Welcome to Shadow banning.

Have a look.

Reports come in that Google has just released a new core algorithm update and that Google is allegedly censoring bitcoin. This is an auspicious time for censorship.

The choices we make today, and it’s consequences will shape up this decade. Can we break the current pattern, engage with this new financial system and adapt to new realities? #blockchain

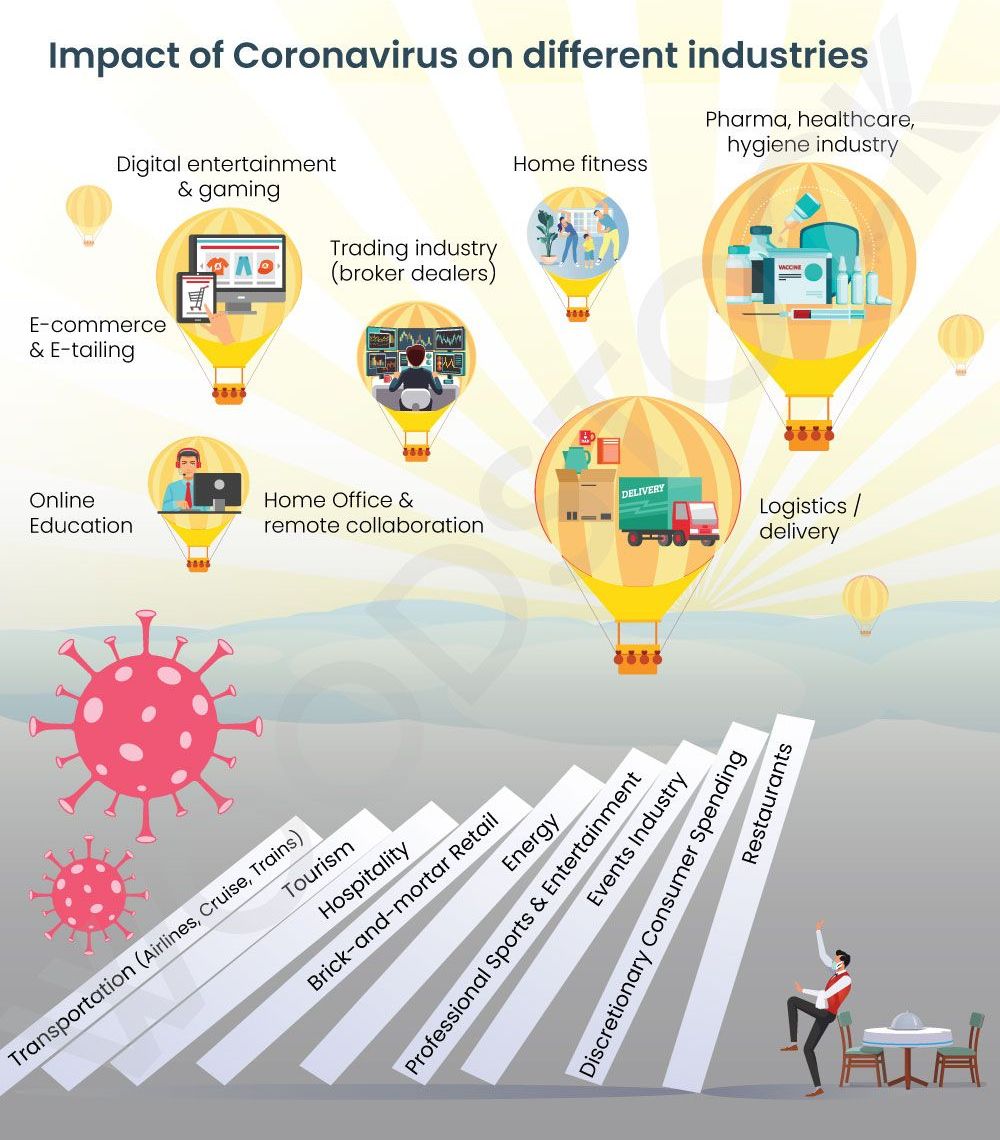

As human beings, we are defined by patterns. Our collective pattern defines society. We are empowered with choices – furthering the patterns, or breaking them or creating new ones. In the physical world, these choices could be social, economic, technological, or ecological. Based on the choices we make – good, bad, or ugly, we enjoy or suffer consequences. COVID-19 escalated the macroeconomic situation leading to liquidity, demand, and supply shocks. Can we break the current pattern and embrace digitization, decentralization and sound money? In turn, making choices that will create affirmative consequences for humanity.

Patterns, Choices & Consequences

On the late evening of 5th July 2004, one of our core team members was driving on Mumbai – Pune highway in a Maruti 800, after an offsite monthly sales review in Mumbai (India). He had to be in Pune for an early morning sales leadership training program. It was getting dark and he was trying his best to get out of Mumbai traffic onto the expressway. Once he reached the expressway, he felt it would be a breeze to get to Pune. This was his usual circuit and he was cruising at about 80 km per hour (not high speed or rash driving by any standards). He was ambitious. Past midway the weather conditions suddenly changed and it started pouring with no visibility beyond two feet. He pushed the accelerator trying to overtake a bus. He hadn’t bothered to check that the tyres were worn out and there was mud sludge on the road. He was ill-prepared and complacent. This lethal combination made his car lose control, spinning and toppling and diving next to a waterlogged canal.

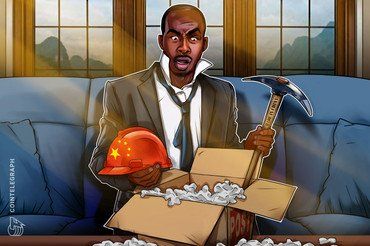

The largest oil field in the People’s Republic of China has been a target for individuals and organizations attempting to mine bitcoins with free electricity. After a bunch of mining farm operators allegedly got caught last summer, a dog kennel owner was recently busted for running cable lines in order to siphon free electricity from China’s Daqing Oil Field. The mining farm owner was arrested, as police found 54 ASIC miners stored in an underground bunker with dog kennels on top making it seem like a legitimate operation.

Electrical costs in China are cheaper than most places around the world, and that is why there is a high concentration of China-based bitcoin mining operations. To this day, it is estimated that more than 60% of today’s bitcoin miners operate in China. On April 26, the regional publication dbw.cn/heilongjiang published a report that explained a bitcoin miner was just arrested for allegedly stealing free electricity from the Daqing Oil Field. The report notes that the mining farm operator got away with the free electricity for months in order to power 54 mining rigs underground.

Further investigation shows that the mining farm owner also operated a K-9 kennel housed with dogs above the bunker. The cover made it seem like he was operating a legitimate business, while he had long cables running into China’s largest oil field. The oil field in Daqing is located between the Songhua river and Nen River. Estimates show that Daqing Oil Field has produced well over 10 billion barrels since the operation started. The man who was busted running cable lines into the oil field is not the only entrepreneur who has tried that specific method. Daqing Oil Field has been a target for many bitcoin mining operators who have attempted to run cables into the plant.

There is an interesting case of a blockchain engineer and a crime in the article.

A district court in China has reportedly ruled that Ethereum’s cryptocurrency is legal property with economic value. This ruling follows a couple of other verdicts on the legality of cryptocurrency, including bitcoin, by various Chinese courts. While cryptocurrency is not legal tender in China, people can hold and transfer them like property.

The Shenzhen Futian District People’s Court in Guangdong Province, China, has ruled that ether is legal property, protected by Chinese law, local media reported last week. This means that the Chinese are not barred from owning or transferring the cryptocurrency, local publication 8btc explained, adding that according to the court ruling:

The crypto assets represented by ETH have economic value and can be traded publicly.

Imagine being able to know when a stock is heading up or going down in the next week and then with the remaining cash you have, you would put all of your money to invest or short that stock. After playing the stock market with the knowledge of whether or not the stock will increase or decrease in value, you might end up a millionaire!

Unfortunately, this is impossible because no one can know the future. However, we can make estimated guesses and informed forecasts based on the information we have in the present and the past regarding any stock. An estimated guess from past movements and patterns in stock price is called Technical Analysis. We can use Technical Analysis (TA)to predict a stock’s price direction, however, this is not 100% accurate. In fact, some traders criticize TA and have said that it is just as effective in predicting the future as Astrology. But there are other traders out there who swear by it and have established long successful trading careers.

In our case, the Neural Network we will be using will utilize TA to help it make informed predictions. The specific Neural Network we will implement is called a Recurrent Neural Network — LSTM. Previously we utilized an RNN to predict Bitcoin prices (see article below):

The crypto market has been able to add on over $20 billion to its total capitalization, with the upswing seen today by Bitcoin and many of its smaller counterparts marking a full erasure of the losses incurred during the mid-March meltdown.

The significance of today’s price action extends far beyond just boosting the market’s technical strength, as it has also revitalized investors – an occurrence indicated by trading volume on crypto exchange Binance hitting a fresh all-time high today.

This comes as the benchmark cryptocurrency’s fundamental undercurrent grows stronger, with the influx of new retail investors into BTC suggesting that there may be a shifting market dynamic that ultimately allows it to continue climbing higher.

New numbers from the digital asset management giant Grayscale show investors are collectively throwing big money into Ethereum for the first time, on top of record investment numbers for Bitcoin.

According to Grayscale’s Q1 2020 report, institutions are taking a serious interest in ETH, enough to print a record quarterly inflow into the Grayscale Ethereum Trust.

Spencer Noon, the head of crypto investments at DTC Capital, says the numbers show Ethereum has reached a turning point with high-net worth investors.

Cool read…hhh.

The emergence of Bitcoin as one of the hottest new investment assets has surprised many who once believed the blockchain-driven cryptocurrency would never have real-world value. It has also generated immense amounts of interest from those who had either never heard of Bitcoin before or who knew relatively little about it. As a result, there are now incredible opportunities for making extra money in the cryptocurrency niche.

In the following article, you’ll find out how to make money with Bitcoin and discover a few of the many different ways to capitalize on the cryptocurrency trend and earn Bitcoin in lots of different ways.

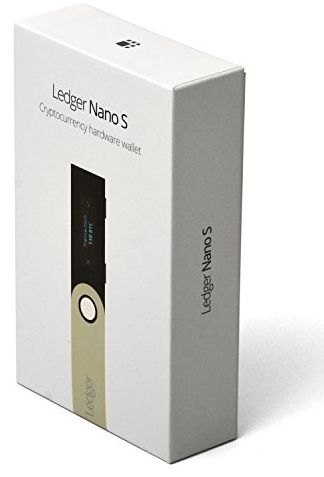

Remember, keeping your bitcoins or altcoins on your exchange wallets is highly insecure. You should never store then on the exchange for longer than is necessary. To make your Bitcoins, LiteCoins or any other crypto currency safe, you will need a hardware wallet like the Ledger Nano S or Trezor.