The Future of Spage-Age Management, Today! by Mr. Andres Agostini at http://lnkd.in/d7zExFi

This is an excerpt from the conclusion section o, “…The Future of Spage-Age Management, Today!..,” that discusses some management strategies. To read the entire piece, just click the link at the end of article:

BEGINNING OF EXCERPT.

Mr. David Shaw’s question, “…Andres, from your work on the future which management skills need to be developed? Classically the management role is about planning, organizing, leading and controlling. With the changes coming in the future what’s your view on how this management mix needs to change and adapt?…” This question was posited on an Internet Forum, formulated by Mr. David Shaw (Peterborough, United Kingdom) at http://lnkd.in/ba6xX-K on October 09, 2013.

This P.O.V. addresses practical and structural solutions, not onerous quick fixes. THIS P.O.V. WILL BE COMMUNICATED UNAMBIGUOUSLY AND EMPHATICALLY.

For instance, Stuart A. Copans asserted, “…Study the past if you would divine the future…” And Edmund Burke pointed out, “…You can never plan the future by the past…”

To set the stage properly, I will start with an enlightening quote by Albert Einstein.

“…The significant problems we face cannot be solved at the same level of thinking we were at when we created them…”

Or, it could be better noted:

“…The significant problems we face [today] cannot be solved [in the future] at the same level of thinking we were at when we created them [in the past]…”

One other thing that must now be considered is a primordial axiom that is instrumental and widely considered here. That is, “…everything is related to everything else…”

Working with the second largest oil group in the world (PDVSA, with 54,000 active employees. PDVSA is Citgo’s parent company), that group wanted me to only institute beyond-insurance risk management.

You see, when they were to incur in a loss (potential disruption), it did not suffice to them to have the indemnity payment from the insurance and reinsurance pool.

On January 1982 I officially started serious thinking about “…beyond-insurance risk management…” And since then all the way throughout this date. Conversely, insurance-based risk management is the old guard while beyond-insurance risk management is the vanguard.

Many experts and even scientists and futurists speak about empirical management with the sole perspective of unimplemented theoretical notions (that is, with too many unanswered questions and unlearned lessons). BUT THE MATTER IS, HAVE THEY REALLY EXERCISED THE ACTUAL RESPONSIBILITY OF DIRECTLY MANAGING A LARGE, GLOBAL ENTERPRISE SUCCESSFULLY? WHAT EXACTLY IS THE APPLIED EXPERIENCE IN THE FIELD THAT THEY POSSES?

QUESTION: What PRECISELY have said scientists and futurists directly manage in the practical theater of operations? How, in the world, can they speak with grounds about practical management solutions? What are the accurate details of their proven track record? Really?

QUESTION: In all truth, What are their applied methodologies?

Let’s see an example of a large misconception now.

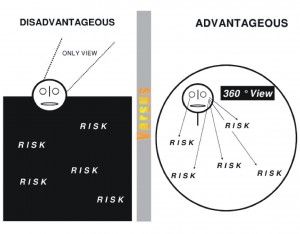

A West-Coast Futurist states that organizations and people must have “…the capacity to adapt and learn now how to prepare for risks…” According to him, How exactly does one institute his futuristic “…risk management…”? Then, he suggests that a) Risk Monitoring, b) Risk Analysis, c) Risk Sensing and d) Risk Management are a function of Strategic Risk Forecasting. Indeed!

My long professional and practical experience in the fields of applied management, corporate planning and risk management consultation, strategy and associated services with major organizations and corporations extends to more than thirty years.

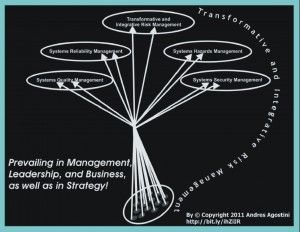

I have instituted all-encompassing beyond-insurance risk management (TAIRM) to more than a dozen of global institutions of unparallelled reputation hereunder.

That is, I have over thirty year of proven, practical “…beyond-insurance risk management…” experience.

Many of these institutions, including the WorldBank, have issued either written evidence or letter of references of the services provided.

Whenever I speak hereby about how I practice “…risk management…”, I will only be referring to scientifically-driven beyond-insurance risk management and never ever be referring to financially-driven risk management.

“…Management of Risk and Insurance…” does not ever equate to beyond-insurance risk management.

It is now important to assert that “…COSO Risk Management…” and “…Enterprise Risk Management…” are never beyond-insurance risk management.

“…Management of Captive Insurance Companies…” does not ever equate to beyond-insurance risk management.

“…‘Risk Management’ (so-called) by Insurance and Reinsurance Brokers…” does not ever equate to beyond-insurance risk management.

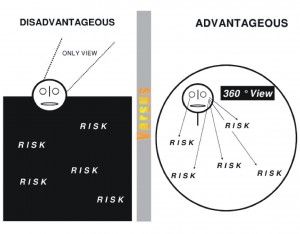

Under the financial focus, institutional and corporate firms “…transfer risks…” (so called) to insurance and reinsurance companies (suboptimal or ineffectual choice).

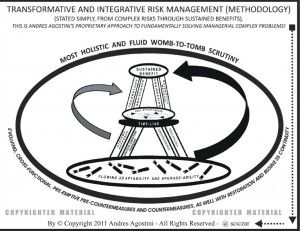

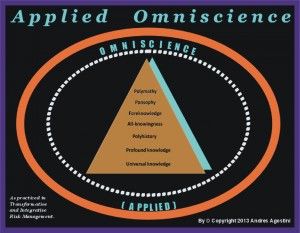

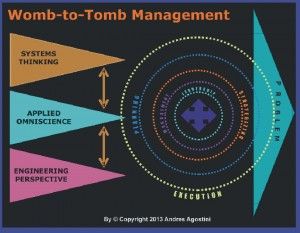

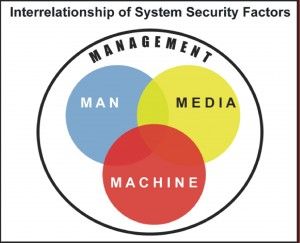

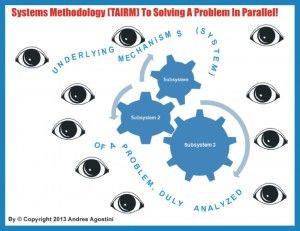

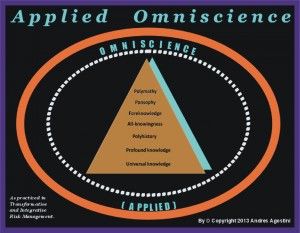

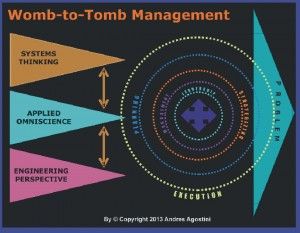

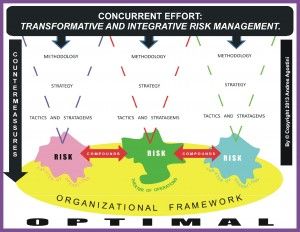

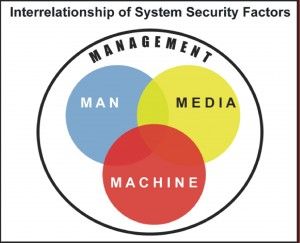

Under the TAIRM focus, institutional and corporate firms manage risks optimally through the systems approach with the applied omniscience perspective (optimal decision).

The word “…system…” is here used in its ample meaning and does not hereby refer to computer systems.

Receiving indemnity payments was observed as insidious mediocrity by this petroleum group. After all, one must realize that they are not a primarily financial system “player” but an institutional incumbent mostly exercising ownership and profit of fixed assets (organically). Obviously, the financial aspects and those of their liquid assets were also important to them.

The high-raking executives of most of these global institutions know that insurance and reinsurance companies have rampant financial ambitions as if they were investment banks.

And, as a consequence, many of them displace (divert) the legally-stipulated “premium reserves” (financial provisions to indemnify the losses to insureds and reinsureds) in order to seize additional and unlawful gains out of said reserves.

These insurance and reinsurance companies do the prior by financially reengineering the allocated portions of the premiums designated to pay for covered losses.

As many insurance and reinsurance companies doctor and manipulate the sacred premium reserves, they make extraordinary and illegitimate earnings while loosing great solvency and their ultimate ability to indemnify duly covered losses.

Most insurance and reinsurance companies view themselves as enjoying blood-related “family relationships” with banks, stock market firms and many other private “players” within the financial system.

Global corporations do not want their corporate insurance policies to be subjected to outright malfeasance and other ups and downs (whether systemic or not) by any “agent” of the financial system, chiefly the insurance and reinsurance companies.

Consequently, management by insurance and reinsurance companies is never beyond-insurance risk management.

Thus, it was insidious mediocrity because this petroleum group’s executives strongly believed that these risks can be stopped before morphing into losses (disruption potentials) if a previous appropriate work was previously designed and in place.

As many governmental agencies and other prominent global corporations, PDVSA did not want a “…financial system…”-driven risk management option. All of these institutions wanted a central and on-site solution through systems approach with the applied omniscience perspective.

Yes, by law and in general, you still need “worker’s compensation,” “directors and officers,” “kidnap and ransom,” “legal expenses,” “product liability” and “life insurance.”

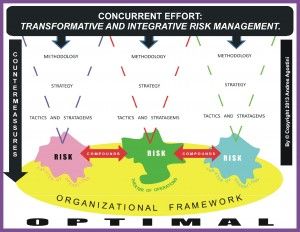

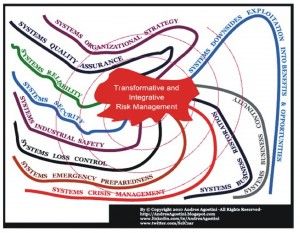

BUT IN ORGANIZATIONAL AND BUSINESS SETTINGS, “…Transformative and Integrative Risk Management…” (explained below) turns corporate and institutional insurance irrelevant and worthless. The great majority of corporate and institutional risks ─ through TAIRM ─ can be optimally managed without insurance and reinsurance. In the process, you are additionally making a huge saving by not paying exaggerated commissions and bonuses to insurance and reinsurance brokers. “Brokers” (“…sales reps…”) of what? Indeed!

We are all professionally and managerially concerned about legalistic and litigious: regulations, frameworks, zeitgeists and Weltanschauungs. But these are not the only perils requiring holistic countermeassuring.

And issues presented by violation of Governance, Compliance and Controls also required a much more holistic countermeassuring.

By way of illustration, only managing issues concerning Governance, Compliance, Controls and Intellectual Property is never ever “…beyond-insurance risk management…”

Nearly all lawyers and economists see “…risk management and insurance…” as a financial and legal approach.

Just about all accountants see “…risk management and insurance…” as a comptroller’s methodology.

The majority of actuaries see “…risk management and insurance…” as a statistical methodology.

Most auditors see “…risk management and insurance…” as a governance and compliance and intellectual property methodology.

To the highest degree, economists and financiers see “…risk management and insurance…” as a financial-transaction methodology.

The great majority of corporate planners see “…risk management and insurance…” as a strategy approach.

Nearly all human resources managers see “…risk management and insurance…” as a psychological approach.

CIOs, CISOs and CTOs, I.T. managers and I.T. risk managers see “…risk management and insurance…” as a computational methodology.

Almost all lawyers, economists, financiers, accountants, business administrators, auditors, corporate planners, actuaries, human resources managers, CIOs, CISOs, CTOs, I.T. managers and I.T. risk managers are not sufficiently right because their focus and pursuit fail to consider the physicist’ and engineer’s all-rounded criteria.

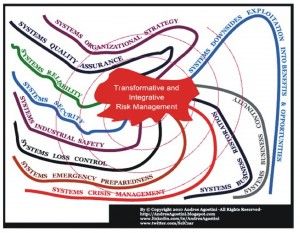

BEYOND-INSURANCE RISK MANAGEMENT AND TAIRM COMPREHENSIVELY CONSIDER LAWFULNESS (INCLUDING INTELLECTUAL PROPERTIES), GOVERNANCE, COMPLIANCE, CONTROLS, BUSINESS ADMINISTRATION, ACCOUNTING, AUDITING, STATISTICS, ACTUARIAL SCIENCES, CORPORATE PLANNING, HUMAN RESOURCES, ECONOMICS AND FINANCE, I.T. AND TECHNOLOGY, AS WELL.

EXTREMELY IMPORTANT:

Supplementary, Andres likewise indicates, “…Transformative and Integrative Risk Management (TAIRM) is also implemented in order to prevent technological surprises to the savvy organization seeking this advice and service by TAIRM, but also to create disruptively technological surprises (managerial ‘…Sputnik Moments…’) for the enterprise’s competitors…”

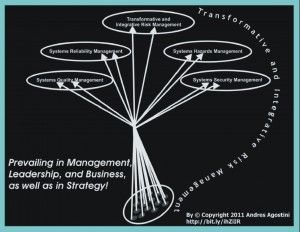

This notion is better understood when the axiom “… strategy is a function of a grander beyond-insurance risk management program and not the other way around…” is fully accepted and practiced.

In one line, Transformative and Integrative Risk Management (TAIRM) is absolutely “Skunkworks,” “Space Age,” “Wargaming” and Technocratic Management. Hence, non-status quo management. While others insist on “…thinking outside the box…” (inconsequential), TAIRM focuses on strong-sense and critico-creative thinking!

To illustrate this function and responsibility better, I.P. takes care of the tangible and intangible integrity of the operating building and corresponding premises and other assets, including the personnel. If one employee is selling secrets of trade or consuming illegal substances, I.P. is watching and acting upon.

I.P. does corporate counterintelligence and operates on it. I.P. incumbents are, for example, also responsible to designing, developing and instituting corporate plans pertaining to emergency preparedness, emergency response, disaster recovery, business restoration (partial function), business continuity (partial function) and business sustainability (partial function) to give you a brief idea.

I.P. also supervises and controls road and air ambulances and other medical and non-medical evacuation systems. I.P. is also responsible for preventive exercises and drills to massive evacuations in case of earthquakes, floods, fires and riots, among other perils.

Transformative and Integrative Risk Management fully contemplates, tackles, advises and operates on instrumental enhancement of the corporate provisions by Integral Protection organizations (sometimes called “departments” and others “divisions”). Have you ever seen an insurance or reinsurance company with these major duties before an organizational client?

And only and partly because of that, insurance and reinsurance companies are, by far, outside of the realm of beyond-insurance risk management and TAIRM.

TAIRM, too, has vast managerial applications for law enforcement and counter-terrorism “activities.” However, the majority of incumbents of public office are in the backyard playing political “games” and don’t possess neither a legitimate interest, nor an appropriate comprehension of techniques and methodologies, conducive to more stable “…national security…” doctrines and policies in actuality.

Many incumbents of public office don’t even have a designated budget to act upon.

Additionally and by way of example, Asian presidents are techies and fluidly communicate on Science, Technology, Engineering and Math issues (that is, STEM careers).

In the mean time, the counterparts in the West are chiefly held hostage to law, sociology and economics, with an overwhelming powerless feeling in technologically advanced conversations. All of this about the heads of state here have been publicly substantiated by Bill Gates.

Please remember: “… THE FUTURE IS NOT AN ECHO OF THE PAST…”

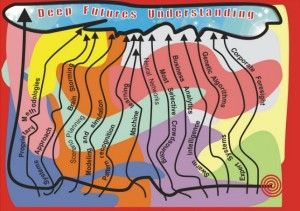

In today’s technologically-driven world, strategic trend evaluation cannot be done using only algorithms.

I do take into account both. I also practice “Analytics” and “Diagnostics” and have nascently become interested on what Cambridge University’ and Royal Society’s Sir Martin Rees, PhD. calls the “…Science of Complexity…”

Once again, TAIRM is vastly more into qualitative analyzes than quantitative analyzes.

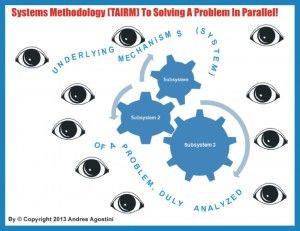

You see, every problem has an underlying mechanism. Once you deeply comprehend how it operates, you can influence (via throughput) on the final outcomes (from known inputs to desired outputs) to your continuous advantage.

It can be logically argued that the term “…throughput…” has a Latin language equivalent by the term modus operandi. To this end, GE’s chairman and CEO Jack Welch, PhD. also mentioned, “…To get to the guts of why things happen…”

I have done extensive research globally throughout many places, institutions and years, from the U.S. marketplace, Lloyd’s of London, Swiss RE, Tokyo Marine Group, and way further beyond to make a lengthy story brief.

I have also become directly knowledgeable (not “bookish,” but factual, empirical and as per the educated battlefield practicalities) of beyond-insurance risk management practices by many large, industrial enterprises and agencies such as NASA.

The NASA Projects Mercury, Gemini, and Apollo and the Intercontinental Ballistic Missile (Minuteman ICBM) initiative, comprehending that he or she or it cannot take those to the local insurance and reinsurance underwriter, yet these enterprises (management) initiatives have been successfully instituted.

To further illustrate the above, the Military-Industrial Complex and companies such as Boeing and Lockheed Martin, along with NASA ─ through their own methods ─ were pursuing their projects and programs without resorting to insurance and reinsurance companies at all.

I became knowledgeable with an in-all-truth polymath and an outright “Rocket Scientist,” a physicist, a systems engineer and a doctor in science, who was directly responsible for the reliability concerning: the NASA Projects Mercury, Gemini, and Apollo. At NASA he was Dr. Wernher von Braun’s right hand! I treasure all of his e-mails, letters and other materials.

To the utmost enhancement of my fortune, I have, for many years now, worked with the most daring, capricious and enlightened clients (minds) that one can imagine ever.

They all were seeking managerial and industrial “miracles” only (sic). WHILE GIVING THEM THEIR OUTRIGHT MIRACLES, I HAVE EXPERIENCED DRAMATIC OVER-LEARNING EXPERIENCES.

I once met a Scottish executive who told me that beyond-insurance risk management methodology by DARPA (Defense Advanced Research Projects Agency), NASA, Boeing, Lockheed Martin and Royal Dutch/Shell Group was “…esoteric…” I still treasure his e-mail.

This so-called “esoteric” beyond-insurance risk management approach by DARPA, NASA, Boeing, Lockheed Martin, Shell and a multitude of global corporations has been first instituted since the end of the 1950s. It is been in increasing utilization and betterment for about fifty-four years to this date.

What these institutions have successfully performed, transforming global civilizations and progress for Life, is un-apologetically and extremely uncomfortable for traditionalists whose ethos, cosmovisions and belief systems are fixed on the fossilized past and bonded to a myriad of obsolete assumptions, outdated notions and utter fallacies. The number of ignoramuses of supine ignorance is a breathtaking existential risk for humankind to deal with.

To further underpin this statement, I will share Peter Drucker’s quote, “…The greatest danger in times of turbulence is not the turbulence; it is to act with yesterday’s logic…” And also that of Dr. Stephen Covey, “…Again, yesterday holds tomorrow hostage .… Memory is past. It is finite. Vision is future. It is infinite. Vision is greater than history…” And that of Sir Francis Bacon, “… He that will not apply new remedies must expect new evils, for time is the greatest innovator …”

And that of London Business School Professor Gary Hamel, PhD., “…You cannot get to a new place with an old map…” And that of Alvin Toffler, “.….The future always comes too fast and in the wrong order…”

And that of Brad Leithauser, “…It reminds us that, in our accelerating, headlong era, the future presses so close upon us that those who ignore it inhabit not the present but the past …”

And that of Robert Kennedy, “…The future is not a privilege but a perpetual conquest…”

And that of Thomas Friedman, “…People are always [and wrongfully] assuming that everything that is going to be invented must have been invented already. But it hasn’t…” THIS QUOTATION IS HUGELY IGNORED.

ON THE FINAL ANALYSIS, WE MUST READILY ACCEPT FORCEFUL NOVEL REALITIES INSTANTANEOUSLY.

Dee Hock, CEO Emeritus of Visa International, stated: “…The problem is never how to get new innovative thoughts into your mind, BUT HOW TO GET OLD ONES OUT …”

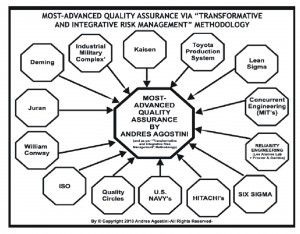

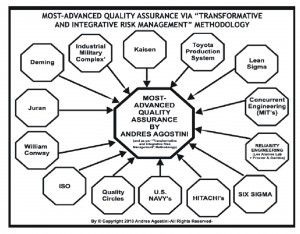

As you know, Japanese corporations and institutions are into intensive Kaisen and Toyota Production System (TPS). Regarding advanced quality assurance and continuous improvement, these approaches have been demonstrated indispensable. But their practitioners are always attempting to manage risks through said approaches without any success.

TPS is also known as “…Thinking People System…”

Toyota’s CFO and the Production Director have their jaws dropped ─ while being observed by their own Chairman and CEO ─ when I carefully demonstrated to them the flaws of Kaisen and TPS in managing risks compared to the ample breadth and depth of scope by the “..Transformative and Integrative Risk Management…” (TAIRM).

Although they were in a major technical bewilderment, they hired me (as Mitsubishi Motors did before) to institute the advanced risk management of a self-funded and self-administered health-care benefit program for some seven-hundred Toyota employees and their respective eligible dependents. Both cases were turnkey undertakings.

TNT Express’ engagement was the implementation of advanced risk management of a self-funded and self-administered health-care benefit program for some five-hundred TNT Express employees and their respective eligible dependents. It was a turnkey undertaking.

Regarding a regional state, I implemented beyond-insurance risk management of a self-funded and self-administered and universal health-care benefit program for some 700,000 citizens (beneficiaries).

TAIRM has been extensively instituted ─ regarding numerous industrial and operational risks ─ in many petroleum joint ventures by corporations such as Shell, Statoil, Exxon, Mobil, BP, Conoco, ENI and Chevron, among others.

Global corporations are greatly into beyond-insurance risk management.

TAIRM seriously considers and utilizes, among many other systems, every Western and Eastern quality assurance methodologies (both from civilian and military spheres).

Subsequently, I expanded, revised and enhanced greatly this practice, after twenty-one years of applied experience, and carefully designed, developed and created my own proprietary methodology and professional, trade secret, “…Transformative and Integrative Risk Management…” (TAIRM) back in 2005 (continually updated and upgraded to date).

a) “…HUMAN KNOWLEDGE IS DOUBLING EVERY TEN YEARS [AS PER THE 1998 STANDARDS]…” [*]

b) “…COMPUTER POWER IS DOUBLING EVERY EIGHTEEN MONTHS. THE INTERNET IS DOUBLING EVERY YEAR. THE NUMBER OF DNA SEQUENCES WE CAN ANALYZE IS DOUBLING EVERY TWO YEARS…” [*]

j) “…The world has profoundly changed … The challenges and complexity we face in our personal lives and relationships, in our families, in our professional lives, and in our organizations are of a different order of magnitude. In fact, many mark 1989 ─ the year we witnessed the fall of the Berlin Wall ─ as the beginning of the Information Age, the birth of a new reality, a sea change of incredible significance ─ truly a new era ─ Being effective as individuals and organizations is no longer merely an option ─ survival in today’s world requires it. But in order to thrive, innovate, excel, and lead in what Covey calls the new Knowledge Worker Age, we must build on and move beyond effectiveness [long-held assumptions, fallacies and flawed beliefs and faulty conventions]…Accessing the higher levels of human genius and motivation in today’s new reality REQUIRES A SEA CHANGE IN THINKING: a new mind-sets, a new skill-set, a new tool-set ─ in short, a whole new habit…”

END OF CITATION.

[*] All citations and quotations are from the Futuretronium Book.

NOTWITHSTANDING, THE HUMAN RACE MUST DECIDE WHICH DETERMINATION TO MAKE ABOUT SAID FORCES QUICKLY.

To the end above, Prof. Gary Hamel, Ph.D. argued, “…Denial is tragic. Delay is deadly …” And Albert Einstein determined, “…It has become appallingly obvious that our technology has exceeded our humanity … We shall require a substantially new manner of thinking if mankind is to survive.…”

And Dr. Aubrey de Grey, PhD. establishes, “…To solve a very complicated problem, you generally need a fairly complicated solution [in advance]…”

Churchill observed that we must get prepared when we cannot predict. Hence, we need to discern the dynamic (driving) forces reshaping the present and future and their impacts on our industries and organizations and professions TODAY.

This we, all managers, must do daily without a fail (and increasingly so).

The “…increasingly so…” MUST be nonlinear and supremely exponential. According to mathematics, nonlinear entails, “…not in a straight line…” (that is, that “grows” geometrically or exponentially).

Stated simply, nonlinear growth equates to most unevenly explosive growth.

“…Here and Now…” is, put simply, the endless entry point into the future.

As a result, Marcus Aurelius Antoninus commented, “…Never let the future disturb you. You will meet it, if you have to, with the same weapons of reason which today arm you against the present …”

And as a consequence, German philosopher Friedrich Nietzsche indicated, “…It’s our future that lays down the law of our today…” NIETZSCHE IS HEREWITH SUGGESTING THAT THE PRESENT IS A FUNCTION OF THE FUTURE.

Whatever is happening in the West, China is, at the moment and by way of example, drastically booming.

As an important point to note, the Futurist Gerald Celente advises, “…If you don’t attack the future [today], the future will attack you…” And John Galsworthy said, “…If you don’t think about the future, you cannot have one.…”

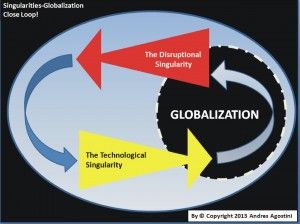

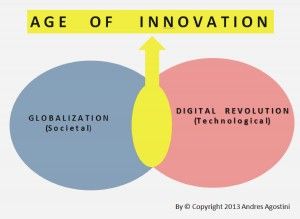

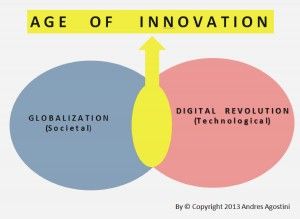

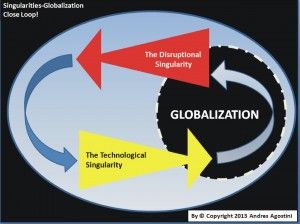

Now, we must concentrate, as a laser-beam pointing precision, on the upsides by the Technological Singularity as well as the downsides by the Disruptional Singularity.

To have a quick and ready look into the future today, one can also ─ free of any obligations ─ join the Forum “…Becoming Aware of the Futures…” at http://lnkd.in/WUm7zA

Or one can also ─ free of any obligations ─ join the Forum “…Future Awareness…” at http://lnkd.in/bjg9UDd

Or one can also ─ free of any obligations ─ join the Forum “…The Disruptional Singularity…” at http://lnkd.in/dXgRkAT

As a manager to me so-called “…insurance…” is not “risk protection” but a financial device that just PARTLY indemnifies you from SOME losses and ONLY SOMETIMES.

AND “LOSS INDEMNITY” IS NEVER RISK MANAGEMENT.

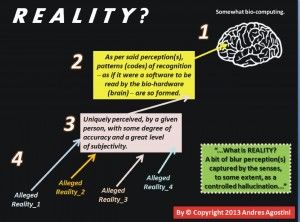

In my case, a loss (disruption potential) is the un-managed and uncontrolled unleashing of pent-up energy. Once pent-up energy is unleashed, it can create (upside risks) or destruct (downside risks).

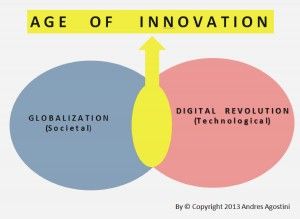

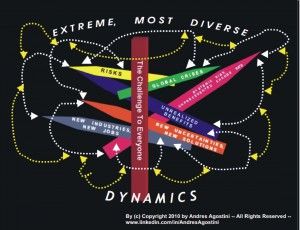

To cope with the future is to cope with changed changes (upside risks and downside risks) today. And the entirety of the planet is inundated with massive, increasing changed changes.

All incumbents and practitioners must perceive that management is turning itself into a highly scientific field and practice without a fail. Believe it or not, management is literally going into applied “…Rocket Science…”

By way of example, the expression “…Keep It Simple, Stupid…” has been radically replaced by “…Keep It Scientific, Savant…”

And notions as those of Thomas Paine’s “…common sense…” are now absurd and rendered ineffectual and counterproductive by representatives of institutions such as DARPA, NASA, MIT and Stanford University.

Common sense is radically replaced by SCIENTIFIC KNOWLEDGE.

So called “…out of the box…” thinking is impious and outrageous mediocrity by the 21st-century standards and practices.

“…Out of the box…” thinking will bankrupt you easily.

And the “…power of simplicity…,” unless is applied by a consummated polymath, is a chat about rubbish.

Managing is an art, practice, technology and science.

Change is going abusively “…auto…” and “…techno…” and “…in vivo…” and “…infotech…” and “…cyborg…” and “…digital…” and “… neuro…” and “…bio…” and “…transbio…” and “…nano…” and “…nanotech…” I am not afraid to proclaim.

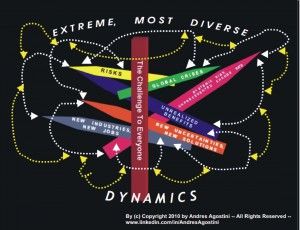

BEYOND THE MANAGERIAL CHALLENGES (DOWNSIDE RISKS) PRESENTED BY THE EXPONENTIAL TECHNOLOGIES AS IT IS UNDERSTOOD IN THE TECHNOLOGICAL SINGULARITY AND ITS INHERENT FUTURISTIC FORCES IMPACTING THE PRESENT AND THE FUTURE NOW, THERE ARE ALSO SOME GRAVE GLOBAL RISKS THAT MANY FORMS OF MANAGEMENT HAVE TO TACKLE WITH IMMEDIATELY.

THESE GRAVE GLOBAL RISKS HAVE NOTHING TO DO WITH ADVANCED SCIENCE OR TECHNOLOGY. MANY OF THESE HAZARDS STEM FROM NATURE AND SOME ARE, AS WELL, MAN MADE. FOR INSTANCE, THESE GRAVE GLOBAL RISKS ─ EMBODYING THE DISRUPTIONAL SINGULARITY ─ ARE GEOLOGIC, CLIMATOLOGICAL, POLITICAL, GEOPOLITICAL, DEMOGRAPHIC, SOCIAL, ETHICAL, ECONOMIC, FINANCIAL, LEGAL AND ENVIRONMENTAL, AMONG OTHERS.

THE DISRUPTIONAL SINGULARITY’S MAJOR RISKS ARE GRAVELY THREATENING US RIGHT NOW, NOT LATER.

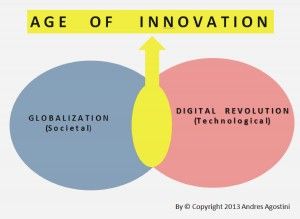

Vast hazards by the Disruptional and Technological Singularities are the combined downsides by and to the globalization.

New science and its intrinsic risks are further discussed herewith. Please see the following accordingly:

Sir Martin Rees, Ph.D. noticed, “…Science is emphatically not, as some have claimed, approaching its end; it is surging ahead at an accelerating rate. We are still flummoxed about the bedrock nature of physical reality, and the complexities of life, the brain, and the cosmos. New discoveries, illuminating all these mysteries, will engender benign applications; but will also pose NEW ETHICAL DILEMMAS AND BRING NEW HAZARDS. How will we balance the multifarious prospective benefits from genetics, robotics, or nanotechnology against the risk (albeit smaller) of triggering utter disaster? .… Science is advancing faster than ever, and on a broader front: bio-, cyber- and nanotechnology all offer exhilarating prospects; so does the exploration of space. BUT THERE IS A DARK SIDE: NEW SCIENCE CAN HAVE UNINTENDED CONSEQUENCES; IT EMPOWERS INDIVIDUALS TO PERPETRATE ACTS OF MEGATERROR; EVEN INNOCENT ERRORS COULD BE CATASTROPHIC. THE ‘DOWNSIDE’ FROM TWENTY-FIRST CENTURY TECHNOLOGY COULD BE GRAVER AND MORE INTRACTABLE THAN THE THREAT OF NUCLEAR DEVASTATION THAT WE HAVE FACED FOR DECADES. AND HUMAN-INDUCED PRESSURES ON THE GLOBAL ENVIRONMENT MAY ENGENDER HIGHER RISKS THAT THE AGE-OLD HAZARDS OF EARTHQUAKES, ERUPTIONS, AND ASTEROID IMPACTS…”

To underpin the motion by Sir Martin Rees, see also the following.

The term [technological] singularity entered the popular science culture with the 1993 presentation at the VISION-21 Symposium sponsored by NASA Lewis Research Center and the Ohio Aerospace Institute, March 30–31, 1993, by Professor of Mathematics Vernor Vinge (San Diego University).

Correspondingly, Professor Vinge, PhD. indicated, “…Within thirty years, we will have the technological means to create superhuman intelligence. Shortly after, the human era will be ended … Is such progress avoidable? If not to be avoided, can events be guided so that we may survive? These questions are investigated. Some possible answers [and some further dangers] are presented…”

An even deeper exploration on existential risks is better achieved through the reading of the following three materials:

1.- “…Our Final Hour: A Scientist’s Warning…” By Sir Martin Rees, PhD. at http://lnkd.in/bHkBp4S

2.- “…Existential Risks: Analyzing Human Extinction Scenarios…” By Professor Nick Bostrom, PhD. at http://lnkd.in/RsNRmm

3.- “…Prophets of Doom…” available at http://lnkd.in/bfpzAdx

THEREFORE, PRACTITIONERS AND INCUMBENTS FORCEFULLY NEED TO MOST URGENTLY AND CONCURRENTLY MANAGE A MYRIAD OF GLOBAL RISKS IN PARALLEL (SIMULTANEOUSLY) BY BOTH THE DISRUPTIONAL SINGULARITY AND THE TECHNOLOGICAL SINGULARITY. THIS IS ULTIMATELY AND DESPERATELY IMPORTANT!

ADDITIONAL MANAGEMENT CHALLENGES. PLEASE NOTICE THESE THREE PIECES:

There is, by way of example and for your consideration of increasing challenges to the management practitioner, this publication, “…Oxford Study – Half of U.S. Jobs Could Be Done by Computers…” At http://lnkd.in/b8mHPpG . Still, even more pervasive challenges to the management profession.

And there is also this article: “…Big nanotech: an unexpected future. How we deal with atomically precise manufacturing will reframe the future for human life and global society…” At http://lnkd.in/bd742Nh

And there is also this article: “…Is Your Job Under Threat From ROBOTS?.…Office Jobs Could Vanish By 2018…” At http://lnkd.in/difDxRd

Consequently, Dr. Gary Hamel, PhD. indicates, “…What distinguishes our age from every other is not the world-flattening impact of communications, not the economic ascendance of China and India, not the degradation of our climate, and not the resurgence of ancient religious animosities. RATHER, IT IS A FRANTICALLY ACCELERATING PACE OF CHANGE…”

CONCLUSIONS

1.- Given the vast amount of insidious risks, futures, challenges, principles, processes, contents, contexts, practices, tools, techniques, benefits, rewards and opportunities, there needs to be a full-bodied practical and applicable methodology (methodologies are utilized and implemented to solve complex problems and to facilitate the decision-making and anticipatory process).

6.- Always institute beyond-insurance risk management as you boldly integrate it with your futuring skill / expertise.

7.- In my firmest opinion, the following must be complied this way (verbatim): the corporate strategic planning and execution (performing) are a function of a grander application of beyond-insurance risk management. It will never work well the other way around. TAIRM is the optimal mode to do advanced strategic planning and execution (performing).

Accordingly, Dr. Carl Sagan, PhD. expressed, “…We live in a society exquisitely dependent on science and technology, in which hardly anyone knows about science and technology…” And Edward Teller stated, “…The science of today is the technology of tomorrow …”

10.- In any profession, beginning with management, one must always and cleverly upgrade his / her learning and education until the last exhale.

An African proverb argues, “…Tomorrow belongs to the people who prepare for it…” And Winston Churchill established, “…The empires of the future are the empires of the mind…” And an ancient Chinese Proverb: “…It is not our feet that move us along — it is our minds…”

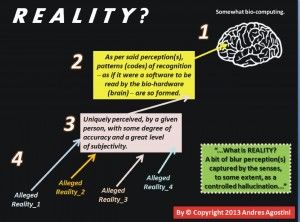

INCIDENTALLY, EVERY REALITY BEFORE THE MANAGER MUST BE BROUGHT UNDER OPTIMAL CONTROL.

As it ensues:

First! Once you realize that the most important thing to nurture is the rotational-and-translational motion revolting within and beyond the innermost core of / by you, you can do your ethics and morality. Now you have conquered bridge 1. Conquering this foundational pillar also implies that every facet and phase of your personal and professional life will be carried on with dogged solemnity.

Second! Once you do your ethics and morality, you can do your actionable knowledge for Life. Now you have conquered, and will be, as follows, securing control of bridge 2 for Life.

Third! Once your actionable knowledge is done by you, you can do your corporate planning and respective marshaled strategy. Now you have conquered, and will be, as follows, securing control of bridge 3 for Life.

Fourth! Once your corporate planning and respective marshaled strategy is done by you, you can do your systems hazard management. Now you have conquered and will be, as follows, securing control of bridge 4 for Life.

Fifth! Once your systems hazard management is done by you, you can do your systems quality assurance management. Now you have conquered and will be, as follows, securing control of bridge 5 for Life.

Sixth! Once your cross-functional, interdisciplinary systems quality assurance management is done by you, you can do your systems reliability engineering. Now you have conquered and will be, as follows, securing control of bridge 6 for Life.

Seventh! Once your systems reliability engineering is done by you, you can do your systems risk management. Now you have conquered and will be, as follows, securing control of bridge 7 for Life.

Eighth! Once your systems risk management — with the applied omniscience perspective — is done by you, you can do your contingency planning lavishly (with thousand layers of redundancy in place) for Life. Now you have conquered, and will be, as follows, securing control of bridge 8 for Life.

Ninth! When your contingency planning is done by you, you can do your benefits (upsides and downsides). Now you have conquered, and will be, as follows, securing control of bridge 9 for Life.

Tenth! When benefits are done by you and you become hyper-engaged into pervasively transformational self-renewal and self-challenging (in excelsis) of your own intellect, you can do your sustainability perpetually. Now you have conquered, and will be, as follows, securing control of bridge 10 for Life.

Eleventh! Now you can conceive and design your own profession and tenure while concentrating in capturing womb-to-tomb (so-called) “…success…” and its gargantuan sustainability effort. Now you have conquered, and will be, as follows, securing control of bridge 11 for Life.

Twelfth! Neither “…the secret,…”, nor the “…hidden secret,…”, nor the “…discrete secret…,” or any “…magnificent marketing stunts…” will warrant the oxygen and energy and vision that your mind, body, and souls require (sic). Now you have conquered management for Life.

Napoleon Bonaparte (1769 — 1821) declared, “…No longer it is question simply of education … NOW IT BECOMES A MATTER OF ACQUIRING SCIENCE…”

THE MANAGER’S HYPOTHETICAL BLUEPRINT TO PRACTICAL SUCCESS CAPTURING:

(1) Picture mentally, radiantly. (2) Draw outside the canvas. (3) Color outside the vectors. (4) Sketch sinuously. (5) Far-sight beyond the mind’s intangible exoskeleton. (6) Abduct indiscernible falsifiable convictions. (7) Reverse-engineering a gene and a bacterium or, better yet, the lucrative genome. (8) Guillotine the over-weighted status quo. (69) Figure out exactly which neurons to make synapses with. (70) Wire up synapses the soonest. (71) Ask now more sophisticated questions to marshal upon.…”

David, commented simply to you and by me:

“…I am no longer a captive to history.

Whatever I can imagine, I can accomplish.

I am no longer a vassal in a faceless

bureaucracy, I am an activist, not a drone.

I am no longer a foot soldier

in the march of progress.

I am a Revolutionary!…”

END OF EXCERPT.

Click here to view the entire writing at http://lnkd.in/bYP2nDC

Mr. Andres Agostini

Author of:

The Future of Scientific Management, Today!

The Future of Skunkworks Management, Now!

Futuretronium Book!

Superthinking!

Transformative and Integrative Risk Management!

END OF EXCERPT.

Please see the full article at http://lnkd.in/bYP2nDC