I administer the Bitcoin P2P discussion group at LinkedIn, a social media network for professionals. A frequent question posed by newcomers and even seasoned venture investors is: “How can I understand Bitcoin in its simplest terms?”

Engineers and coders offer answers that are anything but simple. Most focus on mining and the blockchain. In this primer, I will take an approach that is both familiar and accurate…

Terms/Concepts: • Miners • Blockchain • Double-Spend

First, forget about everything you have heard about ‘mining’ Bitcoin. That’s just a temporary mechanism to smooth out the initial distribution and make it fair, while also playing a critical role in validating the transactions between individuals. Starting with this mechanism is a bad way to understand Bitcoin, because its role in establishing value, influencing trust or stabilizing value is greatly overrated.

The other two terms are important to a basic understanding of Bitcoin and why it is different, but let’s put aside jargon and begin with the familiar. Here are three common analogies for Bitcoin. #1 is the most typical impression pushed by the media, but it is least accurate. Analogy #3 is surprisingly on target.

1. Bitcoin as Gold

You can think of Bitcoin as a natural asset, but with a firm, capped supply. Like gold, the asset is a limited commodity that a great many people covet. But unlike gold, the supply is completely understood and no one organization or country has the potential to suddenly discover a rich vein and extract it from the ground.

2. Bitcoin as a Debit or Gift Card

Bitcoin is also a little like a prepaid debit card, you can exchange cash for it and then use it to buy things—either locally (subject to growing recognition and acceptance) or across the Internet. But here, too, there is a difference. A debit card must be loaded with a prepaid balance. That is, it must be backed by something else, whereas Bitcoin has an intrinsic value based on pure market supply and demand. A debit card is a vehicle to transmit or pay money—but Bitcoin is the money itself.

3. Bitcoin as a Foreign Currency

Perhaps the most accurate analogy for Bitcoin (or at least where it is headed), is as a fungible, convertible, bankable foreign currency.

Like a foreign currency, Bitcoin can be…

- Easily exchanged with cash

- Easily transmitted for purchases, sales, loans or gifts

- Stored & saved in an online account or in your mattress (Advantage: It can also be stored in a smart phone or in the cloud—and it can backed up!)

- Has a value that floats with market conditions

- Is backed by something even more trustworthy than a national government

Unlike the cash in your pocket or bank account, Your Bitcoin wallet can be backed up with a mouse click. And, with proper attention to best practices, it will survive the failure of any exchange, bank or custodian. That is with proper key management and the use of multisig, no one need lose money when a Bitcoin exchange fails. The trauma of past failures was exacerbated by a lack of tools, practices and user understanding. These things are all improving with each month.

So, What’s the Big Deal?

So, Bitcoin is a lot like cash or a debit card. Why is this news? Bitcoin is a significant development, because the creator has devised a way to account for moving money between buyer and seller (or any two parties) that does not require any central bank, bookkeeper or authority to keep tabs. Instead, the bookkeeping is crowd sourced.

For example, let’s say that Alice wants to purchase a $4 item from Bob, an Internet merchant in another country.

a) Purchase and settlement with a credit card

With a credit card, wire transfer or check, Alice can pay $4 easily. But many things occur in the background and they represent an enormous transaction overhead. Alice must have an account at an internationally recognized bank. The bank must vouch for Alice’s balance or credit in real time and it must then substitute its own credit for hers. After the transaction, two separate banks at opposite ends of the world must not only adjust their client account balances, they must also settle their own affairs through an interbank-settlement process.

The two banks use different national currencies and are subject to different laws, oversight and reporting requirements. Over the course of the next few days, the ownership of gold, oil or reserve currencies is transferred between large institutions to complete the affairs of Alice’s $4 purchase.

b) Now, consider the same transaction with Bitcoin

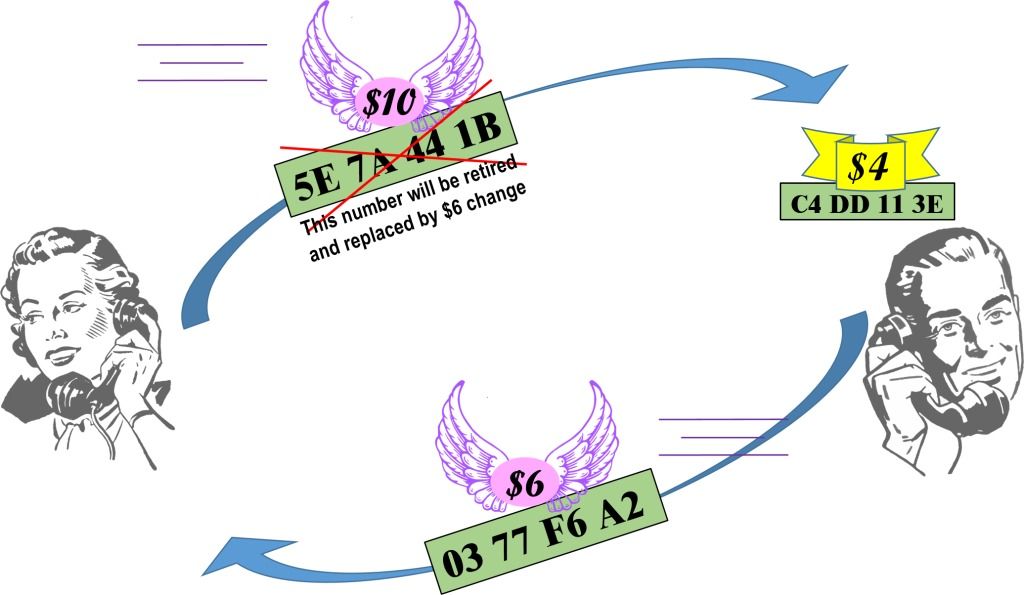

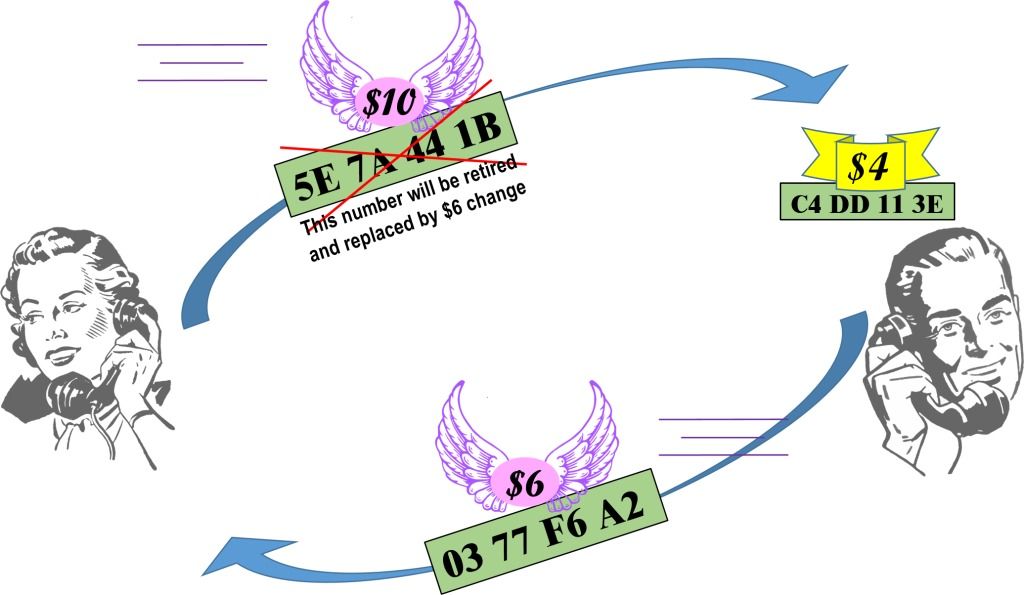

Suppose that Alice has a Bitcoin wallet with a balance equal to $10. Let’s say that these characters represent $10 in value: 5E 7A 44 1B. (Bitcoin value is expressed as a much longer character string, but for this illustration we are keeping it short). Alice wants to buy a $4 item from Bob. Since she has only this one string representing $10, she must somehow get $6 in change.

With Bitcoin, there is no bank or broker at the center of a transaction. The transaction is effected directly between Alice and Bob. But there is a massive, distributed, global network of bookkeepers standing ready to help Alice and Bob to complete the transaction. They don’t even know the identities of Alice or Bob, but they are like a bank and independent auditor at the same time…

If Alice were to give Bob her secret string (worth $10), and if Bob gives her a string of characters worth $6 as change, one wonders what prevents Alice from double-spending her original $10 secret? But this can’t happen, because the miners and their distributed blockchain are the background fabric of the ecosystem. In the Bitcoin world, Alice is left with a brand new secret string that represents her new bank balance. It can be easily tested by anyone, anywhere. It is worth exactly $6.

This example is simplified and without underlying detail. But the facts, as stated, are accurate.

Conclusion

For Geeks, Bitcoin is the original implementation of a blockchain distributed ledger. Miners uncover a finite reserve of hidden coins while validating the transactions of strangers. As such, Bitcoin solves the double spend problem and enables person-to-person transactions without the possibility of seizure or choke points.

But for the rest of us, Bitcoin offers a very low cost transaction network that will quickly replace checks and debit cards and may eventually replace cash, central banks, and regional monetary authorities. The safeties, laws and refund mechanisms offered by banks and governments can still be applied to Bitcoin for selected transactions (whenever both parties agree to oversight), but the actual movement of value will be easier, less expensive and less susceptible to 3rd party meddling.

- Bitcoin is a distributed, decentralized and low cost payment network

- It is adapted to a digital economy in a connected world: fluid & low friction, trusted, secure

- More zealous proponents (like me) believe that is gradually becoming the value itself (i.e. it needn’t be backed by assets, a promise of redemption, or a national government. In this sense, it is like a very stable, foreign currency

Additional Reading:

Philip Raymond sits on Lifeboat’s New Money Systems Board and administers Bitcoin P2P, a LinkedIN community. He is co-chair of CRYPSA and host of The Bitcoin Event. He writes for Lifeboat, Quora, Sophos and Wild Duck.