Steamships, locomotives, electricity; these marvels of the industrial age sparked the imagination of futurists such as Jules Verne. Perhaps no other writer or work inspired so many to reach the stars as did this Frenchman’s famous tale of space travel. Later developments in microbiology, chemistry, and astronomy would inspire H.G. Wells and the notable science fiction authors of the early 20th century.

The submarine, aircraft, the spaceship, time travel, nuclear weapons, and even stealth technology were all predicted in some form by science fiction writers many decades before they were realized. The writers were not simply making up such wonders from fanciful thought or childrens ryhmes. As science advanced in the mid 19th and early 20th century, the probable future developments this new knowledge would bring about were in some cases quite obvious. Though powered flight seems a recent miracle, it was long expected as hydrogen balloons and parachutes had been around for over a century and steam propulsion went through a long gestation before ships and trains were driven by the new engines. Solid rockets were ancient and even multiple stages to increase altitude had been in use by fireworks makers for a very long time before the space age.

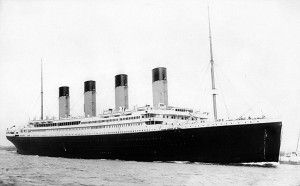

Some predictions were seen to come about in ways far removed yet still connected to their fictional counterparts. The U.S. Navy flagged steam driven Nautilus swam the ocean blue under nuclear power not long before rockets took men to the moon. While Verne predicted an electric submarine, his notional Florida space gun never did take three men into space. However there was a Canadian weapons designer named Gerald Bull who met his end while trying to build such a gun for Saddam Hussien. The insane Invisible Man of Wells took the form of invisible aircraft playing a less than human role in the insane game of mutually assured destruction. And a true time machine was found easily enough in the mathematics of Einstein. Simply going fast enough through space will take a human being millions of years into the future. However, traveling back in time is still as much an impossibillity as the anti-gravity Cavorite from the First Men in the Moon. Wells missed on occasion but was not far off with his story of alien invaders defeated by germs- except we are the aliens invading the natural world’s ecosystem with our genetically modified creations and could very well soon meet our end as a result.

While Verne’s Captain Nemo made war on the death merchants of his world with a submarine ram, our own more modern anti-war device was found in the hydrogen bomb. So destructive an agent that no new world war has been possible since nuclear weapons were stockpiled in the second half of the last century. Neither Verne or Wells imagined the destructive power of a single missile submarine able to incinerate all the major cities of earth. The dozens of such superdreadnoughts even now cruising in the icy darkness of the deep ocean proves that truth is more often stranger than fiction. It may seem the golden age of predictive fiction has passed as exceptions to the laws of physics prove impossible despite advertisments to the contrary. Science fiction has given way to science fantasy and the suspension of disbelief possible in the last century has turned to disappointment and the distractions of whimsical technological fairy tales. “Beam me up” was simply a way to cut production costs for special effects and warp drive the only trick that would make a one hour episode work. Unobtainium and wishalloy, handwavium and technobabble- it has watered down what our future could be into childish wish fulfillment and escapism.

The triumvirate of the original visionary authors of the last two centuries is completed with E.E. Doc Smith. With this less famous author the line between predictive fiction and science fantasy was first truly crossed and the new genre of “Space Opera” most fully realized. The film industry has taken Space Opera and run with it in the Star Wars franchise and the works of Canadian film maker James Cameron. Though of course quite entertaining, these movies showcase all that is magical and fantastical- and wrong- concerning science fiction as a predictor of the future. The collective imagination of the public has now been conditioned to violate the reality of what is possible through the violent maiming of basic scientific tenets. This artistic license was something Verne at least tried not to resort to, Wells trespassed upon more frequently, and Smith indulged in without reservation. Just as Madonna found the secret to millions by shocking a jaded audience into pouring money into her bloomers, the formula for ripping off the future has been discovered in the lowest kind of sensationalism. One need only attend a viewing of the latest Transformer movie or download Battlestar Galactica to appreciate that the entertainment industry has cashed in on the ignorance of a poorly educated society by selling intellect decaying brain candy. It is cowboys vs. aliens and has nothing of value to contribute to our culture…well, on second thought, I did get watery eyed when the young man died in Harrison Ford’s arms. I am in no way criticizing the profession of acting and value the talent of these artists- it is rather the greed that corrupts the ancient art of storytelling I am unhappy with. Directors are not directors unless they make money and I feel sorry that these incredibly creative people find themselves less than free to pursue their craft.

The archetype of the modern science fiction movie was 2001 and like many legendary screen epics, a Space Odyssey was not as original as the marketing made it out to be. In an act of cinema cold war many elements were lifted from a Soviet movie. Even though the fantasy element was restricted to a single device in the form of an alien monolith, every artifice of this film has so far proven non-predictive. Interestingly, the propulsion system of the spaceship in 2001 was originally going to use atomic bombs, which are still, a half century later, the only practical means of interplanetary travel. Stanly Kubrick, fresh from Dr. Strangelove, was tired of nukes and passed on portraying this obvious future.

As with the submarine, airplane, and nuclear energy, the technology to come may be predicted with some accuracy if the laws of physics are not insulted but rather just rudely addressed. Though in some cases, the line is crossed and what is rude turns disgusting. A recent proposal for a “NautilusX” spacecraft is one example of a completely vulgar denial of reality. Chemically propelled, with little radiation shielding, and exhibiting a ridiculous doughnut centrifuge, such advertising vehicles are far more dishonest than cinematic fabrications in that they decieve the public without the excuse of entertaining them. In the same vein, space tourism is presented as space exploration when in fact the obscene spending habits of the ultra-wealthy have nothing to do with exploration and everything to do with the attendent taxpayer subsidized business plan. There is nothing to explore in Low Earth Orbit except the joys of zero G bordellos. Rudely undressing by way of the profit motive is followed by a rude address to physics when the key private space scheme for “exploration” is exposed. This supposed key is a false promise of things to come.

While very large and very expensive Heavy Lift Rockets have been proven to be successful in escaping earth’s gravitational field with human passengers, the inferior lift vehicles being marketed as “cheap access to space” are in truth cheap and nasty taxis to space stations going in endless circles. The flim flam investors are basing their hopes of big profit on cryogenic fuel depots and transfer in space. Like the filling station every red blooded American stops at to fill his personal spaceship with fossil fuel, depots are the solution to all the holes in the private space plan for “commercial space.” Unfortunately, storing and transferring hydrogen as a liquified gas a few degrees above absolute zero in a zero G environment has nothing in common with filling a car with gasoline. It will never work as advertised. It is a trick. A way to get those bordellos in orbit courtesy of taxpayer dollars. What a deal.

So what is the obvious future that our present level of knowledge presents to us when entertaining the possible and the impossible? More to come.