by Tatiana Moroz

The most moving thing to me about music is it’s ability to change. It changes the mood, the atmosphere, and it fills us with emotion. It can unify mankind in the power of good and triumph over evil regimes. What most struck me was when we saw this in the 60’s and 70’s folk songs that became anthems for the civil rights, equality, and antiwar movements. Even as a little girl, I knew that this core drive and expression for freedom was critical to the success of humanity as we marched ever closer to the nightmarish visions painted in 1984 and Brave New World.

This is a heavy and serious purpose, but one I took to heart as I created songs of hope, sadness, life, beauty and love. I noticed that the music industry seemed averse to this type of meaning based songwriting, and the radio waves were filling with more vapid nonsense by the minute. However, I kept my head down and tried to educate myself on the ways we could organize society for the better.

I joined the Ron Paul movement in late 2011 after I learned about the Federal Reserve system of central banking. I saw that it was one of the biggest obstacles to true liberty. I used storytelling in my music to illustrate the solutions I was finding, but I think we all hit a wall with politics at one point (which is probably how we all know each other in a way as seekers of the truth).

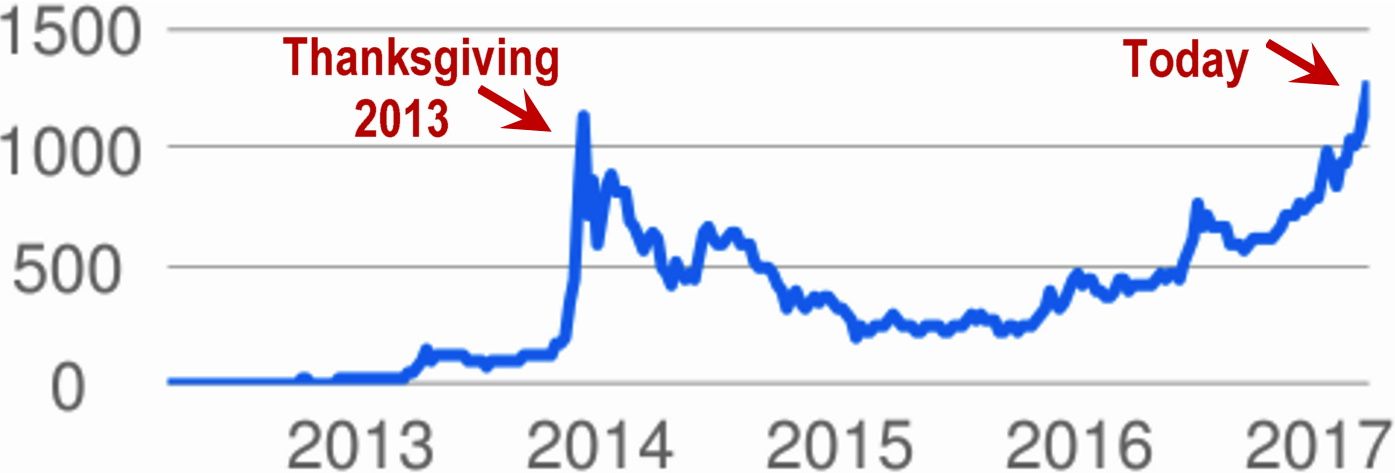

If you told me 6 years ago that I would be involved with “fintech” or technology in general, I would have laughed you out of the room. As soon as I start reading a manual, I disengage, my eyes glaze over, and within 6–8 words, I am daydreaming about something else. Even though my friends teaching me about Bitcoin were able to illustrate the benefits, something didn’t click. I gave them $500 anyway (which was a lot of money to me!) and they bought me some Bitcoins at $11. Eventually as the price went up and I learned more, I became enthusiastic about the possibilities. If my goal was to help “save the world” (for lack of a better term), then there were few inventions in the history of man that could compete with Bitcoin and blockchain technology.

I created the Bitcoin Jingle and became immersed in the community. I soon befriended Adam B. Levine of Let’s Talk Bitcoin, one of the most popular Bitcoin podcasts that also acted as a network home to over a dozen other shows. As content creators, we were the first to experiment with artist tokens and markets based around music, podcasts, and other media that removed the middleman and were secured through the power of the blockchain. In 2014 we created TATIANACOIN, the 1st ever artist cryptocurrency, but creating the coin was just the beginning. Upon launch, we soon realized we had to build the ecosystem for the coin to thrive.

Think of artist coins as a type of token that you can hold in a digital wallet, like store credit. These coins can be sold to your fans that want to support your work, similar to a crowdfund or patronage type platform, but they get back TATIANACOIN that they can spend however they want. It can be redeemed for backstage access, music, merchandise, held onto for future rewards, and the coins can even be traded or sold with other music fans. They allow an artist to gather support from their community through long-term fundraising that gives back real value and engagement. Imagine, as a fan, becoming that much more entwined with the careers of your favorite musicians, visual artists, and other content creators! Artist coins also allow for direct messaging, streaming, and support functions between artists and fans. We see this as a more enriching experience than just your average social media platform.

But so what? We built a platform. What does this have to do with artists and a message? Well, currently artists are paid very little. If your song is played on a streaming platform a million times, you are then paid a measly $1000. When you get a record deal, you are getting, in essence, a bad loan from the record company. Most likely, you have to pay it back over the course of your entire career and you have given control over your music to the record company. There is no transparency, it is inefficient, and rife with human error that slows things down dramatically.

But that’s just one side of the problem. The more glaringly wrong side is the homogenous nature of music we now encounter. Corporations want profit and since the repeat of the same old party music can be more secure and lucrative than an edgy performance, that’s what gets made. But humanity and culture suffer, while a select few accumulate more power over our minds and bodies.

To highlight this, I decided to use a drawing of me made by political prisoner Ross Ulbricht of the Silk Road as my album cover. The drug war is an abysmal failure, and the precedent set by this case effects us all. If I was on a major label, I wouldn’t be able to side with Ross and bring attention to the devastation being wrought worldwide by the US governments overzealous prosecution of non-violent offenders. It’s immoral and as an artist, I have an obligation to stand up and say no more.

Artist coins at their core are about the same thing Bitcoin is about: autonomy and freedom. If we do not have control over our money (in the arts and otherwise), we will have a harder time moving toward more prosperity and enlightenment. We now have the tools to take back our most precious means of communication and create communities based around cryptocurrency and P2P. I believe artistic creativity is essential to mankind’s progress, and I hope others will join me in this pursuit to free the art.

To find out more about Tatiana Coin and to support my new album Keep the Faith out March 31, 2017, please go to www.TatianaMoroz.com