Anyone who does not have QC as part of their 5+Yr Roadmap for IT are truly exposing their company as well as shareholders and customers. China, Russia, Cartels, DarkNet, etc. will use the technology to extort victims, destroy companies, economies, and complete countries where folks have not planned, budget, skilled up, and prep for full replacement of their infrastructure and Net access. Not to mention companies who have this infrastructure will provide better services/ CCE to svc. consumers.

In a recent article, we highlighted a smart beta ETF called the “Sprott BUZZ Social Media Insights ETF” that uses artificial intelligence (AI) to select and weight stocks. If we stop and think about that for a moment, that’s a pretty cool use of AI that seems well ahead of its time. Now we’re not saying that you should go out and buy this smart beta ETF right away. It uses social media data. We know that on social media, everyone’s an expert and many of the opinions that are stated are just that, opinions. However some of the signals may be legitimate. Someone who just bought Apple is likely to go on telling everyone how bullish they are on Apple shares. Bullish behavior is often accompanied by bullish rhetoric. And maybe that’s exactly the point, but the extent to which we’re actually using artificial intelligence here is not that meaningful. Simple scripting tools go out and scrape all this public data and then we use natural language processing (NLP) algorithms to determine if the data artifacts have a positive or negative sentiment. That’s not that intelligent, is it? This made us start to think about what it would take to create a truly “intelligent” smart beta ETF.

What is Smart Beta?

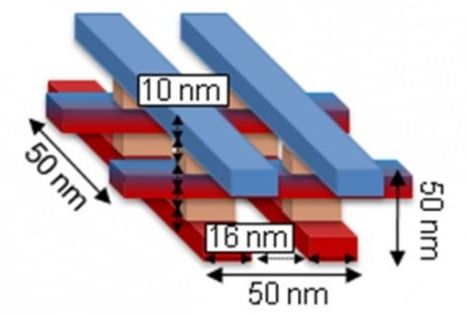

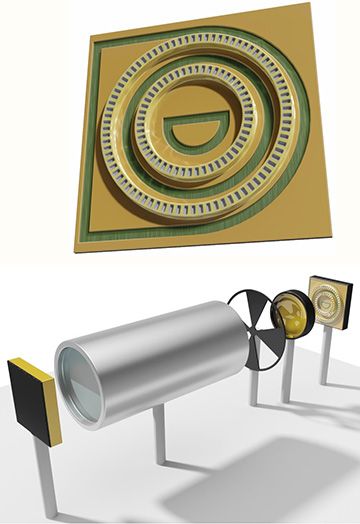

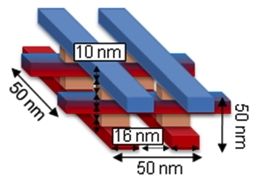

We have talked before about how people that work in finance love to obfuscate the simplicity of what they do with obscure acronyms and terminology. Complex nomenclature is suited for sophisticated scientific domains like synthetic biology or quantum computing but such language is hardly merited for use in the world of finance. We told you before what beta is. Smart beta is just another way of saying “rules based investing” which has in fact been around for centuries, but of course we act like it’s new and start publishing all kinds of research papers on it. In fact, a poll offered up by S&P Capital IQ shows that even 1 out of 4 finance professionals recognizes the term “smart beta” to be little more than a marketing gimmick:

Read more