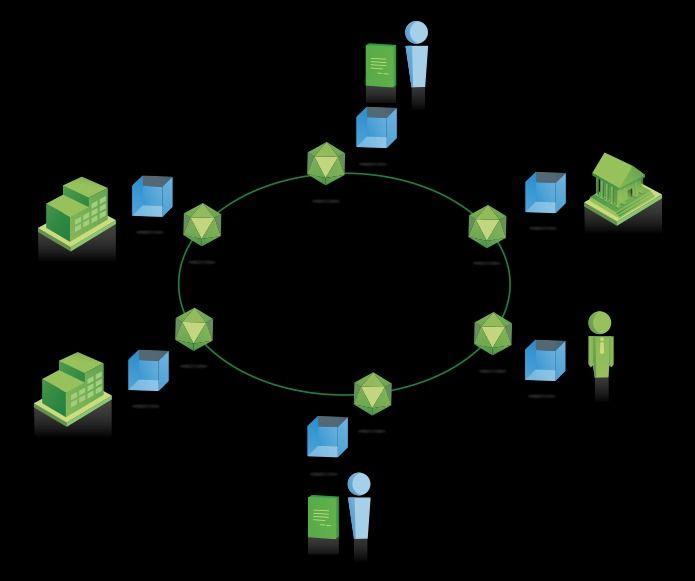

1st D-Wave2 is playing with Blockchaining, with QC and now IBM offering in their cloud services.

IBM Blockchain is launching a cloud-based service that allows companies to test performance, privacy, and interoperability of blockchain systems.

I like this article because I have for years looked at options to address the counterfeiting issues which is a extremely costly criminal industry around diamonds and artwork. As we have seen with synthetic diamonds in their use in QC and medical technology there is a lot that technology can do in addressing the counterfeiting issues as well as registration & certification space. Also, could registered & embedded serialized stones be another form of id for the consumer who wears their accessory with the stone? I believe it can be.

IBM launches a new high security blockchain service that uses hardware to protect valuable data, with provenance startup Everledger as its first customer.

I was asked this at Quora.com, where I answer questions under the pen name, ‘Ellery’. But the query deserves a companion question, and so I approached the reply by answering two questions.

You might have asked “Why was Bitcoin designed to have a cap?” But, instead, you asked “Why is the cap set at 21 million bitcoins”. Let’s explore both questions starting with the choice of a circulation cap…

Why set the cap at 21 million BTC?

The choice of a cap number is arbitrary and in fact, it could be 1 or it could be 1 hundred trillion. It makes no difference at all and it has no effect on the economy—even if Bitcoin were to be adopted as a currency all over the world. If it were set to 1 BTC, we would simply discuss nano-BTC instead of 1 BTC for amounts of about $650.

In fact, we already do this today. For many purposes, people are concerned with very small payments. And to best discuss these payments, we have the Satoshi. There are 100,000 Satoshi to each bitcoin (BTC).

What is important, is that the total number of bitcoin (regardless of how many units there are) can be divided into very tiny fractions. That way, the total worldwide supply can be divided into smaller and smaller slivers as market adoption gains traction. Everyone needs to earn, save, spend or pay with a piece of the pie. All users need to know is what fraction of the pie do I control? and not how many ounces, pounds, Kg, or tons is the pie. That is just a number.

Incidentally, the same could be said of gold (it can be shaved very thin), but gold is not quite like computer bits. It has industrial and cosmetic value, and this intrinsic demand for gold (beyond it’s role as a pure monetary instrument) has an effect on supply and demand along with the influence of investment, circulation, savings and reserve.

Why is there a cap at all?

At the beginning of this answer, I suggested another question: Why is Bitcoin capped at all? After all, the monetary supply in every country grows. Even gold production is likely to continue for centuries to come. Why not Bitcoin?

Satoshi designed Bitcoin to eventually become a deflationary currency. I believe that he/she recognized inflation is an insipid tax that constitutes an involuntary redistribution of earned wealth. With a firm cap on the total number of units that exist, governments can still tax, spend and even enforce tax collection. They can go about business building bridges, waging war and providing assistance to the needy. But without a printing press in the hands of transient politicians, they can only spend money with the consent of their constituents and residents.

Of course, they could borrow money by issuing bonds. But with a capped currency, each creditor would earnestly believe in the will and ability of the country to repay its debts.

In effect, monetary policy is restricted to the business of the governed, but the money itself is not coined by a domestic treasury. It is the province of something that is far more certain than a human institution. It arises from pure math. It is open and transparent. In effect, everyone is an auditor. That’s because the bookkeeping is crowd sourced.

For prescient legislators and national treasurers, Bitcoin presents far more of an opportunity than a threat. It is good for both government, business and consumers, because it forces everyone to be open and honest. Ultimately, it builds trust in government, because no one can cook the books, water down wealth, or print their way out of debt.

What about recession. Isn’t it a result of deflation?

Deflation doesn’t lead to recession. Rather, it sometimes accompanies a recession. Recession is caused by an uncertain job market, war, a massive supply chain interruption or political upheaval. In one way or another, it boils down to a lack of confidence sparked by one of the economy’s core foundations: consumers, investors, business or creditors.

Bitcoin as currency removes a major impediment to confidence. By creating a system that cannot be rigged, it fosters trust in government along with an open and transparent treasury.

Philip Raymond co-chairs CRYPSA and was MC at The Bitcoin Event in New York. He writes for Quora, LinkedIN, Wild Duck and Lifeboat Foundation, where he sits on the New Money Systems Board.

Blockchain Engine and Petrodvorets Watch Factory have introduced blockchain technology into the manufacturing process of Raketa watches, making Raketa one of the first companies in the world to record the production of physical goods in the blockchain.

Established by Peter the Great in 1721, Petrodvorets Watch Factory is one of Russia’s oldest businesses. After the Second World War, the factory produced watches under the brand name Pobeda until 1961, when production of the Raketa [Rocket] watches started, named in honor of the first flight into space by Yuri Gagarin.

In a bid to restructure the historical watch brand, the company entered a rebranding stage in 2009 under the direction of Russian, Swiss and French experts, with director Jacques von Polier heading the creative and design department.

Last week I dipped my toes in the waters of the Lifeboat blog and shared a link about blockchain technology. If you haven’t heard about blockchain technology yet, you can read about it here, here, here, here, here…you get the picture. Blockchain has tons of potential, and appears to also attract hype and money. All which goes to say, there has been a lot of buzz about its social and economic potential. But there is another aspect of blockchain that deserves some futurist exploration, which is that it signals we live in Postnormal Times.

Postnormal Times (PNT) is a fantastic foresight concept that I will focus on in my upcoming Lifeboat posts. There is an underlying theory to it; Ziauddin Sardar explains the entire idea and how it fits into futures studies. Ziauddin Sardar with John Sweeney have expanded the work into a futurist method called The Three Tomorrows of Postnormal Times. It’s well worth reading up on if you enjoy a futurist approach to your work and studies.

I’m still a beginner, but essentially the idea is that we are now in time is a period best characterized as “postnormal,” meaning that the usual ways of solving problems and making progress have stopped working. Our go-to responses, based on all the previously reliable ways of being in and understanding the world are becoming irrelevant and dysfunctional. The simplest way to introduce Sardar’s concept is the three C’s: complexity, chaos and contradictions. These are the key characteristics of postnormal times which I will be exploring in my posts about technology and humanity. I believe the PNT perspective leads to some useful observations about the direction of society over the next decades.

Back to my blockchain example: the Raketa watch company is implementing blockchain in manufacturing, which will protect inventory from counterfeiting. This development signals PNT because it speaks to the complexity of globalized financial and consumer markets. In this case, so intricate as to require a new, high-tech, largely automated and seemingly fail-proof technology. PNT is evident when previous methods of running a company are no longer sound. Enter blockchain to navigate this new business condition.

The PNT characteristic of chaos is also present—the networks of users necessary to have a blockchain at all is a network that behaves as a chaotic system, one that seeks a common goal of verifying blocks in the chain (see links above for more detail on how blockchain works, or read /listen to our chapter in The Future of Business ). Sardar suggests that in PNT terms, all networks are chaos: “Since everything is linked up and networked with everything else, a break down anywhere has a knock on effect, unsettling other parts of the network, even bringing down the whole network.” This is an apt characterization of blockchain technology and why it makes a great counterfeit-detection system.

And, of course, the contradictions of blockchain technology are undoubtedly many, but as we discussed in our chapter in The Future of Business, there is an insistence by its supporters that blockchain is a pure and corruption-free alternative to banks, judges, legal systems and all sorts of oppressive authorities while the truth about blockchain’s origins (i.e. the identity of its inventor, Satoshi Nakamoto ) remain elusive. That’s hardly the most important aspect of the technology’s potential, but it is one of the more intriguing aspects, and something that keeps it firmly in “postnormal” territory.

I hope to explore many more examples of Postnormal Times on this blog.

“The state of New York just got another bitcoin company that can legally operate under the auspices of the state financial regulator’s guidelines.”

Raketa will be one of the the first companies in the world to record the production of physical goods in the Blockchain.

Exponential Finance celebrates the incredible opportunity at the intersection of technology and finance. Watch live as hundreds of the world’s leading investors, entrepreneurs and innovators gather in New York to define the future of the way we do business.

In Bitcoin’s early years computer scientists and early adopters were running the show. Now, a new community of academics, entrepreneurs, and economists, are working with cryptocurrencies and blockchain to bring the technology to a new set of diverse applications.

From building peer-to-peer networks for secure data computation and storage to decentralized content management systems that give patients access to health-care records across hospital databases, blockchain and digital currencies are starting to rewrite the rules of the 21st century transaction.

“In an obscure corner of the internet, an anonymous person or persons published a math paper — the “Bitcoin white paper” — that solved a problem that had until then stumped computer scientists: how to create digital money without any trusted parties.”