The title of this post is intentionally misleading. We frequently discuss the traits that lead to value here in the Lifeboat Blog. But today, I was asked a more nuanced question: “What things will hold their value?”

And there is a ulterior motive in being a columnist for Lifeboat. Analyzing the dynamics of durable value leads to some surprising conclusions about the money supply and what a society chooses to use as money. We’ll get to this at end of this post.

We know that value comes from supply and demand. There are no exceptions. But, we have not addressed the properties that make an asset hold value over the long haul. Let’s consider some examples…

Cars

In an affluent, mobile society, most people desire personal, point-to-point transportation — and so there is clearly a demand for automobiles.

But style & technology change rapidly and automobiles deteriorate with use and weather. After 8 to 10 years, their cost and maintenance rise dramatically, and owners lust for a new model. So cars don’t get our award for assets that hold value.*

Popular Toys

In the 1970s, the Cabbage Patch doll from Calico Industries, and later, Tickle Me Elmo in the 1990s created a buyer frenzy that rivaled a lemonade stand in the desert. Shoppers fought each other to grab a limited supply. Clearly, demand was very high. The one shown below is listed at Ebay this week with a starting bid of $5,000. Other, less popular styles can be found for $4.99.

At first, this demand was driven by clever marketing and crying children in the week before Christmas. Demand was driven by a parent’s love. But at the peak of frenzy, demand shifted to buyers without children who felt certain that they could profit from selling the dolls that they snatched up first.

At first, this demand was driven by clever marketing and crying children in the week before Christmas. Demand was driven by a parent’s love. But at the peak of frenzy, demand shifted to buyers without children who felt certain that they could profit from selling the dolls that they snatched up first.

But the demand was not durable. Fads driven by frenzy don’t hold value for the long haul—especially when a manufacturer can simply turn the spigot back on.

Stocks & Bonds

A share of stock represents ownership in a corporation. A municipal bond represents a lien against a city—or the fees generated by an infrastructure project.

A share of stock represents ownership in a corporation. A municipal bond represents a lien against a city—or the fees generated by an infrastructure project.

In both cases—especially bonds, which are a limited promise—no one expects value to last forever. It is a time-sensitive bet with the intention of expiration, redemption or exchange. So, these things also fail our criteria for durable value.

Houses & Real Estate

Like cars, homes require ongoing maintenance. But, most people weigh the maintenance cost against the benefit of having shelter, rather than comparing it to their gain or loss in value.

Like cars, homes require ongoing maintenance. But, most people weigh the maintenance cost against the benefit of having shelter, rather than comparing it to their gain or loss in value.

On the other hand, real estate value fluctuates in the long run due to things that are difficult to predict — population density, demographics, and quality-of-life issues related to infrastructure: weather, seismic events, politics, and access to health care and education.

Some real estate rises enormously in value over 50 or 100 years. Yet, we have seen boom-and-bust cycles that wipe out substantial wealth. So, real estate does not cut it in our contest for durable value.

Gold

The allure of gold and other precious metals is that their supply is capped — or limited by slow and predictable growth. The asset is difficult to find. It is acquired only from natural phenomena.

So, if we can also make it fungible, divisible, portable and difficult to counterfeit, then it meets most of Aristotle’s requirements for a functional currency. Theoretically, this can lead to widespread demand.

So, if we can also make it fungible, divisible, portable and difficult to counterfeit, then it meets most of Aristotle’s requirements for a functional currency. Theoretically, this can lead to widespread demand.

Gold certainly has exhibited its ability to hold value throughout thousands of years. But it is not so easily tested and divided in the field, and the impression that it has intrinsic value is an illusion. That’s because the fraction of gold acquired by investors dwarfs the amount actually needed for dentistry, electronics and even jewelry. In this modern era, even gold is becoming a house of cards, because its value is built upon speculation and emotion.

Oil (aka “black gold”)

With the rise of the automobile and power plants that burn fossil fuel, oil became a reserve currency of the 19th and 20th centuries. But there are two problems with it holding value over the long haul.

With the rise of the automobile and power plants that burn fossil fuel, oil became a reserve currency of the 19th and 20th centuries. But there are two problems with it holding value over the long haul.

First, unlike gold, oil is a consumable in every market. Therefore it is difficult to think of it as an asset. Also, we now live in a century in which energy and transportation is rapidly switching away from oil, while at the same time, new technology is making it cheap to acquire new oil. This (along with a history of violent political theater) dramatically deteriorates its potential as a store of value in coming years.

Money

The supply-demand dynamics of money is widely misunderstood. More than 2,300 years ago, Aristotle defined the properties of a functional currency.

Earlier, we stated that all value comes from supply and demand. But, it is fair to ask “What creates the demand?” or “What backs the expectation of future demand?” Surprisingly, even if we limit our scope to just one country (USA), the value of government-issued currency has been tied to different things over time:

- Gold

- Promise of redemption

- Legal tender (public must accept it for all debts)

- Settlement of taxes

- The “good faith and credit” of workers

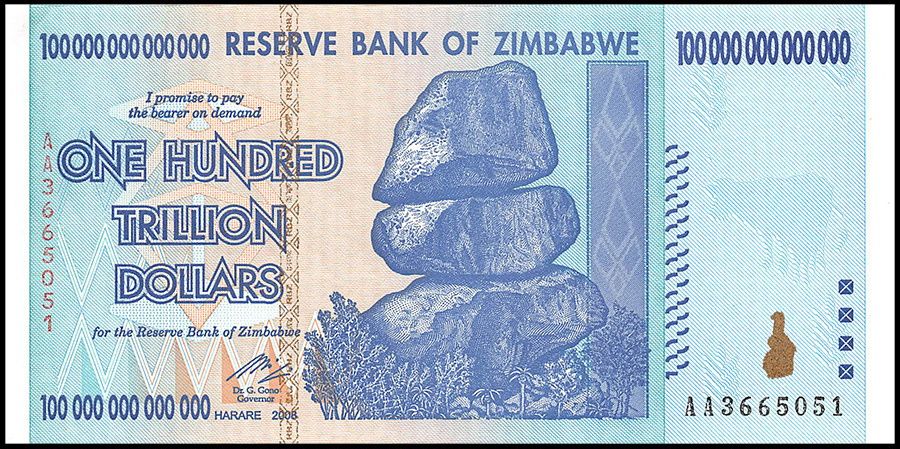

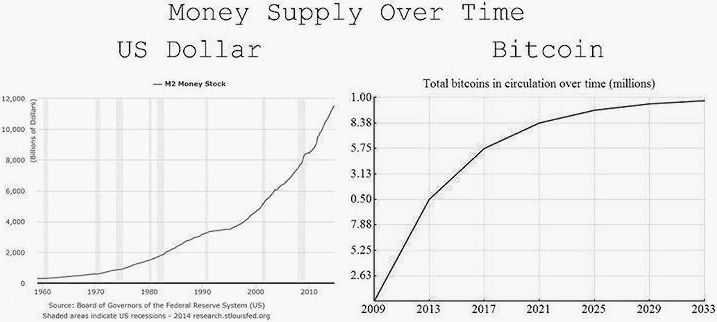

Ultimately, demand is influenced by oversupply and by public perception more than government promises or laws. The perception that the US dollar has no cap and that its supply can be inflated whenever a body of transient politicians decides to raise the debt ceiling may eventually cause its value to collapse. Although it has not happened yet, at some point consumers (or those holding our debt), will begin to question if Americans have the capacity and will to produce and export the goods & services necessary to balance their mass consumption of the past half-century.

And so, government-issued Fiat does not pass our smell test for durable value. Sooner or later, all national currencies collapse. On a personal level, the only question that matters is if you will be caught by surprise—with a fraction of wealth tied to your favored currency.

What has the potential to meet all requirements for holding value?

Wouldn’t it be fascinating if we could find an asset that is a product of pure mathematics? A perfect asset would be fair, fungible, immutable, and capped. It could never be inflated or manipulated by politicians. It would decouple governments from monetary policy. It would be politically agnostic.

If correctly designed, it would be capable of absorbing and incorporating improvements developed by any copycat or pretender nipping at its heels. Most important, it would be open source, peer-to-peer, massively distributed, redundant, and completely permissionless.

This perfect asset would derive trust from mathematics and crowd-sourced consensus. It would not require that anyone believe in a government, a bank, a land mass, or the uncertain supply of precious objects. Authenticity could tested easily and its value transmitted instantly. The history of each unit would be completely transparent. With free tools, anyone, anywhere could trace its history of moving from one owner to the next.

This perfect asset would derive trust from mathematics and crowd-sourced consensus. It would not require that anyone believe in a government, a bank, a land mass, or the uncertain supply of precious objects. Authenticity could tested easily and its value transmitted instantly. The history of each unit would be completely transparent. With free tools, anyone, anywhere could trace its history of moving from one owner to the next.

Ten years ago, such an asset was unleashed into the wild by a person or team of developers under the pseudonym, Satoshi Nakamoto. It not only meets all of these requirements, it has built-in immunity from competition. It even resolves a technical problem that troubled Aristotle more than two millennia ago.

I won’t name this radical yet natural evolutionary development in this answer—but, I can confidently state that it passes our test for an asset that will hold value over time. Despite a wildly fluctuating exchange rate with Fiat currency, its inherent value has never dropped. Ultimately, you will no longer asses value based on the exchange rate of an anachronistic currency that fails all of the other smell tests. Instead, you will assess value on how many heads of lettuce you can buy or how much that new sailboat costs.

* A classic car avoids the problems associated with use & maintenance—and it can hold value over a long period. But like a Picasso painting, the market for classic cars has a limited audience, especially for the florescent green ’63 Mustang that I found in in my great uncle’s garage. Additionally, it is subject to the whims of popular perception. Styles go in and out of vogue and so we cannot predict how long that car will hold value. (Please call me if you value my uncle’s Mustang at more than $150,000).

Philip Raymond co-chairs CRYPSA, hosts the Bitcoin Event and is keynote speaker at Cryptocurrency Conferences. He is a top writer at Quora.