Researchers at Sapience.org foresee market instability intensifying by the computer trading ‘arms race’

FOR IMMEDIATE RELEASE

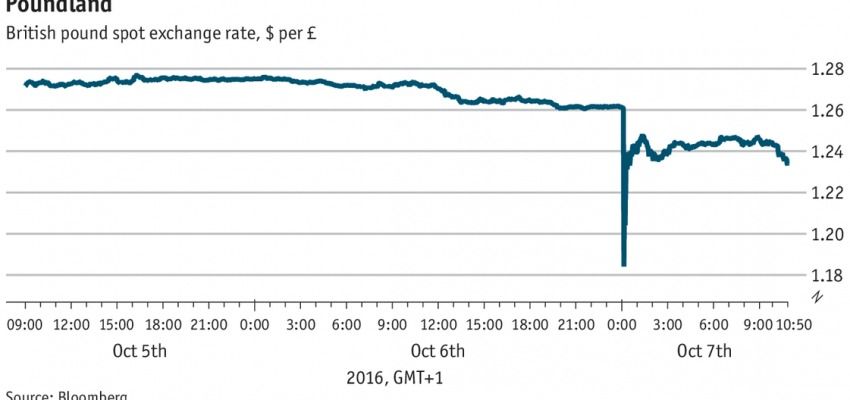

Last Friday the sterling has experienced a dramatic, ultrafast crash. It lost 10% of its value in minutes after the Asian markets opened — a decline usually reserved to declarations of war, major earthquakes and global catastrophes — and bounced right back. Although the affected exchanges are yet to release the details, computer trading algorithms almost certainly played a key role. Just like the 2010 Flash Crash, yesterday’s event is characteristic to Ultrafast Extreme Events[1]: split-second spikes in trade caused by ever smarter algorithms razor-focused on making ever-quicker profits. But the arms race is only likely to intensify as computing speed accelerates and AI algorithms become more intelligent.