Money is the primary mechanism for storing and exchanging value, especially in our daily purchases, and it’s heading rapidly into a faster, smarter and more mobile future. Nevertheless, the constant in the midst of change will remain levels of human trust in the proliferating forms of money. That’s because we have an ancient and abiding partnership with money and no relationship is ever sustainable without trust.

It’s a time of accelerated innovation in this field due to the rapid global expansion of digital banking, especially online and mobile financial services. However, while payments and transfer of money shift inexorably towards mobile devices as the consumer technology of choice, digital currencies expand in scope and number and online shopping begins to enter a golden age, cash is still the most successful and popular form of money ever. Its trust level, as public money backed up by a promise to pay from the government which minted and manufactured it, remains extremely high. This is evidenced by the way the Greeks turned to cash during their fiscal and monetary crisis which rocked the whole European Union, as well as by cash’s current 8.9% per annum average global growth rate. Cash is undoubtedly one of the most successful social technologies in history.

In short, the future of money will be mobile, faster in execution and settlement, and yet as heavily dependent on trust as ever. In my view, for that very reason, there’s unlikely to be a cashless world in this century. Nor is such a scenario desirable, unless you’re a fan of a Big Brother society largely dominated and dictated by multinationals more powerful than many national governments. A cashless world would subvert the economic freedom of citizens to choose the form of money and payment they want and, if that weren’t bad enough, it would lead inevitably to even further marginalisation of the world’s poor. Besides, cash is already universally trusted, instant in execution and mobile in nature (that is, just as portable as a smart phone).

That said, digital banking is here to stay and provides massive levels of convenience and efficiency. Financial institutions the world over are fiercely focused on developing omnichannel (“every channel”) strategies to provide seamless customer experiences across all their banking channels.

In addition, a great “money race” is now on to dominate the world’s vast payment markets between the global card brands, the banks, the technology providers (such as Apple and Samsung), the Internet giants (e.g. Google. Amazon, PayPal), the social media giants (including Facebook, WeChat and Twitter) and, of course, the major retailers.

Having sketched a broad context for understanding what’s happening in the world of money and payments, here are ten megatrends to consider. This will be followed by six additional movers and shakers to watch in the coming months and years.

Megatrend #1: The smart world is coming

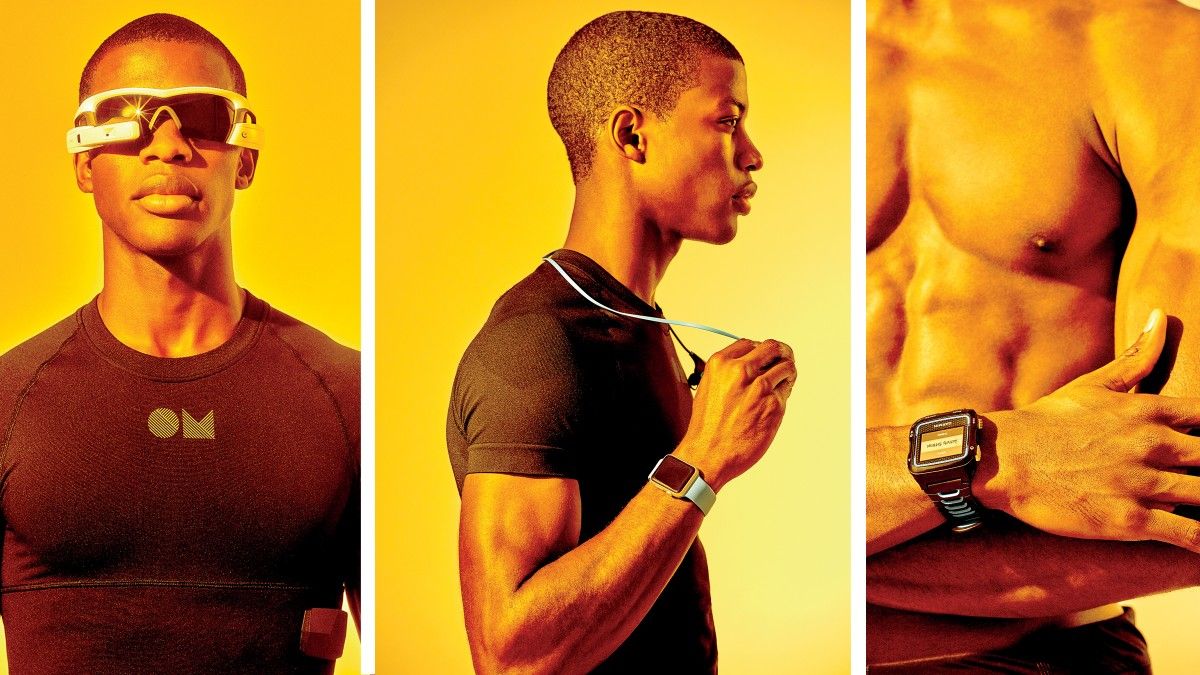

The smart world of smart consumers, some wearing smart technologies like the Apple Watch, smart devices and smart homes, is on its way. This will take place within the Internet of Things (IoT ). Gartner forecasts that the 3.9 billion smart devices connected to Internet at the end of 2014 will increase to about 25 billion by 2020. A key device in the smart world is likely to be the phablet. It should become the dominant mobile device. The number of phablets is expected to increase from 27 million in 2012 to around 230 million by the end of 2015. Business Insider, for example, predicts phablets will outsell smartphones by 2017. Money will gain multiple new forms as it adapts to this new smart world. Old and new forms of money will co-exist, resulting in much greater choice and convenience for consumers.

Megatrend #2: e-commerce is rising, along with digital shopping

Fortune Magazine recently rated the Bank of Internet, an online bank, as the 56th fastest growing company in the world. Online buying is growing exponentially across the globe. For example, WWW Metrics (http://www.wwwmetrics.com) expects Australians to spend $10 billion more online in the next five years than they do currently. The ease and convenience of online shopping cannot be disputed. Although it will never completely replace high-street shopping or lead to the rise of ghostly and abandoned shopping malls, it will probably enjoy good year-on-year growth for a long period to come. This megatrend will increase the importance of digital money.

Megatrend #3: There is a shift to mobile internet and mobile commerce

Today, mobile devices outsell PCs and laptops in a game-changing shift to mobile-based internet. It is therefore not surprising that mobile shopping is growing at 4 x the rate of online shopping. For example, Finextra has reported that 37% of e-commerce originates from a tablet or smart phone. Global mobile purchases are expected to rise from $150bn in 2014 to $214bn in 2015. Mobile money is going to be a big part of the future.

Megatrend #4: Debit card use is on the rise

The rise of mobile commerce does not mean the demise of cards. Retail Banking Research (RBR) have reported that there are now 12 billion payments cards in the world, which were used last year to make 235 billion payments, totalling $20 trillion. The debit card is the king of these cards, representing 68% of the global card market. This share is expected to rise to 72% by 2020. By contrast, credit card share is predicted to decline from 23% to 20% by 2020. Prepaid cards, at the bottom of the scale, have a mere 5% of the market. It is clear that card payments will dwarf mobile payments for the foreseeable future. It will be a long time indeed before mobile payments get close to card payments and cash payments. Nevertheless, the future is very bright for mobile money.

Megatrend #5: In-store NFC payments are being outstripped by mobile commerce in the mobile payments space

Near Field Communication (NFC) based payments – often called “tap and go” or “wave and pay” — have a slow adoption rate but should pick up a head of steam within the next five to ten years. They’re unlikely to grow at the brisk rate at which mobile commerce is growing. Deloitte estimates that only 7% of smartphone users use mPay at POS (Point-of-Sale). By 2018, in-store NFC payments are forecast to reach only about 4.5% of card volume. For the near future, NFC won’t be used much by customers in retail stores with high Average Order Values, but more at coffee shops and fast food chains with lower Average Order Values. Nevertheless, by 2020 there could be 2.2 billion NFC enabled phones and there is a good chance NFC may become a dominant technology as a result of global EMV compliance, with Visa and MasterCard building NFC into the migration path.

Megatrend #6: The omnichannel, customer-centric world has arrived

What Steve Jobs did so well was to introduce the “zen” feel of consumer technology after decades of boring, inert computer hardware and software. Now, there’s no turning back. All channels must be intuitive, all channels must complement one another, there simply must be a seamless omnichannel experience. This is the key to retention of the digital customer. This means money will become more zen-like, especially in an era when Customer Owned Devices (CoDs) have given the connected consumer more power, compared to more static self-service banking through traditional ATMs. Self-service terminals gave the customer access to banking services after hours 24 x 7 but they are banked-owned devices. Now consumers do their banking on their own technology. They demand a personal, smooth, convenient level of service purged of any old-fashioned “clunky” technology experiences. Money cannot afford to look and feel old-fashioned. Thanks, Steve. (By the way, polymer banknotes used in Canada, Australia and being introduced into Britain from next year, may well be the new look of cash, given the increased longevity and security they provide for notes.)

Megatrend #7: The bank branch is being reconfigured

In this increasingly digital world, in which non-banks can provide money and financial services, banks need to resist disintermediation from these new players by redefining the relationship to their customers. I’ve already indicated that the smart banking experience is going to be paramount. Accordingly, banks are redesigning their branches, to provide a balance of digital and traditional services, employing customer-facing technology. Assisted self-service, including remote video banking and in-person assistance, is proving very popular in this new world. At the same time, respect is being shown for the role of Customer Owned Devices and the kind of experience they offer to customers. Banks are saving costs and improving efficiency through increased automation, especially deposit automation. Self-service automation now accounts for 2/3rds of branch transformation technology, according to RBR. The costs of cash are being pushed down through cash deposit acceptance and through recycling ATMs, which are enjoying phenomenal growth in China, for example. RBR states that automated deposit and recycling ATMs make up 40% of global shipments in our industry. The bank branch of the future must be highly automated, smart, offering both in-person teller assistance and video banking.

Megatrend #8: The ATM is evolving into an indispensable value-adding 24×7 customer touchpoint

As CEO of the ATM Industry Association since 2005, I can attest that there is no global movement away from the ATM. ATM shipments have been growing y-o-y since 2010 following the global economic crisis of 2008–9. In fact, the ATM is central to both branch transformation and the omnichannel approaches. It is a highly trusted customer touchpoint found in great locations. I foresee deployers focusing more and more on valued-added services at the ATM, from ticketing to bill payments, while deposit automation and recycling ATMs will continue to reduce the costs of cash on a global scale (cash handling can account for 30–40% of the total cost of operating a large ATM estate). Besides, ATMs are main distribution channel for cash (for example, in the UK 72% of cash is acquired through cash machines) and cash demand is growing (see Megatrend #9 below).

Megatrend #9: Global cash demand is rising at 3 x the rate of economic growth

In an ATM Industry Association study of growth in currency in circulation in thirty countries, representative of advanced and developing economies, over a five year period from 2009–2013, it was found that global cash demand is growing at an average of 8.9% p.a. This is 3 x the rate of global GDP during this time. The study was based on central bank statistics in these thirty countries in annual reports. This figure accords with a prediction by the leading retail banking research house, RBR, that annual cash withdrawal volumes will grow by 7.9% between 2013–2019. In the BRICS countries, which contribute 20% of world GDP with 40% of its population, currency grew y-o-y in this period at 11%, compared to 4.5% in the Eurosystem. If you want to get a feel for cash production in the world’s number one economy, check this out: in the USA, 6.2 billion banknotes were printed in 2014, about 24.8 million per day!

As mentioned earlier, recent turmoil in Greece pushed up demand for cash. For example, in May, 2015, €45 billion in banknotes was in circulation, which equates to just over €4,000 per citizen.

For years now, I have noticed a widening gap between fact and perception regarding cash. Despite being under threat from some governments and other agencies seeking to create a cashless society, as well as a largely hostile media, cash is holding its own as a dominant payment method in the brave new world of digital banking and shopping

Megatrend #10: Remittances and financial inclusion are growing in importance

Today, there are still 2 billion unbanked people. 38% of adults do not have access to basic financial services. That is why financial inclusion is going to be so important a tool for addressing the growing wealth gap between haves and have-nots, which is neither sustainable nor just. However, there is hope: mobile money! While 28% of US households are either unbanked or underbanked, mobile penetration is at 90% of households. Just look at how mobile phones transformed the landscape in Kenya. The renowned MPesa mobile money transfer and payment system gained 17 million users in just 8 years. Mobile phone owners who had never had a bank account in their lives could suddenly conduct secure, fast and convenient financial transactions.

Tellingly, cash in circulation continued to grow strongly during these years of exponential MPesa growth. Today cash transfers and use of vouchers are set to revolutionise global humanitarian aid as more effective than goods. In a time of migration crises, rising natural disasters and extreme weather events, giving cash and vouchers to people in need, trying to survive in an emergency, is the civilised way to go. Physical aid, hamstrung by tough logistics, seldom empowers those most in need in a timely fashion.

What’s also important to the world’s poor is the ability to send remittances. In 2014, there were $440 billion in recorded remittances. Now big names like PayPal are entering this growing remittance market. Money can mean survival. The world would be a much better place if we could take remittances and money transfers to a new level. That’s money in action.

Now think about the following innovations likely to further change the world of money in the near future.

Movers and Shakers #1: Samsung Pay is likely to become the leader in mobile payments within months of its launch

Samsung Pay is going to blow Apple Pay (sorry, Steve) out of the water and here’s why. It combines NFC and MST (Magnetic Secure Transmission) communication, so it can be used at 30 million merchant locations worldwide. Apple Pay is stuck in the slow-moving NFC space. In addition, Samsung is partnering with a network of big players, including global banks, card brands, PayPal, etc. Samsung Galaxy S6 is seen by many technology gurus as the world’s leading smartphone. Finally, the new payment app will be linked to smart TV through a partnership with PayPal to enable payments on the TV platform, using a secure virtual keypad, in thirty-two countries.

Sadly, Apple Pay has a high drop-out rate with 48% of 1st time users not using it again (source: Tremont Capital). While I see the Apple Watch making a major statement and becoming a status symbol among young smart consumers, Apple Pay is probably doomed to play second fiddle to Samsung Pay.

Movers and Shakers #2: PayPal is moving into retail stores and remittances

PayPal, which has 130m online accounts, has agreed to buy online money-transfer company Xoom Corp.for $890m. Xoom’s online service lets users send money internationally, often via mobile phone, charging $5-$10, as well as pocketing the difference in the exchange rates; the service may also be used to pay bills. At the same time, PayPal is also partnering with Discover Financial Services to enable PayPal payments at retail stores. Is PayPal going to become the world’s biggest “bank” of the digital age?

Movers and Shakers #3: Zapp is likely to become a successful domestic mobile payment solution in the UK

Zapp in the UK, introduced by VocaLink, which is part of LINK, the powerful national ATM network, is one to watch. The system will use NFC, which is widely deployed in the country, but will works on the ACH system, which means it will exclude interchange while enjoying fast settlement. It is available to 18 million UK account holders and is strongly supported by all the major banks and retailers. Sounds like a winning formula to me. Money, after all, has a strong national identity and dimension. It isn’t as intangible as it may seem, even in the electronic age.

Movers and Shakers #4: Digital currencies and blockchain technology are here to stay

There are now over 500 decentralised digital currencies in existence. Some central banks are even considering issuing a national digital currency as a back-up currency. There is also talk of future digital currencies which could be asset-based, such as linked to gold or property assets. In Greece after its monetary crisis, it was decided to install 1000 Bitcoin ATMs.

What is becoming clear to operators and to regulators is that the blockchain technology behind bitcoin, which is incredibly robust, has other potential applications, for example, programmable money and currency exchange. Expect to see digital currencies and blockchain technology revolutionise the nature and uses of money.

Movers and Shakers #5: Social media giants are expanding their role in the payments space

Facebook purchased What’s App, with its 500m subscribers for $22bn to add to its own users — 1.19 billion monthly active users, 874 million mobile users, and 728 million daily users. That’s a huge move and it has implications for the future of money. Users can now send or receive money in Facebook Messenger after adding a debit card to the Facebook account. Then you can open a chat with the friend you want to send money to, enter the amount you want to send, click next to your debit card and then click Pay.

Meanwhile, WeChat, with 600m active users, has a mobile payments app for customers to buy in-app items or services. It works for both in-store payments (where retailers will likely scan a QR code generated by your order inside WeChat) or for purely online purchases that’ll be delivered later.

Social media will completely change the face (excuse the pun) of money. They will make it more personal and intimate.

Movers and Shakers #6: Current C is a model of a mobile payment app from a retail consortium

Finally, don’t write off the major retailers. They, too, want a piece of the payments action. Merchant Customer Exchange (MCX) is a company created by a consortium of U.S. retail companies, including Walmart and 7-Eleven, with $1 trillion in annual sales. The consortium has developed a merchant-owned mobile payment system which works through a digital wallet and a smartphone app. To make a purchase, the user scans a QR code shown on the cashier’s screen, or has the cashier scan a QR code from the phone’s screen. The payment settles on the ACH system for speed and efficiency.

These 10 megatrends and 6 movers and shakers together sketch the picture of a battle of the titans for control of the ever-expanding global payments market as it gets transformed by the new digital options opening up for billions of increasingly connected consumers. When the dust settles, only the strongest, most trusted forms of money will still be standing.

Michael Lee’s second book on the future, Codebreaking our Future – deciphering the future’s hidden order, was published in 2014 (http://www.amazon.com/Codebreaking-our-future-Deciphering-futures/dp/1908984260). He is also author of a trilogy of science faction novels available on Amazon, Voyage of the Moon Dream, Heartbeat and Rocket Ride of the Secret Cosmonaut (http://www.amazon.com/Science-Faction-Trilogy-Cosmonaut-Heartbeat-ebook/dp/B00T31U4U8/ref=sr_1_2?ie=UTF8&qid=1443180236&sr=8-2&keywords=voyage+of+the+moon+dream)