More worrying than the internet’s role in the rise of far-right populism is the digital tsunami poised to engulf us: AI and and ‘crypto-anarchists’ are radically restructuring life – and politics – as we know it.

[youtube_sc url=“https://youtu.be/upW5_OvpPU8”]

The recent efforts to remove Net Neutrality have given many a sense of impending doom we are soon to face. What happens to an Internet without Net Neutrality? Advocates have a vision of the possible results — and it is quite the nightmare! In this segment of Future A to Z, The Galactic Public Archives takes a cheeky, yet compelling perspective on the issue.

Individuals who mine Bitcoins needn’t be miners. We call them ‘miners’ because they are awarded BTC as they solve mathematical computations. The competition to unearth these reserve coins also serves a vital purpose. They validate the transactions of Bitcoin users all over the world: buyers, loans & debt settlement, exchange transactions, inter-bank transfers, etc. They are not really miners. They are more accurately engaged in transaction validation or ‘bookkeeping’.

There are numerous proposals for how to incentivize miners once all 21 million coins have been mined/awarded in May 2140. Depending upon the network load and the value of each coin, we may need to agree on an alternate incentive earlier than 2140. At the opening of the 2015 MIT Bitcoin Expo, Andreas Antonopolous proposed some validator incentive alternatives. One very novel suggestion was based on game theory and involved competition and status rather than cash payments.

I envision an alternative approach—one that also addresses the problem of miners and users having different goals. In an ideal world the locus of users should intersect more fully with the overseers…

To achieve this, I have proposed that every wallet be capable of also mining, even if the wallet is simply a smartphone app or part of a cloud account at an exchange service. To get uses participating in validating the transactions of peers, any transaction fee could be waived for anyone who completes 1 validation for each n transactions. (Say one validation for every five or ten transactions). In this manner, everyone pitches in a small amount of resources to maintain a robust network.

A small transaction fee would accrue to anyone who does not participate in ‘mining’ at all. That cost will float with supply and demand. Users can duck the fee by simply participating in the validation process, which continues to be based on either proof-of-work, proof-of-stake — or one of the more exotic proof theories that are being proposed now.

Philip Raymond co-chairs Cryptocurrency Standards Association. He produces

The Bitcoin Event, edits A Wild Duck and is a frequent contributor to Quora

Bitcoin has terrible UX…in our journey into tech we purchased a few pounds worth on a paper wallet on a bitcoin ATM machine to experiment with and gain familiarity with this new form of internet money.

The paper wallet has an illegibly long code that needs to be typed in or QR code scanned in to get the part bitcoin uploaded to an online usable form of bitcoin.

Bitcoins can be lost because of this bad UX/UI issue.

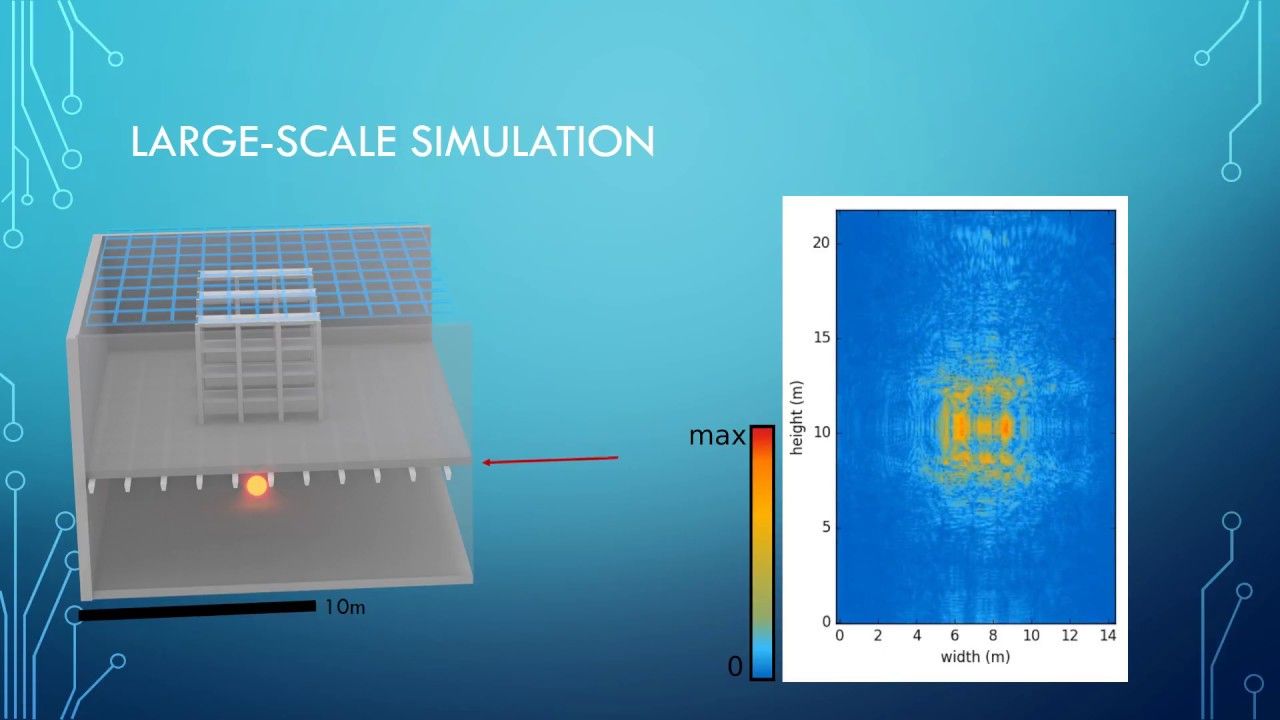

Wi-Fi can pass through walls. This fact is easy to take for granted, yet it’s the reason we can surf the web using a wireless router located in another room.

However, not all of that microwave radiation makes it to or from our phones, tablets, and laptops. Routers scatter and bounce their signal off objects, illuminating our homes and offices like invisible light bulbs.

Now, German scientists have found a way to exploit this property to take holograms, or 3D photographs, of objects inside of a room — from outside of the room.

Confidential details of a top-secret encryption-breaking supercomputer were left completely exposed on an unsecured computer server belonging to New York University (NYU), according to a new report.

While it’s not uncommon for even critical-level infrastructure to suffer potentially catastrophic security breaches, what makes this event different is that there was seemingly no foul-play or attempts to hack into NYU’s systems.

Instead, it looks like somebody may have just forgotten to secure their classified data properly, exposing hundreds of pages of information on a covert code-breaking machine co-administered by the Department of Defence, IBM, and NYU.

Malicious software that blocks access to computers is spreading swiftly across the world, snarling critical systems in hospitals, telecommunications and corporate offices, apparently with the help of a software vulnerability originally discovered by the National Security Agency.

The reports of the malware spread began in Britain, where the National Health Service (NHS) reported serious problems throughout Friday. But government officials and cybersecurity experts later described a far more extensive problem growing across the Internet and unbounded by national borders. Europe and Latin America were especially hard hit.

“This is not targeted at the NHS,” British Prime Minister Theresa May told reporters. “It’s an international attack, and a number of countries and organizations have been affected.”

But there is cause for concern. Internet companies’ control of data gives them enormous power. Old ways of thinking about competition, devised in the era of oil, look outdated in what has come to be called the “data economy” (see Briefing). A new approach is needed.

A NEW commodity spawns a lucrative, fast-growing industry, prompting antitrust regulators to step in to restrain those who control its flow. A century ago, the resource in question was oil. Now similar concerns are being raised by the giants that deal in data, the oil of the digital era. These titans—Alphabet (Google’s parent company), Amazon, Apple, Facebook and Microsoft—look unstoppable. They are the five most valuable listed firms in the world. Their profits are surging: they collectively racked up over $25bn in net profit in the first quarter of 2017. Amazon captures half of all dollars spent online in America. Google and Facebook accounted for almost all the revenue growth in digital advertising in America last year.

Such dominance has prompted calls for the tech giants to be broken up, as Standard Oil was in the early 20th century. This newspaper has argued against such drastic action in the past. Size alone is not a crime. The giants’ success has benefited consumers. Few want to live without Google’s search engine, Amazon’s one-day delivery or Facebook’s newsfeed. Nor do these firms raise the alarm when standard antitrust tests are applied. Far from gouging consumers, many of their services are free (users pay, in effect, by handing over yet more data). Take account of offline rivals, and their market shares look less worrying. And the emergence of upstarts like Snapchat suggests that new entrants can still make waves.

One year after the existence of the afterlife is scientifically verified, millions around the world have ended their own lives in order to “get there”. A man and woman fall in love while coming to terms with their own tragic pasts and the true nature of the afterlife.

Now streaming only on Netflix.

Watch The Discovery: http://www.netflix.com/title/80115857

SUBSCRIBE: http://bit.ly/29qBUt7

About Netflix:

Netflix is the world’s leading Internet television network with over 100 million members in over 190 countries enjoying more than 125 million hours of TV shows and movies per day, including original series, documentaries and feature films. Members can watch as much as they want, anytime, anywhere, on nearly any Internet-connected screen. Members can play, pause and resume watching, all without commercials or commitments.

Connect with Netflix Online:

Visit Netflix WEBSITE: http://nflx.it/29BcWb5

Like Netflix on FACEBOOK: http://bit.ly/29kkAtN

Follow Netflix on TWITTER: http://bit.ly/29gswqd

Follow Netflix on INSTAGRAM: http://bit.ly/29oO4UP

Follow Netflix on TUMBLR: http://bit.ly/29kkemT

Yes, this works with the financial profile of “middle class” American families.

(Tech Xplore)—RethinkX, an independent think tank that analyzes and forecasts disruptive technologies, has released an astonishing report predicting a far more rapid transition to EV/autonomous vehicles than experts are currently predicting. The report is based on an analysis of the so-called technology-adoption S-curve that describes the rapid uptake of truly disruptive technologies like smartphones and the internet. Additionally, the report addresses in detail the massive economic implications of this prediction across various sectors, including energy, transportation and manufacturing.

Rethinking Transportation 2020–2030 suggests that within 10 years of regulatory approval, by 2030, 95 percent of U.S. passenger miles traveled will be served by on-demand autonomous electric vehicles (AEVs). The primary driver of this unfathomably huge change in American life is economics: The cost savings of using transport-as-a-service (TaaS) providers will be so great that consumers will abandon individually owned vehicles. The report predicts that the cost of TaaS will save the average family $5600 annually, the equivalent of a 10 percent raise in salary. This, the report suggests, will lead to the biggest increase in consumer spending in history.

Consumers are already beginning to adapt to TaaS with the broad availability of ride-sharing services; additionally, the report says, Uber, Lyft and Didi are investing billions developing technologies and services to help consumers overcome psychological and behavioral hurdles to shared transportation such as habit, fear of strangers and affinity for driving. In 2016 alone, 550,000 passengers chose TaaS services in New York City alone.