How can we protect Europeans in digital age? Our proposals:

How can we protect Europeans in digital age? Our proposals:

Just like the game of Monopoly, which was created to illustrate the operation of laissez faire capitalism, there is always one big winner at the end of the game.

“Wealth concentration drives a vicious, downward cycle, throttling the very engine of wealth creation itself.”

“Because: people with lots of money don’t spend it. They just sit on it, like Smaug in his cave. The more money you have, the less of it you spend every year. If you have $10,000, you might spend it this year. If you have $10 million, you’re not gonna. If you have $1,000, you’re at least somewhat likely to spend it this month.”

These people could spend $20 million every year and they’d still just keep getting richer, forever, even if they did absolutely nothing except choose some index funds, watch their balances grow, and shop for a new yacht for their eight-year-old.

If you’re thinking that they “deserve” all that wealth, and all that income just for owning stuff, because they’re “makers,” think again: between 50% and 70% of U.S. household wealth is “earned” the old-fashioned way (cue John Houseman voice): it’s inherited.

The bottom 90% of Americans aren’t even visible on this chart — and it’s a very tall chart. The scale of wealth inequality in America today makes our crazy levels of income inequality (which have also expanded vastly) look like a Marxist utopia.

The new digital payment app, called Tez, allows people in India to use a phone to pay for goods in physical stores and online, or make payments to other bank accounts. It’s different to the (already incredibly popular) Indian service PayTM in the respect that it links a phone directly with a bank account, rather than having the user regularly top up a wallet with money.

The Financial Times reports ($) that, unlike many other mobile payment systems which rely on NFC to make payments, Google offers users the ability to make use of a technology called AudioQR to transfer money. The approach allows any two phones with mics and speakers to communicate with each other using ultrasound, above the range of human hearing, to arrange a transaction. That will be particularly useful in a country where not everyone has a high-spec device.

According to TechCrunch, Google has also trademarked the name Tez in other Asian countries, including Indonesia and the Philippines. That suggests that, in the longer term, it has bigger ambitions for the service.

Bitcoin was hit by a double whammy this week. On Tuesday, Jamie Dimon of JP Morgan declared that Bitcoin is a fraud that will “blow up”. Then, just this morning, a Bitcoin exchange in China announced that it would shut its doors in response to verbal pressure from regulators and an uncertain regulatory environment.

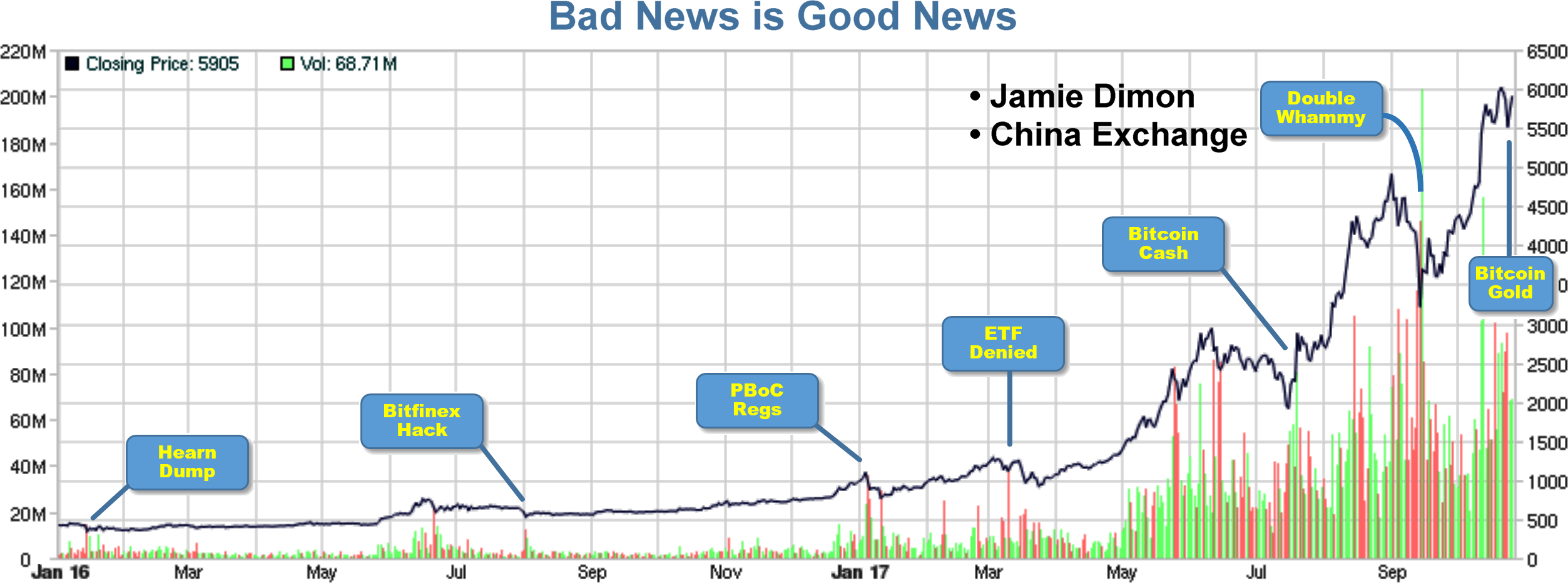

Don’t ya just love it when bad news breaks on Bitcoin? I sure do! It creates a buying opportunity. After all, just look at what happened after the last five bouts of bad news: [updated Oct 2017—Click to reverse colors & enlarge]

In each case, the Bitcoin exchange rate dropped—very briefly—and then climbed higher with renewed vigor. Heck it, doubled from $2400 to $4800 in just the past month! But here’s a the real question: Does either bad news events have legs? Does it spell the end of Bitcoin adoption and enthusiasm, at least for now?

After all, if it were discovered that the math behind Bitcoin were flawed, and that anyone could create forged coins, the empire would come tumbling down. In my book, this would constitute a crisis. But what about now? Do these two damning events—and a 35% correction in the past week—constitute a long-term crisis? To answer, we must first determine if public fears over these two events are credible…

China and JP Morgan: (a) A frightened authority (b) Simple Ignorance

Like most governments, the Chinese are concerned that the growing flight to Bitcoin is impacting liquidity of their national currency. [A superb presentation by Andreas Antonopoulos—Click it, after you read this article]. They are also concerned about the large number of Bitcoin exchanges that operate outside of a tight regulatory framework. They obscure the flow of money in and out of the country and they are a clear scapegoat for tax evasion or other criminal activity. Like any agency charged with financial regulation, the Chinese seek to reign in and regulate these maverick exchanges.

It is interesting to note that the Chinese government is not discouraging Bitcoin mining or even personal savings—only the proliferation of unlicensed exchanges and quasi-anonymous users. After all, More than 50% of all mining is done in China, and it helps to balance the loss of liquidity in the national currency.

Bitcoin is experiencing increased adoption—not just as a payment mechanism—but as a new form of stored value. Is this is a bad thing for governments? Surprise! When a government loses control over its own reserve and monetary policy, it may present more of an opportunity than a threat—for both citizens and governments. Gradually, economists, treasury secretaries, reserve board governors and monetary tsars will are coming to the same conclusion. But regardless of your position on this point of debate, here is a fact that is less controversial…

When governments attempt to restrict an activity that cannot be economically monitored or enforced—or at least when they attempt to do it in a way that leaves no relief valve for hobbyists, business, commerce, research or NGOs—they ultimately fuel the activity that they set out to stifle. Ultimately, if the public cannot discern a reasonable basis for government censorship or excessive restrictions, it leads to interest, innovation, adoption and the emergence of hot new markets.

Consider, again, the graph of Bitcoin price –vs- Bad news events at the top of this page.

On each date highlighted above, there was a damning piece of information that should cause early adopters to reconsider their enthusiasm for Bitcoin. In fact, the Hearn Dump really should have ended the whole party. A core developer sold off his entire BTC savings and claimed that the experiment was a failure. He published an article with his reasons for believing that Bitcoin was dead. Likewise, the SEC decision to prohibit the creation of an exchange traded fund (the Winkelvoss ETF), it sent a clear signal that governments really didn’t consider cryptocurrencies to be an asset at all.

On each date highlighted above, there was a damning piece of information that should cause early adopters to reconsider their enthusiasm for Bitcoin. In fact, the Hearn Dump really should have ended the whole party. A core developer sold off his entire BTC savings and claimed that the experiment was a failure. He published an article with his reasons for believing that Bitcoin was dead. Likewise, the SEC decision to prohibit the creation of an exchange traded fund (the Winkelvoss ETF), it sent a clear signal that governments really didn’t consider cryptocurrencies to be an asset at all.

But the graph demonstrates that each piece of “bad news” fueled a miniature rally. That’s because Bitcoin has none of the elements of a pyramid scheme. It is not an MLM and it cannot be manufactured or controlled by any organization. Rather, it is an exercise in pure supply, demand and market recognition. It is pure adoption mechanism that leads to a two-sided network. It’s benefits multiply as more users join the party.

What about Jamie Dimon at JP Morgan? He says that Bitcoin will crash.

Bitcoin has had a rocky road these first 8 years. Major exchanges have been bankrupt or worse, enormous criminal conspiracies were among the early adopters, the SEC has prohibited the creation of an ETF based on cryptocurrency, rogue spin-off coins are driving a wedge among users, and there are serious problems related to scaling and governance. A casual observer might wonder who is in control and who can be held responsible? After all, the idea of an economic mechanism that is altered by democratic—but decentralized—factors is new and radical. How can Bitcoin evolve, adapt and grow in the absence of an authority at its heart?

This confusion arises from the newness and unfamiliarity of blockchain architecture. Skepticism is natural. Indeed, Bitcoin is guided by an authority, but it doesn’t reside at the center of the network. It resides at the edges. This is the concept behind Proof-of-Stake and Proof-of-Work. Unlike a classic authority, your will matters just as much as anyone else’s. It is exceptionally democratic, self-enforcing, and resistant to gaming.

This is a difficult concept to wrap our heads around, because it is so different than we were taught and it is different than we have experienced for centuries. For this reason, Jamie Dimon’s statement that there is nothing behind Bitcoin presents a buy opportunity for individuals who were late to the table. Jamie may not yet understand intrinsic value, but we can educate ourselves. Bitcoin has more standing behind it than the US dollar.

… But don’t take this as investment advice. Bitcoin should not be thought of as an investment. It is the future of money. Speculation (both day trading and long term buy-&-hold) act to retard the eventual adoption of Bitcoin as a serious monetary instrument. Although I have Bitcoin, I do not encourage people to think of it as an investment. It is more important that it be used for ordinary business and commerce:

When the fraction of Bitcoin transactions servicing these consumer and business activities exceeds the fraction driven by savers and speculators, the dominos will begin to fall rapidly.

Articles about Jamie Dimon and JP Morgan…

Can we draw a conclusion? Certainly, we can. And, we can toss in a prediction. It’s not even a high risk prediction. The recent pullback has no fundamental basis. No legs at all. The two “bad news” are not just a  red herring—they present a buying opportunity. If I were allowed to give investor advice (I am not; and I don’t), I would express my opinion with more verve and obvious conviction.

red herring—they present a buying opportunity. If I were allowed to give investor advice (I am not; and I don’t), I would express my opinion with more verve and obvious conviction.

Caveat Emptor (Everything comes with a disclaimer)…

I am a Bitcoin educator, proponent, early adopter and blockchain consultant. But here is the contradiction: Although I am also a Bitcoin investor, I discourage others from treating Bitcoin as an investment. Use it, but please don’t save it!

Why do I discourage others from investing in Bitcoin?

It’s not that I don’t believe that Bitcoin will increase in exchange value. It will rise spectacularly, as adoption grows. But Bitcoin will not become ubiquitous and trusted until the majority of coins are recycled into the market for payments, settlement, loans, interbank transfers, escrow, contract settlement, etc. That is, its use for business and commerce must exceed the fraction of trades that are driven by savers and speculators. Until this happens, Bitcoin will remain volatile. It will be the subject of suspicion. It won’t be used for large settlements and it won’t become the money itself.

Speculation acts against fluidity. It won’t block the eventual acceptance of Bitcoin as a global currency. Hoarding is not a deal stopper. But It retards momentum and delays the inevitable.

Philip Raymond co-chairs CRYPSA, produces The Bitcoin Event, edits A Wild Duck and is moderator of LinkedIN Bitcoin P2P, the largest discussion group of it’s kind. He is keynote at this year’s Digital Currency Summit in Johannesburg and sits on the New Money Systems board at Lifeboat Foundation. Use the contact form to inquire about a live presentation or consulting engagement.

BOSTON (AP) — IBM is planning to spend $240 million over the next decade to create an artificial intelligence research lab at MIT.

Massachusetts Institute of Technology on Thursday announced the formation of the new MIT-IBM Watson AI Lab. It will support joint research by IBM and MIT scientists.

Its mission will include advancing the hardware, software and algorithms used for artificial intelligence. It also will tackle some of the economic and ethical implications of intelligent machines and look at its commercial application for industries ranging from health care to cybersecurity.

On August 1 2017, the value of a Bitcoin was at $2,750 US dollars. Today, just over one month later, it is poised to leap past $5,000 per unit. With this gain, many people are asking if Bitcoin has any genuine, inherent value. Is it a pyramid scheme? —Or is it simply a house of cards ready to collapse when the wind picks up?

In a past article, I explained that Bitcoin fundamentals ought to place its value in the vicinity of $10,000.* (At the time, it was less than $450, and had even fallen to $220 in the following year).

For many consumers viewing the rising interest in Bitcoin from the stands, there is great mystery surrounding the underlying value. What, if anything, stands behind it? This is a question with a clear and concise answer. In fact, it has a very definitive and believable answer—but it is easiest to understand with just a little bit of historical perspective.

At one time, G7 fiat currencies were backed by a reserve of physical Gold or the pooling or cross-ownership of other currencies that are backed by gold. That ended in 1971 when the Bretton Woods agreement was dissolved by president Richard Nixon in Ithaca NY.

Today, US currency is backed by “The good faith and credit of the American worker” (This is the government explanation of intrinsic value). But in truth its future value is loosely tied to one simple question: Does the typical vendor or consumer (for example, someone accepting a $20 bill in exchange for a movie ticket or 2 large pizzas) expect it to buy these same things in the next few months?

A considerable number of speculative components contribute to the answer. For example:

This list is not exhaustive, but all constituents boil down to two fundamental concepts: Supply-and-demand and How long will demand last?

The dollar is an invention of a transient government. Even with a long history and complex banking framework, it is no more real than Bitcoin. Supply and demand for any commodity is based on popular recognition, anti-counterfeit features, innate desire and public goodwill. The real question is what contributes to the desire to own or spend Bitcoin?

The answer is that Bitcoin is backed by something far more reliable and trustworthy than the transient whim of elected legislators. It is backed by something that carries more weight than the US government. What could possibly guaranty the value of a Bitcoin? After all, it does not convey ownership in gold, and it has no redemption guarantee. There is no engraving of Caesar on the coin. (In fact, there is no coin at all!)…

Answer: Bitcoin is backed by math, a firm cap, a completely transparent set of books, and the critical mass of a two-sided network. Although it can be taxed (like any asset), it can be owned and transferred with impunity and without recourse. These may not seem like critical components of intrinsic value, but they are. In fact, they define intrinsic value in the modern era.

Related:

Philip Raymond co-chairs CRYPSA, produces The Bitcoin Event, edits A Wild Duck and is keynote at this year’s Digital Currency Summit in Johannesburg.

It’s de rigeur for the many of the richest of the rich to tout the benefits of giving cash handouts to all American citizens, in part as a way to end poverty. The idea, called universal basic income (UBI), is for every individual to be paid a regular sum of money regardless of employment status.

One of the tech elite who has an interest in universal basic income is self-made multimillionaire and Y Combinator President Sam Altman. “Eliminating poverty is such a moral imperative and something that I believe in so strongly,” Altman tells CNBC Make It.

“There’s so much research about how bad poverty is. There’s so much research about the emotional and physical toll that it takes on people.

The BRICS Finance Committee is discussing a joint virtual currency for the five nation bloc of developing economies, according to the Russian Direct Investment Fund (RDIF) chief Kirill Dmitriev.

Here’s a people-friendly/business-friendly plan to replace Labor Day with Basic Income Day in America. Your half million dollars is waiting and yours! http://www.businessinsider.com/basic-income-with-federal-land-dividend-2017-7 #FederalLandDividend

Futurist and 2018 libertarian candidate for California governor Zoltan Istvan outlines his plan to give everyone a government kickback from untapped land.

Article out by Ron Bailey at Reason Magazine that discusses #transhumanism and #libertarianism:

Kai Weiss, a researcher at the Austrian Economics Center and Hayek Institute in Vienna, Austria, swiftly denounced the piece. “Transhumanism should be rejected by libertarians as an abomination of human evolution,” he wrote.

Clearly there is some disagreement.

Weiss is correct that Istvan doesn’t expend much intellectual effort linking transhumanism with libertarian thinking. Istvan largely assumes that people seeking to flourish should have the freedom to enhance their bodies and minds and those of their children without much government interference. So what abominable transhumanist technologies does Weiss denounce?

Weiss includes defeating death, robotic hearts, virtual reality sex, telepathy via mind-reading headsets, brain implants, ectogenesis, artificial intelligence, exoskeleton suits, designer babies, and gene editing tech. “At no point [does Istvan] wonder if we should even strive for these technologies,” Weiss thunders.