Money 2017 speakers Juergen Schmidhuber, Wirecard’s Joern Leogrande and Nutmeg’s Nick Hungerford discuss the changing face of AI-driven finance.

Ice-nine is a fictitious alternative structure of water that is solid at room temperature. When a crystal of ice-nine contacts liquid water, it becomes a seed crystal that makes the molecules of liquid water arrange themselves into the solid form, ice-nine. Felix Hoenikker’s reason to create this substance was to aid in the military’s plight of wading through mud and swamp areas while fighting. That is, if ice-nine could reduce the wetness of the areas to a solid form, soldiers could easily maneuver across without becoming entrapped or slowed. (Cat’s Cradle by Kurt Vonnegut) Source: https://en.wikipedia.org/wiki/Cat%27s_Cradle

Jim Rickards uses ICE 9 in his latest work “The Road to Ruin” to warn investors of a potential ICE 9 event in which the financial system literally freezes up in a domino type event as he describes in a recent interview:

Deep learning owes its rising popularity to its vast applications across an increasing number of fields. From healthcare to finance, automation to e-commerce, the RE•WORK Deep Learning Summit (27−28 April) will showcase the deep learning landscape and its impact on business and society.

Of notable interest is speaker Jeffrey De Fauw, Research Engineer at DeepMind. Prior to joining DeepMind, De Fauw developed a deep learning model to detect Diabetic Retinopathy (DR) in fundus images, which he will be presenting at the Summit. DR is a leading cause of blindness in the developed world and diagnosing it is a time-consuming process. De Fauw’s model was designed to reduce diagnostics time and to accurately identify patients at risk, to help them receive treatment as early as possible.

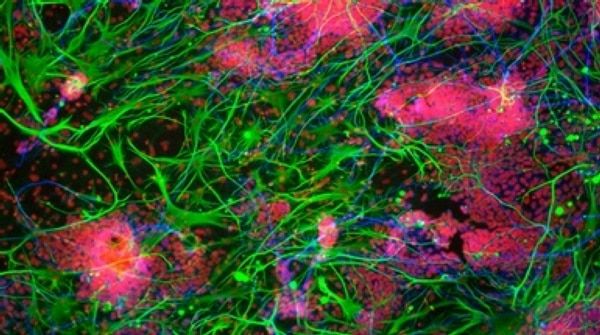

Joining De Fauw will be Brian Cheung, A PhD student from UC Berkeley, and currently working at Google Brain. At the event, he will explain how neural network models are able to extract relevant features from data with minimal feature engineering. Applied in the study of physiology, his research aims to use a retinal lattice model to examine retinal images.

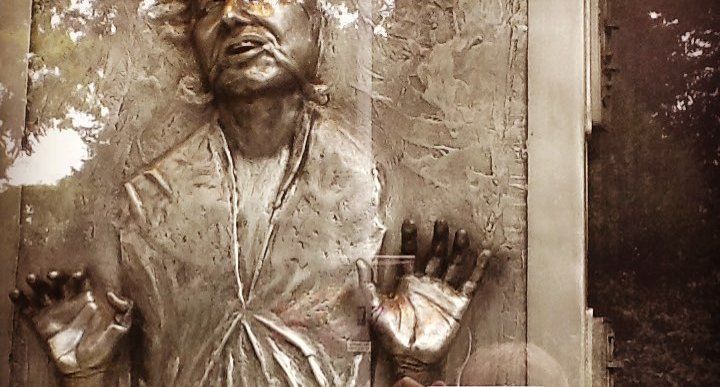

And yet, as impressive and powerful as these new technologies and machines are—and they’re becoming more so all the time—I believe they’re an opportunity to be embraced by accountants.

Computers and software have evolved to a point where they can populate spreadsheets, crunch numbers, and generate financial statements and earnings reports more quickly and accurately than any human accountant. In fact, machines are already taking on many of an accountant’s old, routine, administrative chores—on-line tax returns, and book-keeping software, are great examples of routine work that accountants no longer have to do.

This is a good thing. It is already allowing for human accountants to be more sophisticated advisors and planners. In this way, technology can be best used as a tool that gives humans more space to focus on analysis, interpretation, and strategy. In other words, computers have enormous potential to empower—rather than displace—accountants.

“Bloomberg, an entrepreneur and former mayor of New York City, and Pope, a lifelong environmental leader, approach climate change from different perspectives, yet they arrive at similar conclusions.”

In fact, when speaking with many AI experts across academia and industry, the consensus was unanimous: the development of AI cannot benefit only the few.

Income inequality is a well recognized problem. The gap between the rich and poor has grown over the last few decades, but it became increasingly pronounced after the 2008 financial crisis. While economists debate the extent to which technology plays a role in global inequality, most agree that tech advances have exacerbated the problem.

In an interview with the MIT Tech Review, economist Erik Brynjolfsson said, “My reading of the data is that technology is the main driver of the recent increases in inequality. It’s the biggest factor.”

Which begs the question: what happens as automation and AI technologies become more advanced and capable?

World-first transplant to treat macular degeneration could augur rise of iPS cell banks.

Hedge funds have been trying to teach computers to think like traders for years.

Now, after many false dawns, an artificial intelligence technology called deep learning that loosely mimics the neurons in our brains is holding out promise for firms. WorldQuant is using it for small-scale trading, said a person with knowledge of the firm. Man AHL may soon begin betting with it too. Winton and Two Sigma are also getting into the brain game.

The prospect that artificial intelligence (AI) might one day surpass human intelligence is one that many people, including a number of notable personalities, are terrified of. And it’s not hard to see where that fear is coming from.

As it is, deep learning machines have already shown a number of ways where they outperform humans. So far, they can play video games, recognize faces, and even do stock market trading. There’s one area, though, where humans are still superior, and that’s the speed at which we learn.

Right now, humans learn at a rate that’s 10 times faster than that of a deep learning machine. And it is this ‘superiority’ that has kept that ‘AI taking over humans’ apocalyptic view in the background. Thanks (or no thanks?) to Google, however, this status quo is about to change.

Tech to aid video search, detection of disease and of fraud.

Artificial intelligence has been the secret sauce for some of the biggest technology companies. But technology giant Alphabet Inc.’s Google is betting big on ‘democratising’ artificial intelligence and machine learning and making them available to everyone — users, developers and enterprises.

From detecting and managing deadly diseases, reducing accident risks to discovering financial fraud, Google said that it aimed to improve the quality of life by lowering entry barriers to using these technologies. These technologies would also add a lot of value to self-driving cars, Google Photos’ search capabilities and even Snapchat filters that convert the images of users into animated pictures.