misconceptions of early pundits, it does not interfere with a government’s ability to tax, to spend or to enforce tax collection—and it does not facilitate crime.

Bitcoin is new, but the goal of distributing trust is not as radical as you might think. It addresses a problem that economists and mathematicians have pondered since Aristotle and the ancient Greeks…

Background

Ever since the transition from real gold to government notes, bank notes and bank ledgers—economists have wondered if value can arise from a public trust that is durable, distributed and stateless. Until 2009, the answer seemed to be that this was impossible because of the double-spend problem.

But 9 years ago, something changed; and the change is dramatic. It will take an additional decade for most people to understand and appreciate this change…

In the first paragraph, I cited Mr. Krugman’s statement that the US Dollar has value because of “men with guns” (a reference to the fact that its use is legally compelled for payment of any debt and for government taxes). But this is not what gives it value. The dollar, the Euro, a Picasso painting and a fresh serving of hot french fries all derive their value from supply and demand. Bitcoin is no different. The trick is to generate viral demand and a ubiquitous infrastructure needed to achieve a robust two-sided network.

In the white paper that introduced both blockchain and Bitcoin (the first blockchain application), Satoshi taught us that a widespread and easy to access communications network (the internet and universal access to smartphones) can give rise to value that is based on a different type of trust. Instead of trust in a government, a bank, or testing the chemistry of a precious metal, value can arise from trust in a formula that is ubiquitous, redundant and constantly monitored and vetted.

All of these things have a value based on demand and the available supply. But with Bitcoin, the medium of exchange (and additionally the store and transfer of value), can be achieved by math, distributed trust and a pure, two-sided network.

So, is Bitcoin taking us backward in time, utility, safety and governance? I have never been awarded a Nobel Prize—but it seems pretty clear to me that Bitcoin is taking us forward and not backward.

Philip Raymond co-chairs CRYPSA, hosts the New York Bitcoin Event and is keynote speaker at Cryptocurrency Conferences. He sits on the New Money Systems board of Lifeboat Foundation. Book a presentation or consulting engagement.

Xage (pronounced Zage), a blockchain security startup based in Silicon Valley, announced a $12 million Series A investment today led by March Capital Partners. GE Ventures, City Light Capital and NexStar Partners also participated.

The company emerged from stealth in December with a novel idea to secure the myriad of devices in the industrial internet of things on the blockchain. Here’s how I described it in a December 2017 story:

Xage is building a security fabric for IoT, which takes blockchain and synthesizes it with other capabilities to create a secure environment for devices to operate. If the blockchain is at its core a trust mechanism, then it can give companies confidence that their IoT devices can’t be compromised. Xage thinks that the blockchain is the perfect solution to this problem.

What do the Gallic Wars and online shopping have in common? The answer, believe it or not, is cryptography. Cryptography is the cement of the digital world, but it also has a long history that predates the digital era.

Most people do not realize that cryptography is a foundational element to our modern society. At it’s heart cryptography is about access to data, and controlling who can see and use it.

Don’t get your hopes up.

Blockchain developers won’t be at peace until every single thing in the world is on blockchain. Or, so it seems.

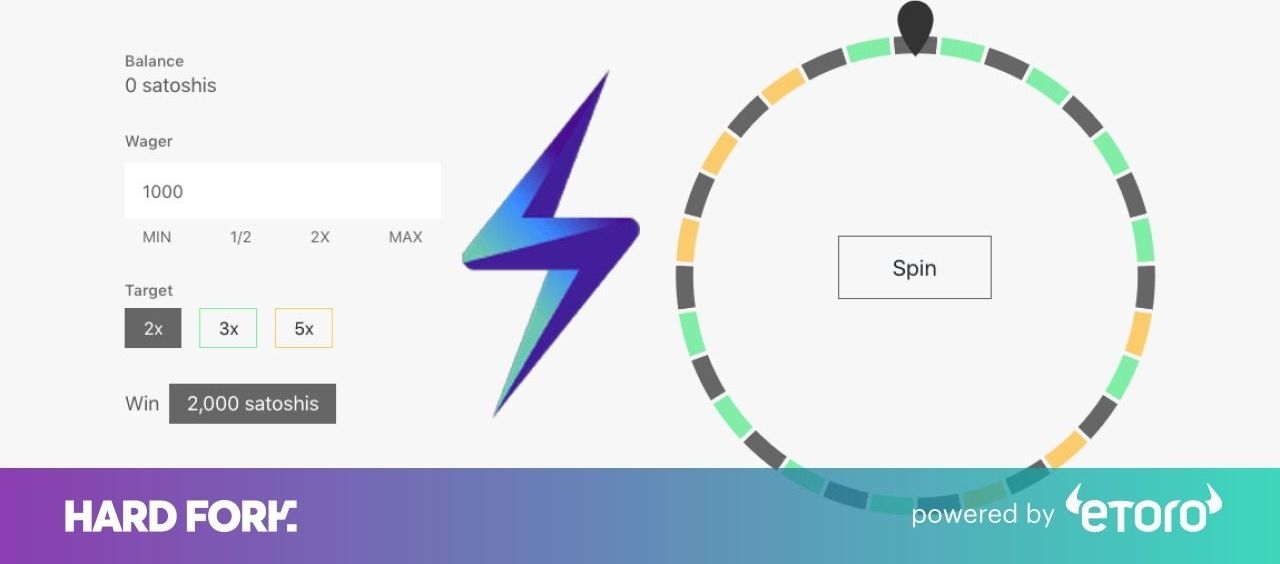

Web developer Rui Gomes has created Lighting Spin — a web app that lets you play roulette over Bitcoin Lightning Network.

The app lets you wager anywhere between 1,000 Satoshi (approximately 6¢) to 100,000 Satoshi (approximately $6) per round. All you need to play the game is load your balance using a wallet service with support for the Lightning Network – like Eclair, for instance.

Last year, I got invited to a super-deluxe private resort to deliver a keynote speech to what I assumed would be a hundred or so investment bankers. It was by far the largest fee I had ever been offered for a talk — about half my annual professor’s salary — all to deliver some insight on the subject of “the future of technology.”

I’ve never liked talking about the future. The Q&A sessions always end up more like parlor games, where I’m asked to opine on the latest technology buzzwords as if they were ticker symbols for potential investments: blockchain, 3D printing, CRISPR. The audiences are rarely interested in learning about these technologies or their potential impacts beyond the binary choice of whether or not to invest in them. But money talks, so I took the gig.

After I arrived, I was ushered into what I thought was the green room. But instead of being wired with a microphone or taken to a stage, I just sat there at a plain round table as my audience was brought to me: five super-wealthy guys — yes, all men — from the upper echelon of the hedge fund world. After a bit of small talk, I realized they had no interest in the information I had prepared about the future of technology. They had come with questions of their own.