[youtube_sc url=“https://www.youtube.com/watch?v=NSzLOugK44M”]

“It’s a fairly concise but expansive vision of what is possible to build with open public blockchains.”

[youtube_sc url=“https://www.youtube.com/watch?v=NSzLOugK44M”]

“It’s a fairly concise but expansive vision of what is possible to build with open public blockchains.”

In Brief:

Recent reports by IBM have revealed that by 2017, 15 percent of big banks worldwide and 14 percent of major financial institutions will be using Blockchain technology.

“One of the most interesting questions to me is whether we can figure out how to implement a proof of stake consensus mechanism in a large decentralized trustless public blockchain (ie Bitcoin, Ethereum, etc).”

Worried about security for your bitcoin in the face of quantum computing? According to computer researchers, there’s no reason to be.

Source: https://hacked.com/breathe-easy-bitcoiners-quantum-computing-no-match-for-sha-2-encryption

Some people assume that once quantum computing comes along modern encryption technologies will be outpowered. But experts are starting to posit that hash functions and asymmetric encryption could defend not only against modern computers, but also against quantum attackers from the future.

Matthew Amy from Canada’s University of Waterloo proposes just this in a paper by the International Association of Cryptologic Research.

Amy, and researchers from Perimeter Institute for Theoretical Physics and the Canadian Institute for Advanced Research, examined attacks against SHA-2 and SHA-3 with Grover’s algorithm.

Grover’s algorithm is a quantum algorithm that finds with high probability the input to black box functions that produce particular, and predictable, output values.

Grover’s algorithm could brute-force a 128-bit symmetric cryptographic key in roughly 264iterations,” Wikipedia states, “or a 256-bit key in roughly 2128 iterations. As a result, it is sometimes suggested that symmetric key lengths be doubled to protect against future quantum attacks.”

Researchers surmise SHA-256 and SHA3-256 need 2166 “logical qubit cycles” to break, and the paper suggests quantum papers pose little threat, though classical processors will need to manage them.

The paper notes: “The main difficulty is that the coherence time of physical qubits is finite. Noise in the physical system will eventually corrupt the state of any long computation,” the paper states. “Preserving the state of a logical qubit is an active process that requires periodic evaluation of an error detection and correction routine.”

With ASICs running at a few million hashes per second, it would take Grover’s algorithm 1032 years to crack SHA-256 or SHA3-256. That is longer than the universe has existed.

As The Register adds: “Even if you didn’t care about the circuit footprint and used a billion-hash-per-second Bitcoin-mining ASIC, the calculation still seems to be in the order of 1029 years.”

SHA-2 is the set of cryptographic hash functions designed by the National Security Agency (NSA), an intelligence branch of the US government under scrutiny for ubiquitous surveillance due to revelations released by Edward Snowden. SHA stands for “Secure Hash Algorithm.”

These hash functions represent mathematical operations run by digital means Cryptographic hash functions boast collision resistance, which means attackers cannot find two different input values that result in the same hash output. The SHA-2 family is comprised of altogether six hash functions with hash values that are 224, 256, 384 or 512 bits: SHA-224, SHA-256, SHA-384, SHA-512, SHA-512/224, SHA-512/256.

SHA-256 and SHA-512 are novel hash functions computed with 32-bit and 64-bit words, respectively.

By now, most Bitcoin and Blockchain enthusiasts are aware of four looming issues that threaten the conversion of Bitcoin from an instrument of academics, criminal activity, and closed circle communities into a broader instrument that is fungible, private, stable, ubiquitous and recognized as a currency—and not just an investment unit or a transaction instrument.

These are the elephants in the room:

As an Op-Ed pundit, I value original content. But the article, below, on Bitcoin fungibility, and this one on the post-incentive era, are a well-deserved nod to inspired thinking by other writers on issues that loom over the cryptocurrency community.

This article at Coinidol comes from an unlikely source: Jacob Okonya is a graduate student in Uganda. He is highly articulate, has a keen sense of market economics and the evolution of technology adoption. He is also a quick study and a budding columnist.

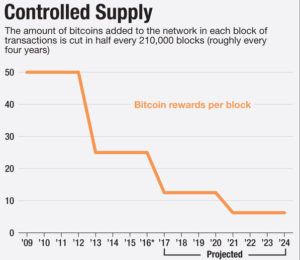

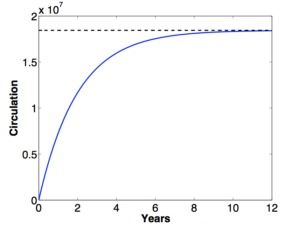

What Happens When Bitcoin Mining Rewards Diminish To Zero?

Jacob addresses this last issue with clarity and focus. I urge Wild Ducks to read it. My response, below touches on both issues 3 and 4 in the impromptu list, above.

Sunset mining incentives—and also the absence of supporting fully anonymous transactions—are two serious deficiencies in Bitcoin today.

I am confident that both shortcomings will be successfully addressed and resolved.

Thoughts about Issues #3 and #4: [Disclosure] I sit on the board at CRYPSA and draft whitepapers and position statements.*

Blockchain Building: Dwindling Incentives

Financial incentives for miners can be replaced by non-financial awards, such as recognition, governance, gaming, stakeholder lotteries, and exchange reputation points. I am barely scratching the surface. Others will come up with more creative ideas.

Financial incentives for miners can be replaced by non-financial awards, such as recognition, governance, gaming, stakeholder lotteries, and exchange reputation points. I am barely scratching the surface. Others will come up with more creative ideas.

Last year, at the 2015 MIT Bitcoin Expo, Keynote speaker Andreas Antonopoulos expressed confidence that Bitcoin will survive the sunset of miner incentives. He proposed some novel methods of ongoing validation incentives—most notably, a game theory replacement. Of course, another possibility is the use of very small transaction fees to continue financial incentives.

Personally, I doubt that direct financial incentives—in the form of microcash payments— will be needed. Ultimately, I envision an ecosystem in which everyone who uses Bitcoin to buy, sell, gift, trade, or invest will avoid fees while creating fluidity—by sharing the CPU burden. All users will validate at least one Blockchain transaction for every 5 transactions of their own.

Today, that burden is complex by design, because it reflects increasing competition to find a diminishing cache of unmined coins. But without that competition, the CPU overhead will be trivial. In fact, it seems likely that a validation mechanism could be built into every personal wallet and every mobile device app. The potential for massive crowd-sourced scrutiny has the added benefit of making the blockchain more robust: Trusted, speedy, and resistant to attack.

Transaction Privacy & Anonymity

Bitcoin’s lack of rock-solid, forensic-thwarting anonymity is a weak point that must ultimately be addressed. It’s not about helping criminals, it’s about liberty and freedoms. Detectives & forensic labs have classic methods of pursuing criminals. It is not our job to offer interlopers an identity, serial number and traceable event for every transaction.

Anonymity can come in one of three ways. Method #3 is least desirable:

and earnest but misguided attempts to create a registry of ‘tainted’ coins.

and earnest but misguided attempts to create a registry of ‘tainted’ coins.That’s my opinion on the sunset of mining incentives and on transaction anonymity.

—What’s yours?

* Philip Raymond is co-chair of the Cryptocurrency Standards

Association. He was host and MC for the Bitcoin Event in New York.

I was pointed to this article by Jon Matonis, Founding Director, Bitcoin Foundation. I was sufficiently moved to highlight it here at Lifeboat Foundation, where I am a contributing writer.

On Fungibility, Bitcoin, Monero and ZCash … [backup]

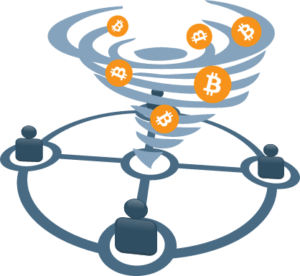

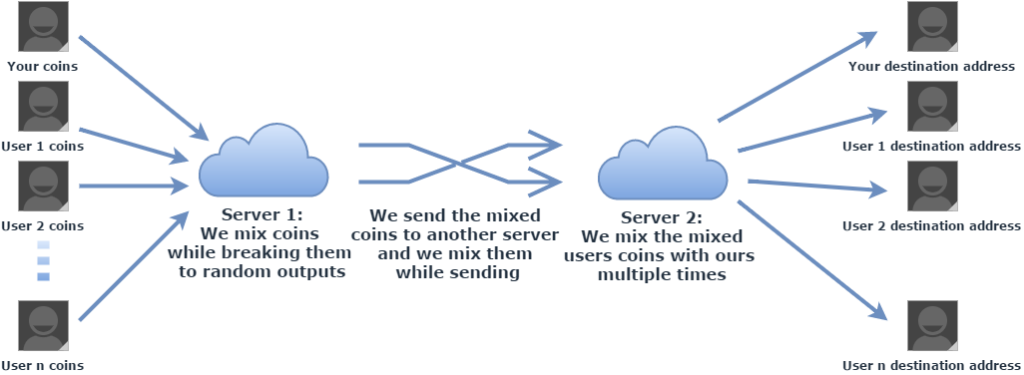

This is among the best general introductions I have come across on traceability and the false illusion of privacy. The explanation of coin mixing provides and excellent, quick & brief overview.

Regarding transaction privacy, a few alt-coins provide enhanced immunity or deniability from forensic analysis. But if your bet is on Bitcoin (as it must be), the future is headed toward super-mixing and wallet trading by desgin and by default. Just as the big email providers haved added secure transit,

Bitcoin will eventually be fully randomized and anonymized per trade and even when assets are idle. It’s not about criminals; it’s about protecting business, government and individuals. It’s about liberty and our freedoms. [Continue below image]

The next section of the article explains the danger of losing fungibility due to transaction tracing and blacklisting. I can see only ONE case for this, and it requires a consensus and a hard fork (preferably a consensus of ALL stakeholders and not just miners). For example, when a great number of Etherium was stolen during the DAO meltdown.

My partner, Manny Perez, and I take opposing views of blacklisting coins based on their ‘tainted’ history (according to “The Man”, of course!). I believe that blacklists must ultimately be rendered moot by ubiquitous mixing, random transaction-circuit delays,  and multiple-transaction ‘washing’ (intentionally invoking a term that legislators and forensic investigators hate)—Manny feels that there should be a “Law and Order” list of tainted coins. Last year, our Pro-&-Con views were published side-by-side in this whitepaper.

and multiple-transaction ‘washing’ (intentionally invoking a term that legislators and forensic investigators hate)—Manny feels that there should be a “Law and Order” list of tainted coins. Last year, our Pro-&-Con views were published side-by-side in this whitepaper.

Finally, for Dogbert’s take on fungible, click here. I bought the domain fungible.net many years ago, and I still haven’t figured out what to do with it. Hence this Dilbert cartoon. smile

____________

Philip Raymond is co-chair of The Cryptocurrency Standards Association.

He also presents on privacy, anonymity, blind signaling & antiforensics.

” … the ECB urged EU lawmakers to tighten proposed new rules on digital currencies such as bitcoin …”

California Space Center (CSC) founder Eva Blaisdell announced in a press release sent to CoinReport the launch of “Copernic,” a blockchain-based, finance-focused rights management system developed for the space industry.

Named after legendary Polish astronomer Copernicus, Copernic will provide the infrastructure for the future space economy and ecosystem to be built upon, said CSC.

After mentioning that Elon Musk, the legendary founder of SpaceX, Tesla and PayPal recently presented plans at the ICA in Guadalajara outlining the next era of space exploration and the first steps towards colonization, the press release went on to say that Copernic was designed to be a platform for the space colonization era. With a system designed to be functional both on Earth and in space, Copernic, said CSC, plans to provide the ecosystem with an effective and transparent platform for the registration of rights and transfer of value.

If the Defense Department is looking to implement blockchain, other organizations may quickly follow suit. Blockchain technology helps guarantee that information has a timestamp and recorded whenever any change happens, ensuring data can be trusted in real time. In DARPA’s case, blockchain technology could help track attempted data breaches.

“Whenever weapons are employed … it tends to be a place where data integrity in general is incredibly important,” Booher said. “So nuclear command and control, satellite command and control, command and control in general, [information integrity] is very important.”

In September, DARPA awarded a $1.8 million contract to computer security firm Galois, asking it to verify a specific type of blockchain technology from a company called Guardtime. If the verification goes well, the military could become one of a growing number of industries and institutions using blockchain to help ensure the security of their operations.

Since they were first theorized by the physicist Richard Feynman in 1982, quantum computers have promised to bring about a new era of computing. It is only relatively recently that theory has translated into significant real-world advances, with the likes of Google, NASA and the CIA working towards building a quantum computer. Computer scientists are now warning that the arrival of the ultra-powerful machines will cripple current encryption methods and as a result bring a close to the great bitcoin experiment—collapsing the technological foundations that bitcoin is built upon.

“Bitcoin is definitely not quantum computer proof,” Andersen Cheng, co-founder of U.K. cybersecurity firm Post Quantum, tells Newsweek. “Bitcoin will expire the very day the first quantum computer appears.”

The danger quantum computers pose to bitcoin, Cheng explains, is in the cryptography surrounding what is known as the public and private keys—a set of numbers used to facilitate transactions. Users of bitcoin have a public key and a private key. In order to receive bitcoin, the recipient shares the public key with the sender, but in order to spend it they need their private key, which only they know. If somebody else is able to learn the private key, they can spend all the bitcoin.