Category: economics

ICOs & Altcoins rise and fall—yet, Bitcoin endures

At the end of 2017 and the first months of 2018, we witnessed a surge of interest in Initial Coin Offerings or ICOs. Perhaps the word “interest” gives too much credit to ICOs. Most are scams. ICOs are pushed through by vendor hype, rather than pulled through by investor research. They are almost all pump-and-dump schemes.

But what about Bitcoin? It is not a scam, but questions remain about regulation, intrinsic value* and its likelihood to be superseded by something better. Bitcoin skeptics point to two facts: (1) Bitcoin is open source, and so anyone can create an equally good altcoin. (2) Newer coins incorporate improvements that overcome governance and scaling issues: cost, transaction speed, the burgeoning electric needs of miners, or whatever…

While both statements are true, they miss the point. This is not a VHS-vs-Beta scenario. Bitcoin has achieved a 2-sided network and it is free to fold in every vetted improvement that comes along. For Bitcoin, all those other coins are simply beta tests.

Even the functional tokens will unwittingly feed their “improvements” into Bitcoin. For this reason, it is a safe bet that Bitcoin will reign supreme for years to come—perhaps even long enough for the dominos to fall.

Why I rarely consult to ICOs or prospective ICO investors

I recently presented at cryptocurrency expos in Dubai and Gujarat. As a result of these presentations, my organization now receives ICO pitch decks, white papers and business summaries—15 or 20 each week. About ⅔ are sent by investors asking for advice as an investment opportunity, while ⅓ are from issuers seeking accreditation from CRYPSA or at least a quote than can be used as a comfort statement.

The market potential for consulting to issuers and high-rolling investors is very alluring. Figuring that we could certify gems and advise the dogs (help them to create a more legitimate token), we put together a business plan to address a massive new consulting opportunity. But guess what?

… They are ALL dogs! That’s right! ICOs are scams. They are not the same as ‘altcoins’, which is a term more commonly used for open source forks of legitimate cryptocurrency platforms.

Now, the SEC has begun to investigate ICOs and for good reason. Most are thinly veiled scams to fleece widows and orphans by ducking under securities regulations. Others are MLM scams, proprietary mechanisms (in which founders or early partners hold all the cards), or they are simply poor/fake implementations of Blockchain services.

How to spot an ICO scam (Hint: They are almost all scams!)

What fraction of ICOs are scams? More than 97% according CRYPSA. To preserve our reputation, we have suspended a high profit project to endorse the hidden gems. Despite scores of applicants, we simply cannot find any worthy of accreditation, with the exception of a few Bitcoin forks. But, these forks are altcoins, and not really ICOs.

Nearly all ICOs that we analyzed fall into one of these categories…

- Veiled securities offerings, designed to duck under securities regulations

- Created for the express purpose of pump & dump (without clearly disclosing caps, reserves or pre-mined stakeholders)

- A non-functioning coin that can only gain value through MLM. (This is not necessarily criminal, but outside our research and advisory mandate. Such coins are unlikely to provide value without quick, speculative trades and market timing that amounts to “dumb luck”).

So, what are the signs that an ICO is a scam? Is there anything you can do—short of hiring an expert—to evaluate each new proposal that comes along?

So, what are the signs that an ICO is a scam? Is there anything you can do—short of hiring an expert—to evaluate each new proposal that comes along?

We don’t advise or recommend holding such risky tokens—but for those attracted to the siren call of ICOs, here are six common tale tell signs that you are dealing with a scam:

- If you received an announcement of an ‘Air drop’ or a coupon to get 25 or 50% bonus coins, it is a scam

- If the value of coins is influenced by your ability to find new investors, it is a scam

- If the coin is not based on Satoshi’s blockchain reference code, or is not open source, peer-to-peer and permissionless, then it is very likely a scam. (There are certain, limited exceptions)

- If the coin is based on Tangle, then it is a scam—or at least, it is functionally useless—and therefore it is a bad investment risk

- If the coin was pre-mined, then it is a scam. All mining by principals, insiders and early buyers must be disclosed and must be at least a full month after the first widely available public announcements

- If any advertisement, announcement, affiliate contact or press release ends up in the hands of someone who did not independently contact the issuer for information and a prospectus, it is most definitely a scam

Are you like me?

Because most initial coin offerings exhibit these traits, I pass on opportunities to consult or present at organizations and conferences that cozy up to ICOs. This decision limits my participation at many crypto venues, but my conscience is clean and my Bitcoin future is secure.

Resist the siren call and keep your wits about you. You, too, can also avoid the illusory trap of ICOs. Run, hide or just ignore them. “These are not the coins that you are looking for.” (with apologies to Obi-Wan Kenobi and Alec Guinness).

* Related:

- Spell it Out: What backs Bitcoin?

- ICO’s –vs– Value: Tale of two Bitcoins

- Can Bitcoin be Defeated by Legislation?

Philip Raymond chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He was featuerd at cryptocurrency conferences in Dubai, South Africa and India. Click Here to inquire about a presentation.

Would an ethical government surrender control of monetary policy?

Godfrey Bloom is a member of the British Parliament. His in-your-face style of educating and shocking his peers has made him a controversial politician. He has occasionally been escorted out of the assembled parliament because of his rowdy rhetoric.

Consider the video below. Bloom offers a critical, but simple and clear explanation of the Fractional Reserve banking system used in the US and Europe. This gets to the heart of the matter! [continue below video]…

Conclusion (mine, and not Mr. Bloom’s): It is in the interest of governments to use a form of money that they cannot manipulate, print, spend, hide or lend without first earning, taxing or legitimately borrowing — and then balancing the books, openly.

Bitcoin is such a currency. Any country that adopts an open source, permissionless, and completely transparent monetary instrument will demonstrate to citizens and taxpayers that they respect their constituents and that they commit to balance their books like any state, corporation, NGO or household.

Would an ethical government surrender control of its own monetary policy? H*ll, yes! This is how a government avoids rampant inflation and the burden of non-consensual debt to future generations. It is also how a government makes taxation, redistribution and spending transparent and accountable. It is how a government restores trust.

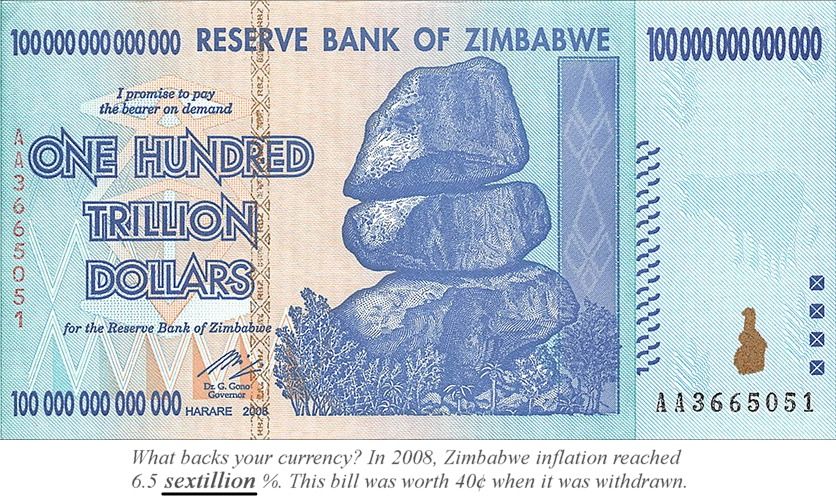

We have been raised with centuries of dogma that teach us to accept inflation, and a constantly escalating public debt. Sometimes, the path forward is not immediately obvious. But history doesn’t lie. When trusted nations with large economies manipulate interest rates, borrow without a lender, or inflate a nation out of a crisis (what the US calls “quantitative easing”), the long term effect is certain to be no different than Argentina, Zimbabwe, Venezuela or Germany between the wars. It is a recipe for disaster. It places every citizen and their future children into debt-bondage.

Moving away from the Gold Standard in the 1970s was a risky maneuver. The risk was not abandoning a precious metal with intrinsic value—but rather it placed the full faith and credit of our economy in the hands of transient politicians, rather than in a capped commodity with certain and immutable properties.

Bitcoin is the new gold. It is capped, transparent, open-source, vetted and without a mechanism for quick or covert manipulation (the US calls this “raising the debt ceiling” and they do it every few months!). We may not move to an economy based on Bitcoin today or tomorrow, but that day is coming. Thankfully, it’s coming!

- Related: Is Cryptocurrency Good for Government?

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He was speaker at Cryptocurrency Conferences in Dubai, South Africa and India. Click Here to inquire about a presentation.

Health and the crypto-economy. Health Blockchain

AI and blockchain, the main innovations in #Longevity, are united in DAYS.exchange platform.

DAYS tokens are to be sort of guarrantee for longevity services effectiveness.

DAYS.exchange partner supported Longevity Impact Forum.

The first step to rhe most effective healthcare, based on blockchain consensus regarding health span technologies.

Thanks omar fogliadini, ondřej pilný, ben kraus, alex lightman, avi roy, liz parrish, george kyriakos sergei sevriugin edgar kampers kirill zhukov philippe van nedervelde anton dziatkovskii darr aita.

New Report Explores The Forces Affecting The Future Of Work — By Adi Gaskell | Forbes

“The last few years have seen a wide range of reports from governments, think tanks, consultancies and academics exploring how the future of work might look. Many of these have revolved around the impact technology, and especially AI, might have on how (and indeed whether) we work.

The latest effort, from Bain’s Macro Trends Group, takes a slightly broader view and examines not just the technological landscape but also demographic and economic forces.”

Artificial Intelligence Possible Concepts — Are You Ready for the Future

Artificial Intelligence has come a long way in the last decade and still, you have to ask; Where Are We Today? In reviewing the Brief History of AI or Artificial Intelligence we see such things as Humans VS Machines Chess Champions, but the current research goes way beyond that.

The applications and uses for artificially intelligent machines are endless. Prediction software can help us in medicine, environmental monitoring, weather warnings and even streamlining our transport systems, monetary economic flows and assist us in protecting our nation. The road ahead for artificial intelligence is more like the runway ahead and you can expect us to blast off into the future within the next five years.

For instance, if you are concerned that your CEO is making too much money in your corporation, you need not worry much longer because very soon they will be replaced with an artificial business tool; that’s right, meet your new CEO.

Reversing Aging — 2018 update

What progress is being made in the field of reversing aging — the grand humanitarian project to extend healthy lifespan?

In this London Futurists online video conference, a number of healthspan extension researchers and activists from around the answered questions such as:

*) What do you know now, that wasn’t known, or which was less clear, back in January 2017?

*) What progress has encouraged you? And what disappointments have there been?

*) Overall, what have we learned? And what should the field do differently in the future?

We’ll discussed developments in the understanding of:

*) The underlying science of aging

*) The most effective medical interventions to slow or reverse aging

*) The most effective forms of advocacy, to change public opinion regarding this field

*) The social and economic consequences of significantly extended healthspans.

== Panellists ==

Elizabeth Parrish, CEO of BioViva Sciences Inc, https://bioviva-science.com/ — known as “patient zero” for two anti-aging therapies that her company is researching.

Ilia Stambler, Author of the definitive history of life extensionism, http://www.longevityhistory.com/ and Outreach Coordinator at International Society on Aging and Disease (ISOAD), http://www.isoad.org/.

How Technology Is Leading Us Into the Imagination Age

In many ways, the future is unpredictable. A report by the World Economic Forum reveals that almost 65 percent of the jobs elementary school students will be doing in the future do not even exist yet. Combined with technological automation and the disappearance of traditional jobs, this leaves us with a critical question: how can we survive such a world?

The answer may be imagination.

Initially coined by Rita J. King, the imagination age is a theoretical period beyond the information age where creativity and imagination will become the primary creators of economic value. This is driven by technological trends like virtual reality and the rise of digital platforms like YouTube, all of which increase demand for user-generated content and creativity. It is also driven by automation, which will take away a lot of monotonous and routine jobs, leaving more higher-ordered and creative jobs.