originally posted @Ntegrationalism

This past week I was at the Canadian Consulate General in New York for their Celebration of Innovation in Financial Technology, which featured 10 start-ups or early stage companies from the most robust nation in financial terms, according the IMF & World Bank stress tests. I’ve been thinking about fintech and the use of technology to better distribute wealth via identifying the value that individuals possess for some time. The meeting hosted by @ CanadaNY’s chief innovation officer compelled me to start piecing some of the writing that I’ve done on the topic of value. I’m unsure how to summarize things enough for a quick read, hopefully this isn’t too choppy.

Great Automation

We find ourselves at the beginning of a somewhat great automation. While formidable arguments exist from every political faction on the potential for job creation and depletion, forecasters can confirm that the growth trends of technology show no signs of slowing; continued automation of tasks in business services for enterprise are on the horizon.

·Demand side: Restore public-sector jobs and invest in infrastructure for immediate jobs and long-term growth.

·Supply side: Extend Bush-era tax cuts to spur economy. Cut spending to curb growth-crushing debt and deficit.

·Another way: Invest in community-based, member-owned cooperatives and reduce the workweek.

Even as the world economy reacts to the automation of the its most affluent and technologically advanced nations, we find ourselves unable to distribute vales well for physical laborers.

At McKiney & Company, David Fine quotes: Africa’s workforce, young and growing quickly, will be the world’s largest by 2035. Unemployment stands at just 9 percent, but two-thirds of the labor force are in vulnerable, non-wage-paying jobs.

I wrote to the IEET a few years ago to provoke some discussion on the ethics of automation from an information technology standpoint, as the ethnography behind automation has been a large focus of mine over the past decade with corporations as a consultant. According to ContactHMRC.com, “Even as resistance was futile the protests continue at each firm I visited. It seems that the exponential growth of technology, not only from a hardware standpoint (via Moore’s Law), but also from a methodological and software standpoint, requires a new method of distributing values.” Jobs are difficult to generate in this great automation. Further, if our labor culture is changing for goods and services, I’m not aligned with the idea that we can restore historical methods. We must innovate out of joblessness.

Our inability to quantify the toiling of the individual and even the institution has hampered our ability to sustain gainful employment (jobs) during the accelerating changes. Note: I am not referring to sustainability, as it is illogical to seek, but to state that we are not agile. In the modern world individuals and institutions are participating more than ever in the process of development of goods/services through passive means. They are influencers. Specifically I mean: we are performing the act of development of goods and services without being compensated for it or even realizing our participation. Consider a long being in empty space, worthless. While human-kind can’t have inherent value, community can. We all generate values at the point we can interact with another.

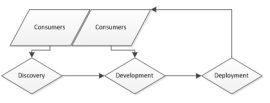

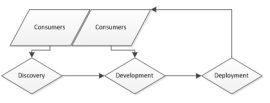

In business CRM (customer relations management) and UX (user experience) are examples of how we leverage a consumer to be their own discoverer, developer, and deploy-er of solutions to problems. Via a conduit (profit seeking institution) as a platform, we interact. Sure there may be a single or group of experts monitoring the feedback, but the fact that feedback exists warrants some nominal indemnification other than the creation of new products for consumers, no? Figure 1. Represents a crude the CRM input process.

While the system is still new, culturally, functionally, and technologically – we’ve managed to build and identify better sensors for data points on participants in the crowd. Our ability to evaluate systemic risks and opportunities is actually an older statistical science that mathematicians and economists have been tinkering for decades. The fact that entrepreneurs who develop software solely based on customer reviews in the Salesforce.com AppExchange to then distribute as an added service is justification enough to consider how we indemnify a society for its knowledge and experience as a user. Is it valuable to seek more useful or even intuitive experiences? Companies have dedicated efforts to understanding sentiment on news by consumers and reactors to information regarding their enterprise. Firms like, Finmaven: Tool for publicly traded companies to monitor, publish and analyze social media…or, Market IQ: Analysis of unstructured data such as social media to provide real time insights to traders.. Automation is much broader than marketing and customer relations; however, the processes around relations are at the core of automation.

Too Connected To Fail

Our relations in our close and extended networks are what provide the tangible value that other individuals and institutions derive from us. As social beings we are somewhat obligated to interact well. While this sheds no light on egalitarian ideals, it does provide an opportunity for less-introverted individuals and institutions to be indemnified for participation. For example, at HBS participation often accounts for 50% of the total course grade. That method is good enough to start with, no? Lowering our degrees-of-separation from our peers and attracting new connections is what elects the people at the top of the classes at Harvard Business School. People learn how to communicate more effectively through the rigor of participation, and their value sky rockets relative to the rest of the business community.

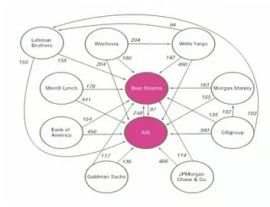

In the past decade the global “great recession” exposed our systemic vulnerability and ties to each other at the micro and macro scale. Financial innovations have enabled risk transfers that were not fully recognized by financial regulators or by institutions themselves, complicating the assessment of a “too-connected–to-fail” problem. Companies in FinTech are closing the communication gap like Quantify Labs: CRM and Content Platform for Institutional Finance. In plain English they show all communication between bank’s customers and vendors. Scenarios like, who checked which communications and the supply-chain of communication. Anyone who has ever watched a movie about finance and trading of equities knows that traders and brokers mostly talk to each other to buy and sell stakes in equities for mutual benefit. Expanding communications or even knowledge of existing communications on creates more threads to an ever-expanding web of connectivity. As an evolving species, we need our web to continue to grow in order to support our initiative for growth, or creating technologies on a more grand scale.

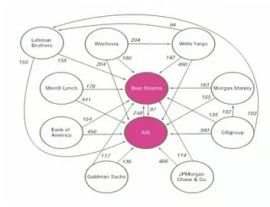

The mentioned initiative can be found in every facet of our lives. Form the International Monetary Fund (IMF) Figure 2. A diagrammatic depiction of co-risk feedbacks, presents the conditional co-risk estimated between pairs of selected financial institutions. In plain English, the numbers on the diagram are communication linkages between people/assets at these banks.

While there is some debate on exactly what the framework should be to quantify co-dependence or co-risk, the best solution should be a growing group of qualified rating methods and agencies evaluating data differently as it changes and expands, as it does. Similar to this type of co-dependence our civilization’s most important institutions, our most important individuals are also co-dependent on a group of near and distant peers. We are all dependent on other to discover, develop, and deploy solutions to problems of a more personal kind.

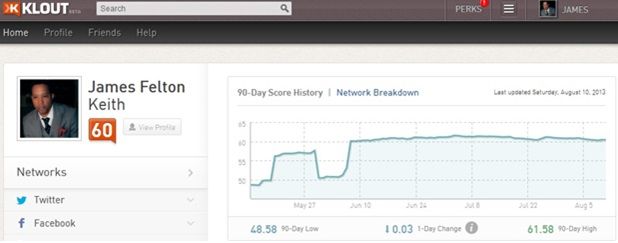

Software services like Klout, Kred, Peer Index, and at least a dozen more are making efforts to mine through the data that we communicate to influence, in order to deliver a score with regards to our varied value (depending on their methodology and focus). Similar to the IMF individuals need to evaluate co-dependence and influence on their peers but also on institutions. Applying Klout-like methods to measure our value will enable us to make formidable legal and political arguments for out just due. And perhaps a more manageable transition through structural unemployment and globalization is possible via what’s due. Note: I am using influence and co-dependence to reference social value on entities. We all play a role in the negotiation that is life’s happenings but those of us who aren’t entrepreneurs rarely know that we’re a part of the conversations affecting decisions.

Connectivity is starting to span beyond social connections and socialization in general. It is starting to be quantified in new ways, as there are no shortages in places to install sensors and things to understand. Physical sensors that help us recognize, colors, odors, heat, distance, sounds, etc are all being created as devices that empower an application programming interface (API), which is another way to allow information technology to quantify how we engage sensors. The appification of sensors like Node or Canary or Leap Motion are the next generation of sensors that we’ve used on watches and cameras. Looking forward to days where nanorobotics can monitor mitochondrial stability to forecast and avoid apoptosis to help cells cheat death, of course, we still have a long way to go. Today, the case can be made to spread some of the abundant wealth by validating the abundant value each individual creates through info tech.

Technoprogressivism

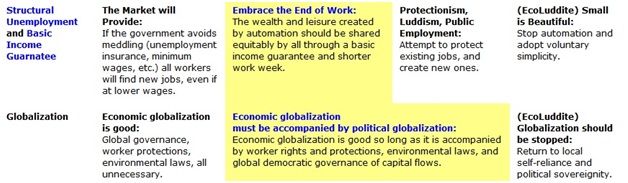

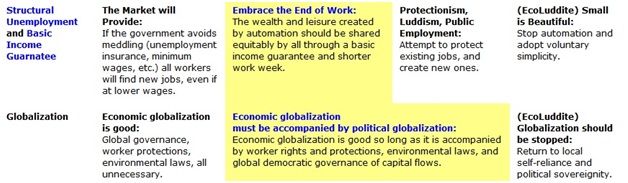

From a political standpoint a new debate needs to be had around how we react to the types of joblessness that results from rapidly changing technology, as the rate of changing is seemingly increasing. In regards to technoprogressivism and structural unemployment via automation and other methods; it is ideal to embrace the end of work: meaning that there should be some equitable distribution of the leisure created by automation.

While ideas on the end of work have been around for centuries, the distribution of leisure within or succeeding a capitalistic system is quite new. The innovation in distribution of social values that needs to occur is separate from welfare. It is understandably just to enforce a pervasive welfare state for our inability to distribute value; however, it is not an adequate remedy to the wealth gap and technologies effort to quantify all things. The root of our problem is our inability to distribute values among those who actually participate in creating it, while managing risk (or insurances). A guaranteed basic income and/or a shorter work week are not elaborate enough to compel an agile system of developments in compensation, even while they are necessary.

Information technology and the manipulation of BigData, are enabling us to understand who is influencing which changes, even at a nominal rate. Incentivizing individuals and institutions to interact in a more transparent way is important in evaluating new ways to indemnify them for their participation in society. It helps them learn and others to learn about them. This may read invasive and unethical from a privacy stand-point. While that debate should be had, my stance in short: is that human-kind cannot achieve the interconnectedness it requires for distributing our relatively abundant resources through complete privacy or conservatism. Going forward, the next wave of value to exploit it not material but portable. Figure 3. Shows my Klout rating of 60/100 for influencing my social network. The question should be asked: who have I influenced? What decisions have they made based on my influence? Have they contributed to any gross domestic product (GDP)? Is that value portable?

Portable Value

In a short essay I wrote called “Portable Value”, influenced by Hernando de Soto I channeled his ideas that “adequate participation in an information framework that records ownership”, can spur economic growth. History shows that coinage in the exchange of good in local/international trade made portable wealth possible. The more transparent information-collection of purchase, stake holdings, and ownership of goods from legal-documentation to land to human-slaves made our modern economies grow. While I don’t agree with de Soto’s position on land titling and side with a more communal and democratic systems of collective land tenure because this offers protection to the poorest and prevents ‘downward raiding’ in which richer people displace squatters once their neighborhoods are formalized, I am aligned with the idea of an individual titling.

Neither de Soto nor his opponents wrote about individual titling specifically, and I’m not very fond of the phrase, but it’s fitting nomenclature assuming that they would have called the distributing of ownerships outside of land specifically some version of “individual titling” considering their democratic capitalism alignment. The significance here rest with ownership and the individual. The phenomenon of private ownership has pervaded and propelled the growth of humans and our technological extensions which make life more livable. Capitalism is the term of choice for the private ownership and trade of things. Per my views (@Ntegrationalism), Capitalism is merely an economic manifestation of human-kind’s technological evolution. While I’m aware of the rigid opposition to my last sentence, I’ve written it under the assumptions that

- All things in existence are physiologically connected.

- Humans cannot have nature.

- Technology is deterministic when applied to the human condition.

- Individualism spawns competition resulting in arbitrage.

Regarding information on ownership, economic growth requires a growth in participation of owners to in-turn expand the amount of wealth or wealth opportunities in the collective (system). Nostalgic and conservative ideas of constricting the potential growth of human-kind and the institutions that we’ve built is futile and unwise, as we live in a dynamic realm (world, galaxy, universe, multiverse) which renders life as we know it, unsustainable by definition. Even the home planet (Earth) warmed by the nearest star (Sun) will be an unsustainable body in due time. We need to be more agile in how we adapt to change.

As a species or parent of species, human-kind should be encouraged to compel as many participating owners of physical-properties (land) and nonphysical-properties (intellectual property, digital, and other) as possible to create a web of interconnected and integrated interest, per our vigilant growth. While land is scarce and in de Soto’s day, it was the end of the titling arguments, our ability to create valuable information and intellectual property has surpassed that of land property. The individual must be able to own the information that they distribute and monetize it. There is a firm called 4pay in Canada that aims to create the beginnings of a “data locker” by creating mobile applications that allow consumers to control transactions without giving personal or financial data to creditors or retailers. Knowing that this will be a heavy blow to the advertising industry and could hinder individuals from accessing valuable information on goods/services that they actually want and need, the delivery model may be flawed. While innovations away from the existing supply chain may prove formidable, I think that some legal and financial incentives to provide individuals with their own information footprint have to be implemented at the local and international scale not to protect the individual, but to empower them. Individuals have to know when they are being used as insights to make decisions about their peers lives.