PALO ALTO, Calif., Feb 5 (Reuters) — The Federal Reserve is looking at a broad range of issues around regulations and protections for digital payments and currencies, including the costs and potential benefits of issuing its own digital currency, Governor Lael Brainard said on Wednesday.

“By transforming payments, digitalization has the potential to deliver greater value and convenience at lower cost,” Brainard said in remarks prepared for delivery at the Stanford Graduate School of Business. The speech did not touch on interest rates or the current economic outlook.

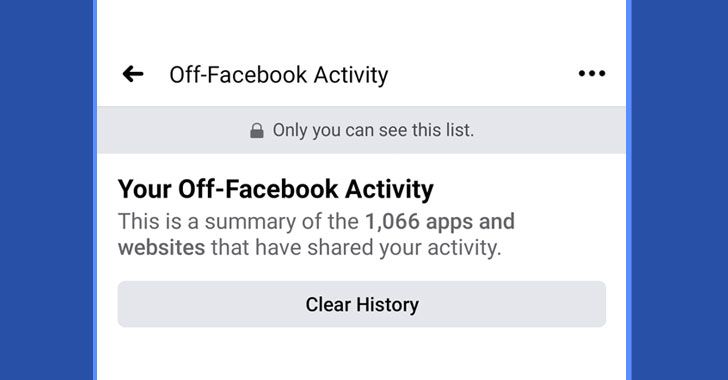

“But there are risks,” Brainard said, in a partial reprisal of her own and other global central bankers’ worries about the rise of private digital payment systems and currencies, including Facebook’s Libra digital currency project. “Some of the new players are outside the financial system’s regulatory guardrails, and their new currencies could pose challenges in areas such as illicit finance, privacy, financial stability, and monetary policy transmission.”