This Star Wars augmented reality game means the Force can be with you always.

Imagine you and a group of friends are at the peak of a mountain after a long hike. It’s sunset and the sky is alight; you want to take a photo. You pull out your smartphone, but instead of flipping it around to take a long-armed selfie, you unclip a tiny drone from the back of your phone, make it hover at the perfect height and snap a series of photos, no extendo-arms required.

With CES 2018 now in full swing, it’s time to explore what Intel, Samsung, Toyota, and other companies have in store for the future of consumer electronics.

The 2018 Consumer Electronics Show is now in full swing. Between now and Friday, January 12, all kinds of technology — both conceptual and practical — will be unveiled and trotted out in front of audiences. We’ve already written about what you can expect to see from CES 2018, but as day one draws to a close, it’s a good time to check-in on what’s already trending.

WiFi security hasn’t changed much since WPA2 came to be in 2004, and that’s becoming increasingly apparent when public hotspots are frequently risky and glaring exploits are all too common. It’s about to get a long-due upgrade, though: the Wi-Fi Alliance plans to roll out a WPA3 standard that addresses a number of weak points. For many, the highlight will be individualized data encryption. Even if you’re on an open public network, you won’t have to worry quite so much about someone snooping on your data.

You’ll also see safeguards even when people have terrible passwords, and a simplified security process for devices that have either a tiny display or none at all (say, wearable devices or smart home gadgets). And companies or governments that need stricter security will have access to a 192-bit security suite.

WPA3 should arrive sometime in 2018, and comes on the back of other improvements like more thorough testing to catch potential vulnerabilities before they require emergency patches. These initiatives aren’t going to guarantee airtight security when you’re at the coffee shop, but they could at least eliminate some of WiFi’s more worrying flaws.

Tesla has apparently begun manufacturing its solar roof tiles at its Buffalo, New York, factory, according to Reuters. The company is also starting the process of surveying the homes of people who placed a deposit on the tiles last year for installation purposes. We’ve reached out to Tesla for confirmation.

Preorders for the solar roof tiles began back in May; customers paid $1,000 as a deposit on the product, and US installation was supposed to start in the summer of 2017. However, unsurprisingly, the process was delayed. But now, it looks as though most of the kinks have been worked out, and Reuters reports that the roofs will be installed in coming months.

Tesla claims that the solar roof tiles will cost less than a typical roof, around $21.85 per square foot instead of $24.50. The tiles are a solid option if you’re planning on replacing your roof in the next few years, or if you’re considering solar panels. The tiles look like regular shingles; in fact, not every shingle installed is solar, though you can’t distinguish between the two. You can customize what percentage of your roof tiles are solar in their online tool; the max is 70 percent. Obviously, the more solar panels you install, the more expensive your roof is. The company is still taking preorders with $1,000 deposits. You can sign up at their website if you’re so inclined.

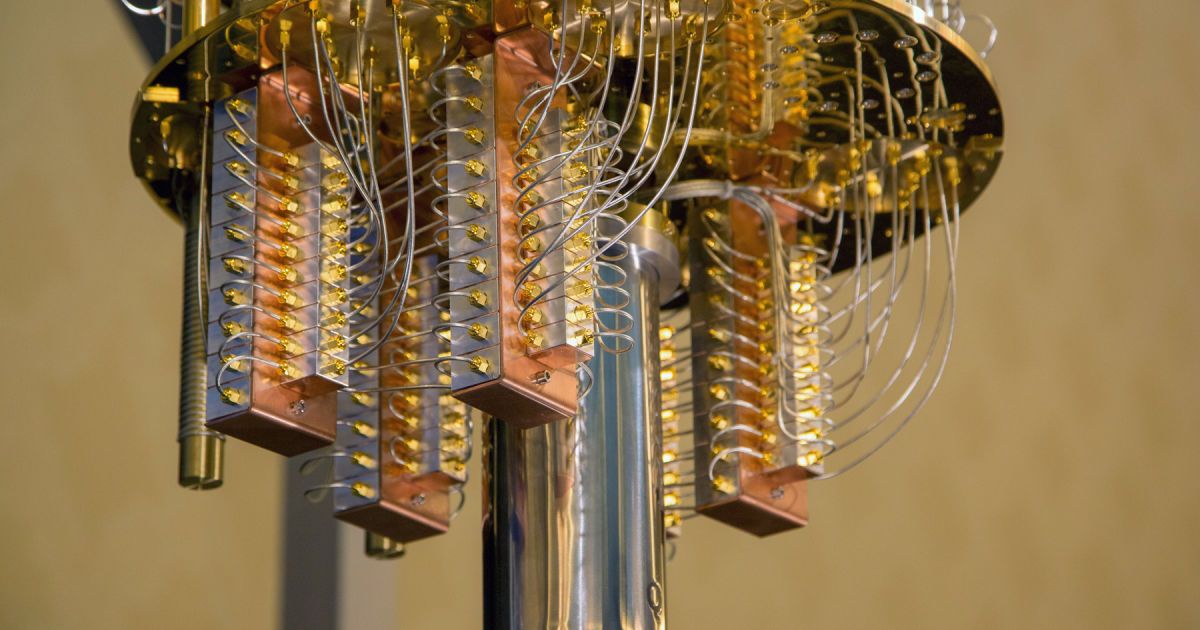

From afar, it looks like a steampunk chandelier. An intricate collection of tubes and wires that culminate in a small steel cylinder at the bottom. It is, in fact, one of the most sophisticated quantum computers ever built. The processor inside has 50 quantum bits, or qubits, that process tasks in a (potentially) revolutionary way. Normally, information is created and stored as a series of ones and zeroes. Qubits can represent both values at the same time (known as superposition), which means a quantum computer can theoretically test the two simultaneously. Add more qubits and this hard-to-believe computational power increases.

Last November, IBM unveiled the world’s first 50-qubit quantum computer. It lives in a laboratory, inside a giant white case, with pumps to keep it cool and some traditional computers to manage the tasks or algorithms being initiated. At CES this year, the company brought the innards — the wires and tubes required to send signals to the chip and keep the system cool — so reporters and attendees could better understand how it works. The biggest challenge, IBM Research Vice President Jeffrey Welser told me, is isolating the chip from unwanted “noise.” This includes electrical, magnetic and thermal noise — just the temperature of the room renders the whole machine useless.

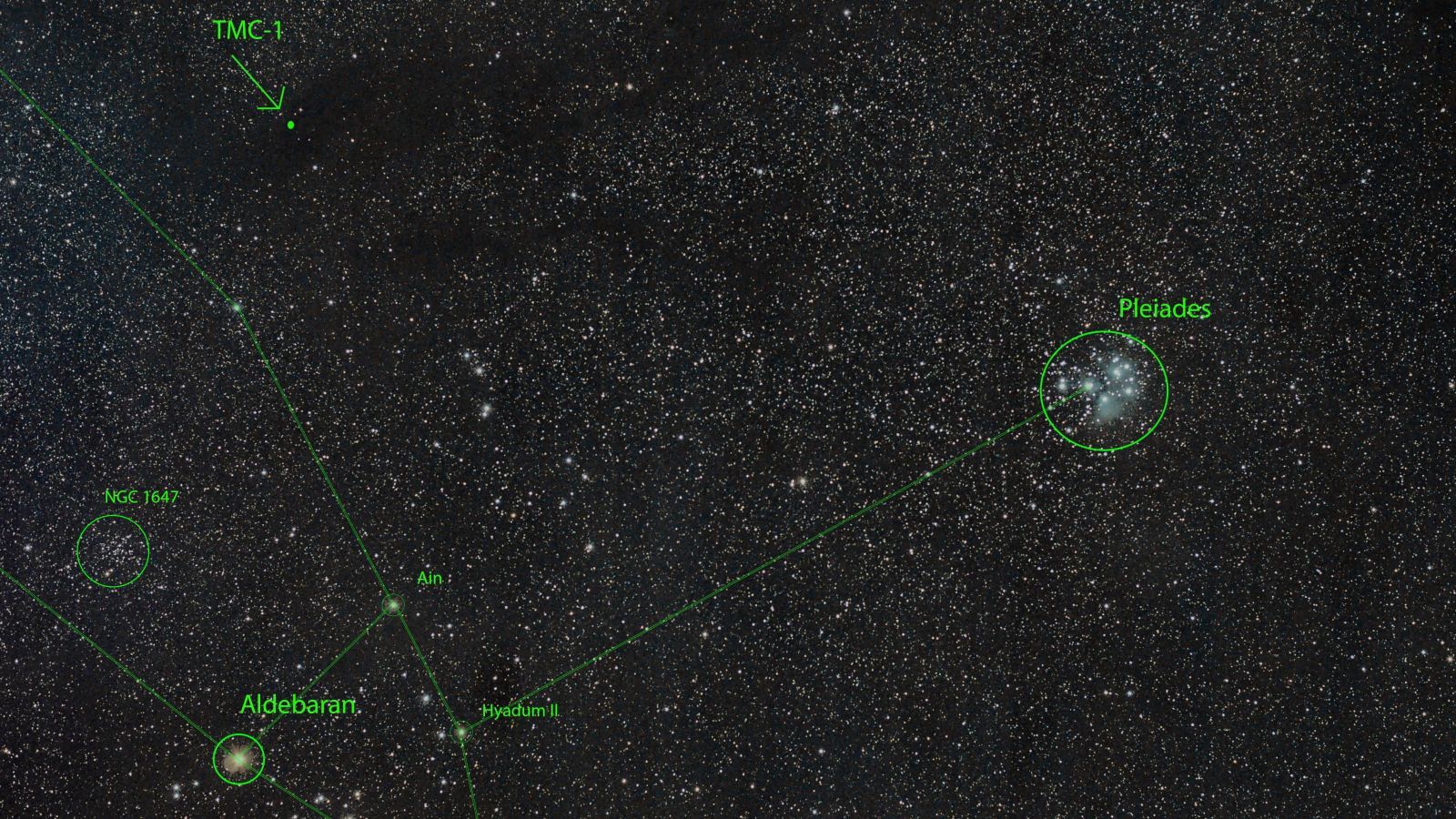

There’s an unidentified source of infrared throughout the universe. By looking at the specific wavelengths of the light, scientists think that come from carbon—but not just any carbon, a special kind where the atoms are arranged in multiple hexagonal rings. No one has been able to spot one of these multi-ring “polycyclic aromatic hydrocarbons,” or PAHs in space—even though the infrared emissions imply that these PAHs should make up 10 percent of the universe’s carbon. Now, scientists have found a new hint.

A team of researchers in the United States and Russia are now reporting spotting a special single-carbon-ring-containing molecule, called benzonitrile, with a radio telescope in a part of space called the Taurus Molecular Cloud-1. Benzonitrile only has one hexagonal ring of carbon, so it’s not a poly cyclic aromatic hydrocarbon itself. But it could be a potential precursor and could help explain the mysterious radiation.

Before you even ask, yes, this “aromatic” benzonitrile molecule has a smell. “I can tell you from personal experience it smells like almonds,” study first author Brett McGuire from the National Radio Astronomy Observatory told Gizmodo, who has encountered the molecule in the lab.

Today, editors at Quora asked me to answer a seemingly simple question:

This is a terrific question, and one that I write about frequently. The question gives me a chance to summarize the key facets of widely mistaken fears. But, here, in the Lifeboat Blog, there is room to elaborate a bit.

In the first phase of cryptocurrency adoption (we are in the midst of this now), there is an abundance of skepticism: Misunderstanding, mistrust, historical comparisons that aren’t comparable, government bans & regulatory proposals—and a lot of questions about intrinsic value, lack of a redemption guaranty, risky open source platforms, tax treatment, etc, etc.

Out of the gate, few individuals and governments paid attention to Bitcoin. That was when it traded under $100. It was complicated to understand, and it seemed to be nothing more than gaming money coveted by nerds and geeks. But with each wave of adoption, or the crash of a major exchange, or the shutdown of Silk Road, public interest has piqued. And, of course, the price of Bitcoin has shot up from nothing to almost $20,000 in the past few years.

It’s natural that governments watch developments closely, and sometimes weigh in with guidance, licensing or regulations. But consider the underlying concerns: Why should governments care about this activity? Is cryptocurrency good for government?

Very often, we hear of government restrictions or “bans” on trading bitcoin. The justification typically hinges on a belief that cryptocurrency leads to bad things:

The first three concerns are patently false and the last three concerns raise an interesting question: Might it benefit a government to surrender control over its own monetary policy? We’ll explore this, below…

Let’s look at each of these fears. I won’t try to analyze or defend each statement below. You can find the justifications throughout Lifeboat.

1. Gradually, governments are coming to recognize that the first three concerns are false. If cryptocurrency gains widespread traction as a payment instrument—or even as cash itself—governments are not weakened in their ability to tax, spend, or enforce tax collection. This myth arises from a lack of education, experience and familiarity.

2. We have seen some spectacular news stories involving very serious criminal activity that accepts bitcoin. In each case, the bad guys were caught—and they were caught because they foolishly accepted bitcoin.

In fact, cash is a far better tool of crime than cryptocurrency. Pre-paid debit cards are even worse.

Bitcoin is not anonymous. It is what cryptographers call pseudo-anonymous. I call it “a fool’s anonymity”! Although Bitcoin allows users to create anonymous wallets, anyone selling drugs or committing a notorious deed can be tracked. A million armchair analysts (anyone who uses and follows Bitcoin), can follow the money trail—through VPNs and mixers—all the way until something is spent in the real world. At some point, someone buys a tennis ball or gets braces for their kid, or buys a book at Amazon. That’s when it all unwinds.

3. Far from cryptocurrency undermining trust in government, it does just the opposite. It demonstrates to citizens that the government shares an obligation to balance its books, just like every individual, corporation, NGO, city or state.

In effect, governments must raise the dollars that they intend to spend. In an emergency, they can borrow, of course, but only if they can find creditors that truly believe in their ability to repay the debt.

This trust yields phenomenal results:

4, 5 and 6: Now, we arrive at the least understood concerns…

#4 and #5 are true. But as we discuss in #3, loss of control over monetary policy is a very different thing than losing control over fiscal policy.

It took decades to discover that decoupling a country from its delivery service and telephone companies resulted in a remarkable boost to industries, services and productivity. Likewise, decoupling a nation from its currency is a really, really good thing. No one can play games, trust is restored. Our kids aren’t born into debt of the nations that purchase our government bonds.

#6 is perhaps the most difficult to accept. Some economists still insist that a small amount of inflation is critical to getting people to spend and invest. But a growing number of experts are discovering that this just isn’t so. Deflation is often associated with unemployment, war, recession and a loss of liquidity and investment. In fact, deflation can be triggered by these things, but when it is the result of a trusted and capped-but-divisible money supply, it doesn’t lead to any of these things.

The concern about people not spending is a linguistic trick. Another way to say the same thing is that a capped money supply encourages people to save for big expenses and for retirement. Since when is that a bad thing?

I have been answering questions about Bitcoin and cryptocurrency since Satoshi was at the helm. Talk to me. Ask about it! Then, think for yourself. Stay engaged.

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He is keynote speaker at the Cryptocurrency Expo in India this month. Click Here to inquire about a presentation or consulting engagement.