“In October, the commercial giant teamed up with IBM and Tsinghua University in Beijing to track pork in China as it moves from the farm to the shelves.”

“In October, the commercial giant teamed up with IBM and Tsinghua University in Beijing to track pork in China as it moves from the farm to the shelves.”

“One of the most interesting questions to me is whether we can figure out how to implement a proof of stake consensus mechanism in a large decentralized trustless public blockchain (ie Bitcoin, Ethereum, etc).”

“I haven’t placed a vote on a blockchain yet, but it’s so simple to do that I expect I will be doing it frequently soon enough.”

By now, most Bitcoin and Blockchain enthusiasts are aware of four looming issues that threaten the conversion of Bitcoin from an instrument of academics, criminal activity, and closed circle communities into a broader instrument that is fungible, private, stable, ubiquitous and recognized as a currency—and not just an investment unit or a transaction instrument.

These are the elephants in the room:

As an Op-Ed pundit, I value original content. But the article, below, on Bitcoin fungibility, and this one on the post-incentive era, are a well-deserved nod to inspired thinking by other writers on issues that loom over the cryptocurrency community.

This article at Coinidol comes from an unlikely source: Jacob Okonya is a graduate student in Uganda. He is highly articulate, has a keen sense of market economics and the evolution of technology adoption. He is also a quick study and a budding columnist.

What Happens When Bitcoin Mining Rewards Diminish To Zero?

Jacob addresses this last issue with clarity and focus. I urge Wild Ducks to read it. My response, below touches on both issues 3 and 4 in the impromptu list, above.

Sunset mining incentives—and also the absence of supporting fully anonymous transactions—are two serious deficiencies in Bitcoin today.

I am confident that both shortcomings will be successfully addressed and resolved.

Thoughts about Issues #3 and #4: [Disclosure] I sit on the board at CRYPSA and draft whitepapers and position statements.*

Blockchain Building: Dwindling Incentives

Financial incentives for miners can be replaced by non-financial awards, such as recognition, governance, gaming, stakeholder lotteries, and exchange reputation points. I am barely scratching the surface. Others will come up with more creative ideas.

Financial incentives for miners can be replaced by non-financial awards, such as recognition, governance, gaming, stakeholder lotteries, and exchange reputation points. I am barely scratching the surface. Others will come up with more creative ideas.

Last year, at the 2015 MIT Bitcoin Expo, Keynote speaker Andreas Antonopoulos expressed confidence that Bitcoin will survive the sunset of miner incentives. He proposed some novel methods of ongoing validation incentives—most notably, a game theory replacement. Of course, another possibility is the use of very small transaction fees to continue financial incentives.

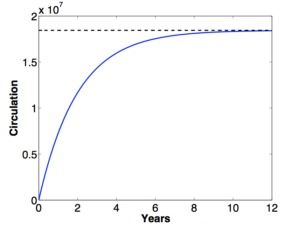

Personally, I doubt that direct financial incentives—in the form of microcash payments— will be needed. Ultimately, I envision an ecosystem in which everyone who uses Bitcoin to buy, sell, gift, trade, or invest will avoid fees while creating fluidity—by sharing the CPU burden. All users will validate at least one Blockchain transaction for every 5 transactions of their own.

Today, that burden is complex by design, because it reflects increasing competition to find a diminishing cache of unmined coins. But without that competition, the CPU overhead will be trivial. In fact, it seems likely that a validation mechanism could be built into every personal wallet and every mobile device app. The potential for massive crowd-sourced scrutiny has the added benefit of making the blockchain more robust: Trusted, speedy, and resistant to attack.

Transaction Privacy & Anonymity

Bitcoin’s lack of rock-solid, forensic-thwarting anonymity is a weak point that must ultimately be addressed. It’s not about helping criminals, it’s about liberty and freedoms. Detectives & forensic labs have classic methods of pursuing criminals. It is not our job to offer interlopers an identity, serial number and traceable event for every transaction.

Anonymity can come in one of three ways. Method #3 is least desirable:

and earnest but misguided attempts to create a registry of ‘tainted’ coins.

and earnest but misguided attempts to create a registry of ‘tainted’ coins.That’s my opinion on the sunset of mining incentives and on transaction anonymity.

—What’s yours?

* Philip Raymond is co-chair of the Cryptocurrency Standards

Association. He was host and MC for the Bitcoin Event in New York.

I was a guest on the Robot Overlordz podcast again recently, and was asked about my post on Medium for KnowledgeWorks called “Preparing for Hybrid Schools and Jobs.” The conversation with Mike and Matt took some interesting turns, as always, and they got me thinking about some really important questions when it comes to blockchain and society, namely: assuming blockchain lives up to it’s reputation as a ‘truth machine,’ as I refer to it in my post, or a ‘revolution,’ as the Tapscotts say, why is there now a need for a revolutionary technology to enhance trust?

Although blockchain has captured the attention of the financial, management consulting and consumer goods industries, it hasn’t quite taken hold in education yet. KnowledgeWorks has published a fantastic report on the possibilities. I suggest in my post that the rise of hybrid jobs will generate support for hybrid schooling, and blockchain may be the technology that is best suited to track and communicate qualifications. The World Economic Forum said it best: “Farewell Job Title, Hello Skill Set.” If we are to be evaluated on our skills and experience, we must have some reliable way of guarding and transmitting that information.

But why is it that we need to enhance trust among students and teachers, employees and employers? I think that the facts that college students (some who didn’t even graduate) owe massive student loans, though worker’s wages have gone stagnant, play into this tension. How can students trust schools to provide the education they need, considering the high cost and the gamble that it may never really be recouped?

We are beginning to see slight signals that things are changing, at least a little, on the remuneration side, and it’s possible that a truth machine could help restore trust to hierarchical relationships (student/university and employee/employer) that are extremely out of balance. But what is at risk in assuming a technology can reverse human corruption?

Last week I dipped my toes in the waters of the Lifeboat blog and shared a link about blockchain technology. If you haven’t heard about blockchain technology yet, you can read about it here, here, here, here, here…you get the picture. Blockchain has tons of potential, and appears to also attract hype and money. All which goes to say, there has been a lot of buzz about its social and economic potential. But there is another aspect of blockchain that deserves some futurist exploration, which is that it signals we live in Postnormal Times.

Postnormal Times (PNT) is a fantastic foresight concept that I will focus on in my upcoming Lifeboat posts. There is an underlying theory to it; Ziauddin Sardar explains the entire idea and how it fits into futures studies. Ziauddin Sardar with John Sweeney have expanded the work into a futurist method called The Three Tomorrows of Postnormal Times. It’s well worth reading up on if you enjoy a futurist approach to your work and studies.

I’m still a beginner, but essentially the idea is that we are now in time is a period best characterized as “postnormal,” meaning that the usual ways of solving problems and making progress have stopped working. Our go-to responses, based on all the previously reliable ways of being in and understanding the world are becoming irrelevant and dysfunctional. The simplest way to introduce Sardar’s concept is the three C’s: complexity, chaos and contradictions. These are the key characteristics of postnormal times which I will be exploring in my posts about technology and humanity. I believe the PNT perspective leads to some useful observations about the direction of society over the next decades.

Back to my blockchain example: the Raketa watch company is implementing blockchain in manufacturing, which will protect inventory from counterfeiting. This development signals PNT because it speaks to the complexity of globalized financial and consumer markets. In this case, so intricate as to require a new, high-tech, largely automated and seemingly fail-proof technology. PNT is evident when previous methods of running a company are no longer sound. Enter blockchain to navigate this new business condition.

The PNT characteristic of chaos is also present—the networks of users necessary to have a blockchain at all is a network that behaves as a chaotic system, one that seeks a common goal of verifying blocks in the chain (see links above for more detail on how blockchain works, or read /listen to our chapter in The Future of Business ). Sardar suggests that in PNT terms, all networks are chaos: “Since everything is linked up and networked with everything else, a break down anywhere has a knock on effect, unsettling other parts of the network, even bringing down the whole network.” This is an apt characterization of blockchain technology and why it makes a great counterfeit-detection system.

And, of course, the contradictions of blockchain technology are undoubtedly many, but as we discussed in our chapter in The Future of Business, there is an insistence by its supporters that blockchain is a pure and corruption-free alternative to banks, judges, legal systems and all sorts of oppressive authorities while the truth about blockchain’s origins (i.e. the identity of its inventor, Satoshi Nakamoto ) remain elusive. That’s hardly the most important aspect of the technology’s potential, but it is one of the more intriguing aspects, and something that keeps it firmly in “postnormal” territory.

I hope to explore many more examples of Postnormal Times on this blog.

Anyone who has heard of Bitcoin knows that it is built on a mechanism called The Blockchain. Most of us who follow the topic are also aware that Bitcoin and the blockchain were unveiled—together—in a whitepaper by a mysterious developer, under the pseudonym Satoshi Nakamoto.

That was eight years ago. Bitcoin is still the granddaddy of all blockchain-based networks, and most of the others deal with alternate payment coins of one type or another. Since Bitcoin is king, the others are collectively referred to as ‘Altcoins’.

But the blockchain can power so much more than coins and payments. And so—as you might expect—investors are paying lots of attention to blockchain startups or blockchain integration into existing services. Not just for payments, but for everything under the sun.

Think of Bitcoin as a product and the blockchain as a clever network architecture that enables Bitcoin and a great many future products and institutions to do more things—or to do these things better, cheaper, more robust and more secure than products and institutions built upon legacy architectures.

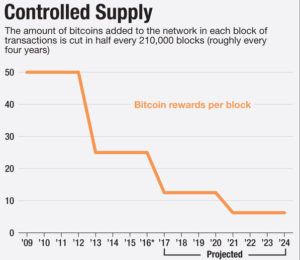

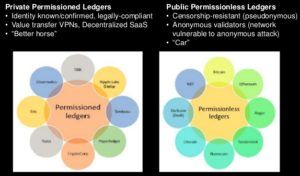

When blockchain developers talk about permissionless, peer-to-peer ledgers, or decentralized trust, or mining and “the halving event”, eyes glaze over. That’s not surprising. These things refer to advantages and minutiae in abstract ways, using a lexicon of the art. But—for many—they don’t sum up the benefits or provide a simple listing of products that can be improved, and how they will be better.

I am often asked “What can the Blockchain be used for—other than digital currency?” It may surprise some readers to learn that the blockchain is already redefining the way we do banking and accounting, voting, land deeds and property registration, health care proxies, genetic research, copyright & patents, ticket sales, and many proof-of-work platforms. All of these things existed in the past, but they are about to serve society better because of the blockchain. And this impromptu list barely scratches the surface.

I address the question of non-coin blockchain applications in other articles. But today, I will focus on a subtle but important tangent. I call it “A blockchain in name only”…

Question: Can a blockchain be a blockchain if it is controlled by the issuing authority? That is, can we admire the purpose and utility, if it was released in a fashion that is not is open-source, fully distributed—and permissionless to all users and data originators?

Answer: Unmask the Charlatans

Many of the blockchains gaining attention from users and investors are “blockchains” in name only. So, what makes a blockchain a blockchain?

Everyone knows that it entails distributed storage of a transaction ledger. But this fact alone could be handled by a geographically redundant, cloud storage service. The really beneficial magic relies on other traits. Each one applies to Bitcoin, which is the original blockchain implementation:

▪Open-source

▪Open-source

▪Fully distributed among all users.

▪ Any user can also be a node to the ledger

▪Permissionless to all users and data originators

▪Access from anywhere data is generated or analyzed

A blockchain designed and used within Santander Bank, the US Post Office, or even MasterCard might be a nifty tool to increase internal redundancy or immunity from hackers. These potential benefits over the legacy mechanism are barely worth mentioning. But if a blockchain pretender lacks the golden facets listed above, then it lacks the critical and noteworthy benefits that make it a hot topic at the dinner table and in the boardroom of VCs that understand what they are investing in.

Some venture financiers realize this, of course. But, I wonder how many Wall Street pundits stay laser-focused on what makes a blockchain special, and know how to ascertain which ventures have a leg up in their implementations.

Perhaps more interesting and insipid is that even for users and investors who are versed in this radical and significant new methodology—and even for me—there is a subtle bias to assume a need for some overseer; a nexus; a trusted party.  After all, doesn’t there have to be someone who authenticates a transaction, guarantees redemption, or at least someone who enforces a level playing field?

After all, doesn’t there have to be someone who authenticates a transaction, guarantees redemption, or at least someone who enforces a level playing field?

That bias comes from our tendency to revert to a comfort zone. We are comfortable with certain trusted institutions and we feel assured when they validate or guarantee a process that involves value or financial risk, especially when we deal with strangers. A reputable intermediary is one solution to the problem of trust. It’s natural to look for one.

So, back to the question. True or False?…

In a complex value exchange with strangers and at a distance, there must be someone or some institution who authenticates a transaction, guarantees redemption, or at least enforces the rules of engagement (a contract arbiter).

Absolutely False!

No one sits at the middle of a blockchain transaction, nor does any institution guarantee the value exchange. Instead, trust is conveyed by math and by the number of eyeballs. Each transaction is personal and validation is crowd-sourced. More importantly, with a dispersed, permissionless and popular blockchain, transactions are more provably accurate, more robust, and more immune from hacking or government interference.

What about the protections that are commonly associated with a bank-brokered transaction? (For example: right of rescission, right to return a product and get a refund, a shipping guaranty, etc). These can be built into a blockchain transaction. That’s what the Cryptocurrency Standards Association is working on right now. Their standards and practices are completely voluntary. Any missing protection that might be expected by one party or the other is easily revealed during the exchange set up.

For complex or high value transactions, some of the added protections involve a trusted authority.  But not the transaction itself. (Ah-hah!). These outside authorities only become involved (and only tax the system), when there is a dispute.

But not the transaction itself. (Ah-hah!). These outside authorities only become involved (and only tax the system), when there is a dispute.

Sure! The architecture must be continuously tested and verified—and Yes: Mechanisms facilitating updates and scalability need organizational protocol—perhaps even a hierarchy. Bitcoin is a great example of this. With ongoing growing pains, we are still figuring out how to manage disputes among the small percentage of users who seek to guide network evolution.

But, without a network that is fully distributed among its users as well as permissionless, open-source and readily accessible, a blockchain becomes a blockchain in name only. It bestows few benefits to its creator, none to its users—certainly none of the dramatic perks that have generated media buzz from the day Satoshi hit the headlines.

Related:

Philip Raymond is co-chair of The Cryptocurrency Standards Association,

host & MC for The Bitcoin Event and editor at A Wild Duck.

Steve Forbes sits across Brian Singer, a partner at William Blair, as Blair explains the potential of blockhain encryption to empower individuals. He also explains why credit card companies are beginning to embrace a technology that undermines their high fees.

Here in the Lifeboat Blog, I have the luxury of pontificating on existential, scientific and technical topics that beg for an audience—and sometimes—a pithy opinion. Regular Lifeboat readers know that I was recently named most viewed Bitcoin writer at Quora under a Nom de Plume.

Quora is not a typical Blog. It is an educational site. Questions and numerous answers form the basis of a crowd-sourced popularity contest. Readers can direct questions to specific experts or armchair analysts. A voting algorithm leads to the emergence of some very knowledgeable answers, even among laypersons and ‘armchair’ experts.

During the past few weeks, Quora readers asked me a litany of queries about Bitcoin and the blockchain, and so I am sharing selected Q&A here at Lifeboat. This is my professional field—and so, just as with Mr. Trump, I must resist an urge to be verbose or bombastic. My answers are not the shortest, but they are compact. Some employ metaphors, but they explain complex ideas across a broad audience.

As you browse some recent Bitcoin questions below, click a question for which you know the least. (Example: Do you know what the coming ‘halving event’ is about?). Leave a comment or question. I am interested in your opinion.

Philip Raymond sits on Lifeboat’s New Money Systems Board, is co-chair of the

The Cryptocurrency Standards Association, and is a most viewed writer at Quora.

“Major financial institutions like some technical features of Bitcoin but are building their own versions that leave out the digital cash and built-in economics.”