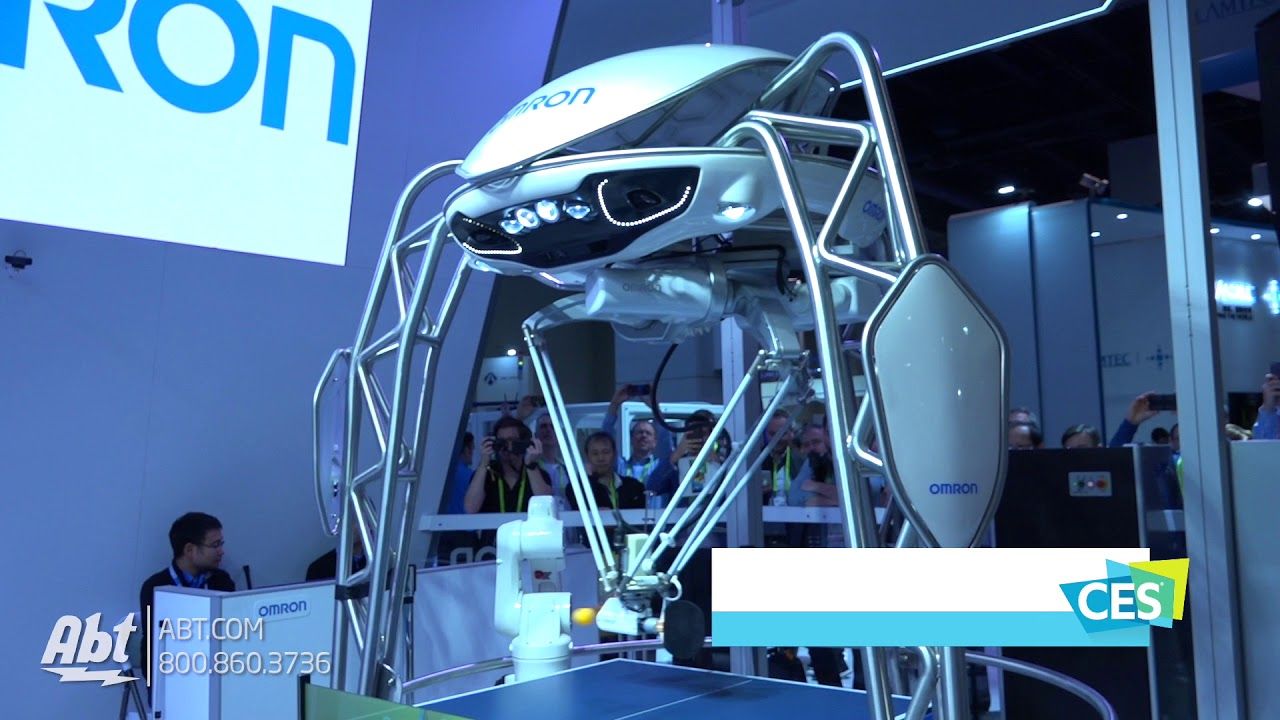

At CES 2018 in Las Vegas, we faced off with Omron’s Forpheus, a robot that learns from your every move and expression, and plays harder as you get better.

As compared to India, other BRICS nations — Brazil, Russia, China and South Africa — had spent more of their GDP on research. Most of the developed countries, in fact, spent more than 2 per cent of their GDP on R&D.

India’s gross research spending has consistently been increasing over the years but the country’s total expenditure on R&D continues to be less than 1 per cent of its gross domestic product (GDP) when other emerging economies, including China and Brazil, invest more money on this head.

Representative image.

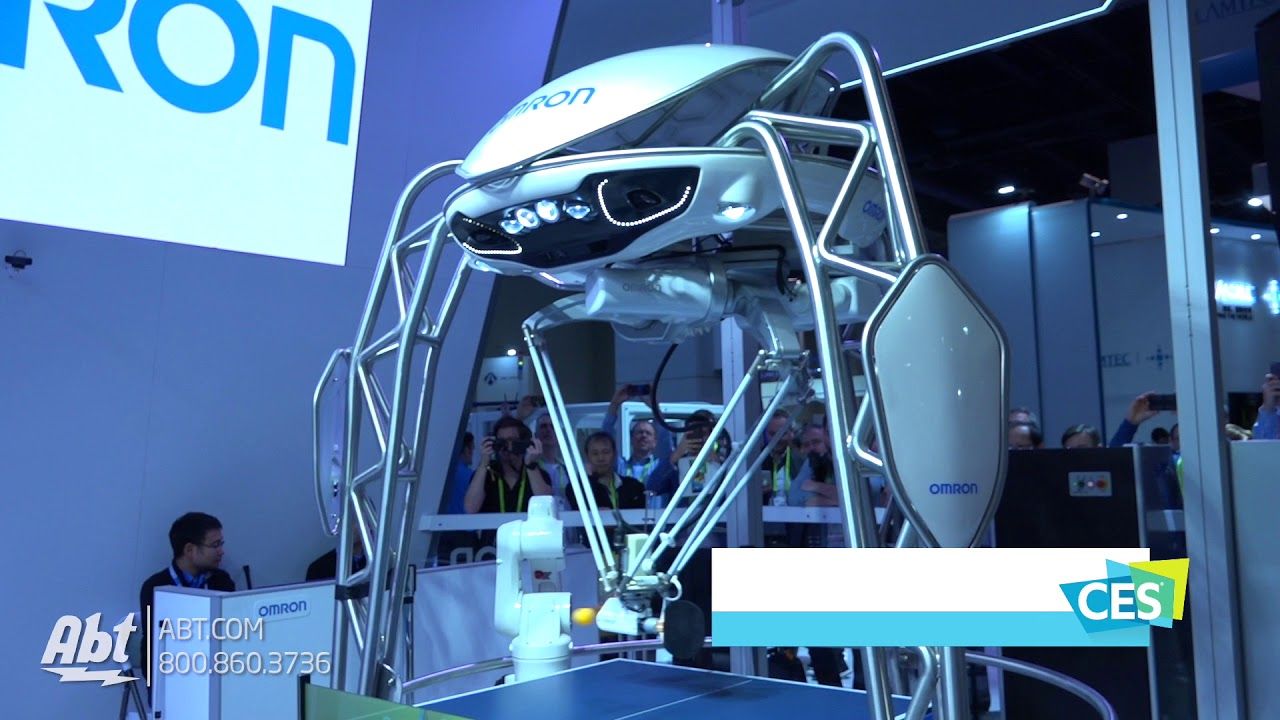

If you are reading this on January 16, 2018, then you are aware that Bitcoin (and the exchange rate of most other coins) fell by 20% today. Whenever I encounter a panic sell-off, the first thing that I do is try to ascertain if the fear that sparked the drop is rational.

But what is rational fear? How can you tell if this is the beginning of the end, or simply a transient dip? In my book, rational fears are fundamental facts like these:

Conspicuously missing from this list is “government bans” or any regulation that is unenforceable, because it fails to account for the design of what it attempts to regulate. Taxes, accounting guidelines, reporting regulations are all fine! These can be enforced. But banning something that cannot be banned is not a valid reason for instilling fear in those who have a stake in a new product, process, or technology.

Rule of Acquisition #1:

Drops triggered by false fears present buying opportunities

At times like this, you must make a choice: If you can’t afford to stay in the market and risk a bigger drop, then cash out and live with it. But if you believe in crypto and the potential for a digital future that dis-intermediates your earning, spending and savings, then this drop in dollar value presents opportunity.

At times like this, you must make a choice: If you can’t afford to stay in the market and risk a bigger drop, then cash out and live with it. But if you believe in crypto and the potential for a digital future that dis-intermediates your earning, spending and savings, then this drop in dollar value presents opportunity.

This downturn will pass, because the cryptocurrency fundamentals have not changed or been undermined by recent events. There is no new technical flaw or hack. The potential for cash transactions and future applications get rosier every day (let’s assume that Bitcoin will finally add Lightning Network and that miners will stop fighting with developers)*

The current 20% drop is not a big deal. It takes us back to an exchange rate that we saw just one month ago in early December. It was triggered by saber rattling in South Korea. But, let’s face it: Governments have as much influence over trading or spending cryptocurrency as they do over the mating of squirrels in your backyard. Do you think fewer squirrels would mate, if the government banned them from mating?

If you can answer that question—and if you can afford to stay in the game—then relax. 1 BTC has the same value today as it had yesterday and the day before. It is worth exactly one bitcoin. The current dip in exchange rate with other currencies was sparked by fear; and that fear is misguided or irrational.

[click below for perspective]…

* Bitcoin has a serious limitation in transaction throughput and transaction cost. The problem is serious and it frustrates users, developers, miners and vendors. But it is not new, and the consensus about its likelihood of being corrected has not suddenly changed. These limitations are unrelated to today’s large drop in exchange value.

Philip Raymond co-chairs CRYPSA, publishes A Wild Duck and hosts the New York Bitcoin Event. He is keynote speaker at the Cryptocurrency Expo in India this month. Click Here to inquire about a presentation or consulting engagement.

A look back at the most popular life extension articles of 2017. Here is the report “Can We Live To 120 On the Blood Of Teens?”

Parabiosis is back in the spotlight. The latest news reports that scientists have discovered the previously hidden rejuvenating factors in young blood.

Young blood seems to have healing powers, but how can we get benefit from them without relying on donors?

Newly published research shows that scientists may have found one of the hidden factors in the blood that are responsible its rejuvenating effects.

A look back at the most popular life extension articles of 2017. Here is the report Can We Live to 120 on the Fasting Mimicking Diet or Calorie Restriction?

Summary: The Fasting Mimicking Diet, also called the Valter Longo diet, and the spartan practice of calorie restriction are the twin subjects of two recent research reports. Both research reports show that the fasting regimens offer potential health benefits. This article includes commentary by the inventor of the Fasting Mimicking Diet, Valter Longo. [Cover Photo: Ryan McGuire.]

The idea that animals can live longer, healthier lives by drastically reducing their calorie intake is not exactly new. Scientists have repeatedly demonstrated the life-extending value of calorie restriction (CR) in animals from worms to monkeys—with the implication that the same might be true for humans.

In fact, geroscientists consider CR as one of the most effective ways to extend lifespan. Our metabolism slows down as we age, due to a phenomenon called deregulated nutrient sensing. This metabolic change contributes to a host of age-related diseases.

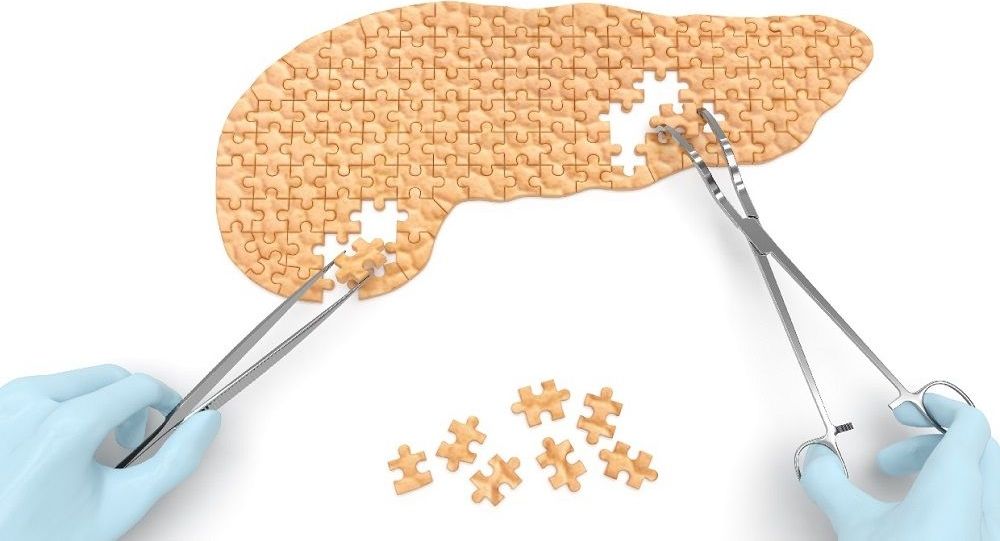

Pancreas in a box is currently in first clinical trial in patients with type 1 diabetes and contains beta cells grown from stem cells.

The pancreas in a box contains beta cells grown from stem cells and is currently in its first-ever clinical trial in patients with type 1 diabetes. Geroscientists are hopeful that a replacement pancreas grown from stem cells will be much healthier than insulin injections, and are working on pure stem cell-based treatments. [Editor’s note: the article has been updated on 10/19/2017 and the title changed.]

Experts once thought that developing and testing an effective stem cell treatment for diabetes would take years.

Due to a recent discovery, a cure may closer than we think.