![]()

It’s not all that easy to call KnuEdge a startup. Created a decade ago by Daniel Goldin, the former head of the National Aeronautics and Space Administration, KnuEdge is only now coming out of stealth mode. It has already raised $100 million in funding to build a “neural chip” that Goldin says will make data centers more efficient in a hyperscale age.

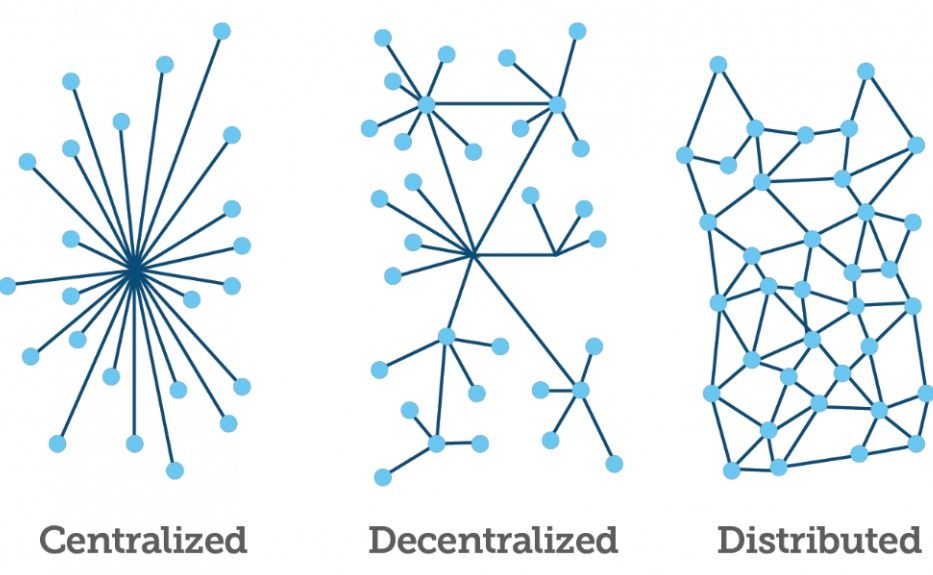

Goldin, who founded the San Diego, California-based company with the former chief technology officer of NASA, said he believes the company’s brain-like chip will be far more cost and power efficient than current chips based on the computer design popularized by computer architect John von Neumann. In von Neumann machines, memory and processor are separated and linked via a data pathway known as a bus. Over the years, von Neumann machines have gotten faster by sending more and more data at higher speeds across the bus as processor and memory interact. But the speed of a computer is often limited by the capacity of that bus, leading to what some computer scientists to call the “von Neumann bottleneck.” IBM has seen the same problem, and it has a research team working on brain-like data center chips. Both efforts are part of an attempt to deal with the explosion of data driven by artificial intelligence and machine learning.

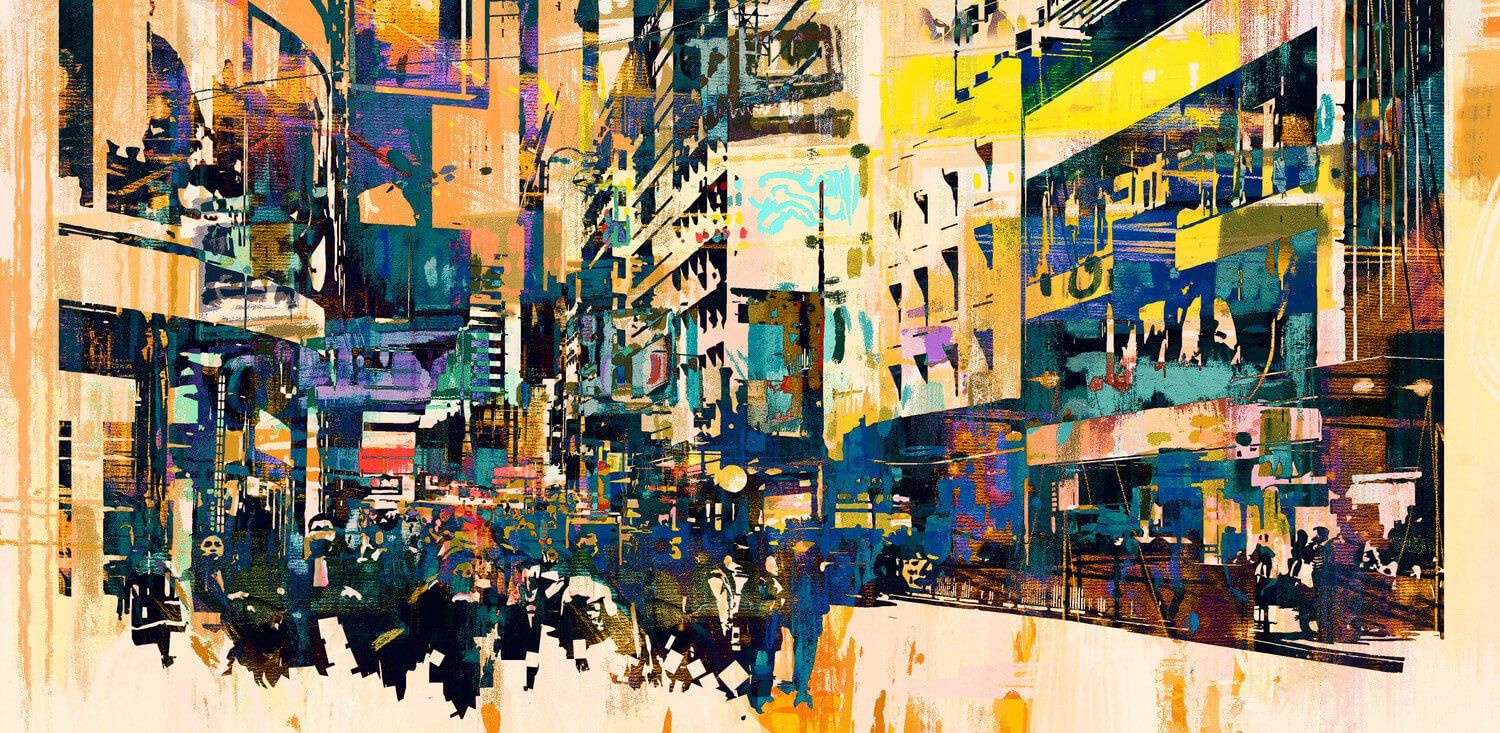

Goldin’s company is doing something similar to IBM, but only on the surface. Its approach is much different, and it has been secretly funded by unknown angel investors. And Goldin said in an interview with VentureBeat that the company has already generated $20 million in revenue and is actively engaged in hyperscale computing companies and Fortune 500 companies in the aerospace, banking, health care, hospitality, and insurance industries. The mission is a fundamental transformation of the computing world, Goldin said.

Read more