At Quora, I occasionally role play, “Ask the expert” under the pen name, Ellery. Today, I was asked “Is it too late to get into Bitcoin and the Blockchain”.

A few other Bitcoin enthusiasts interpreted the question to mean “Is it too late to invest in Bitcoin”. But, I took to to mean “Is it too late to develop the next big application—or create a successful startup?”. This is my answer. [co-published at Quora]…

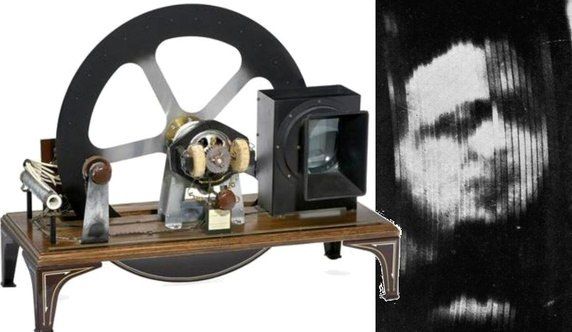

The question is a lot like asking if it is too late to get into the television craze—back in the early 1930s. My dad played a small role in this saga. He was an apprentice to Vladamir Zworykin, inventor of the cathode ray tube oscilloscope. (From 1940 until the early 2000s, televisions and computer monitors were based on the oscilloscope). So—for me—there is fun in this very accurate analogy…

John Logie Baird demonstrated his crude mechanical Televisor in 1926. For the next 8 years, hobbyist TV sets were mechanical. Viewers peeked through slots on a spinning cylinder or at an image created from edge-lit spinning platters. The legendary Howdy Doody, Lucille Ball and Ed Sullivan were still decades away.

But the Televisor was not quite a TV. Like the oscilloscope and the zoetrope, it was a technology precursor. Filo T. Farnsworth is the Satoshi Nakamoto of television. He is credited with inventing TV [photo below]. Yet, he did not demonstrate the modern ‘cathode ray’ television until 1934. The first broadcast by NBC was in July 1936, ten years years after the original Baird invention. (Compare this to Bitcoin and the blockchain, which are only 7 years old).

Most early TV set brands died during the first 10 years of production: Who remembers Dumont, Andrea and Cossor? No one! These brands are just a footnote to history! Bear in mind that this was all before anyone had heard of Lucille Ball, The Tonight Show or the Honeymooners. In the late 1950s, Rod Serling formed Cayuga Productions to film the Twilight Zone in New York. Hollywood had few studios for dramatic television production, and the west coast lacked an infrastructure for weekly episode distribution.

Filo T. Farnsworth demonstrates an advanced television receiver

Through the 1950s (25 years after TV was demonstrated), there was no DVR, DVD or even video tape. Viewers at home watched live broadcasts at the same time as the studio audience.

The short answer to your question: No. Absolutely not! It’s not too late to get into Bitcoin and the blockchain. Not too late, at all. That ship is just pulling into the dock and seats are mostly empty. The big beneficiaries of blockchain technology (it’s application, consulting, investing or savings) have not yet formed their first ventures. In fact, many of the big players of tomorrow have not yet been born.

Philip Raymond is a Lifeboat columnist and contributor to Quora. He is also co-chair of Cryptocurrency Standards Association and editor at A Wild Duck.

I am neither an arbitrage player nor a day trader. These are just a few warning bells that come to mind when I think about such activity. You can be sure that this list of risks only scratches the surface. Bitcoin is remarkably fluid and many people flaunt regulations. For this reason, I am confident that opportunities for profitable arbitrage are rare and very tiny (small gain for a big risk).

I am neither an arbitrage player nor a day trader. These are just a few warning bells that come to mind when I think about such activity. You can be sure that this list of risks only scratches the surface. Bitcoin is remarkably fluid and many people flaunt regulations. For this reason, I am confident that opportunities for profitable arbitrage are rare and very tiny (small gain for a big risk).