Immortalists magazine issue no. 5 is out smile

It is predicted that a pandemic of psychological and societal injuries is to come as we face financial and emotional crises across the globe.

As the pandemic’s economic toll grows around the world, some experts fear it could harm science for decades by putting many thousands of researchers out of work and forcing nations to slash funding as they rebuild societies. Others say the pandemic could highlight the importance of science and spur long-term support, especially for basic research, much as the Second World War did.

Financial crises could spell trouble for science budgets but spending could surge in some countries: part 2 in a series on science after the pandemic.

Researchers in Italy have melded the emerging science of convolutional neural networks (CNNs) with deep learning — a discipline within artificial intelligence — to achieve a system of market forecasting with the potential for greater gains and fewer losses than previous attempts to use AI methods to manage stock portfolios. The team, led by Prof. Silvio Barra at the University of Cagliari, published their findings on IEEE/CAA Journal of Automatica Sinica.

The University of Cagliari-based team set out to create an AI-managed “buy and hold” (B&H) strategy — a system of deciding whether to take one of three possible actions — a long action (buying a stock and selling it before the market closes), a short action (selling a stock, then buying it back before the market closes), and a hold (deciding not to invest in a stock that day). At the heart of their proposed system is an automated cycle of analyzing layered images generated from current and past market data. Older B&H systems based their decisions on machine learning, a discipline that leans heavily on predictions based on past performance.

By letting their proposed network analyze current data layered over past data, they are taking market forecasting a step further, allowing for a type of learning that more closely mirrors the intuition of a seasoned investor rather than a robot. Their proposed network can adjust its buy/sell thresholds based on what is happening both in the present moment and the past. Taking into account present-day factors increases the yield over both random guessing and trading algorithms not capable of real-time learning.

The fast and efficient generation of random numbers has long been an important challenge. For centuries, games of chance have relied on the roll of a die, the flip of a coin, or the shuffling of cards to bring some randomness into the proceedings. In the second half of the 20th century, computers started taking over that role, for applications in cryptography, statistics, and artificial intelligence, as well as for various simulations—climatic, epidemiological, financial, and so forth.

https://facebook.com/LongevityFB https://instagram.com/longevityyy https://twitter.com/Longevityyyyy https://linkedin.com/company/longevityy

- Please also subscribe and hit the notification bell and click “all” on these YouTube channels:

https://youtube.com/Transhumania

https://youtube.com/BrentNally

https://youtube.com/EternalLifeFan

https://youtube.com/MaxEternalLife

https://youtube.com/LifespanIO

https://youtube.com/LifeXTenShow

https://youtube.com/BitcoinComOfficialChannel

https://youtube.com/RogerVer

https://youtube.com/RichardHeart

https://youtube.com/sciVive

Follow Peter Voss on social media:

Tweets by peterevoss

https://linkedin.com/in/vosspeter

https://facebook.com/petervoss

https://medium.com/@petervoss

Check out projects Peter focuses on:

https://agiinnovations.com

http://optimal.org/voss.html

SHOW NOTES

2:31 Who is Peter Voss and what is Ai-GO? https://aigo.ai

6:51 Problems with AGI: Cognitive-Psychology, Mathematics, and Intelligence

10:12 AI and Life-Extension : Robotic surgeons, machine learning, and gero-disease modeling

14:03 Artificial General Intelligence (AGI) VS Artificial Narrow Intelligence (ANI)

19:41 Will Ai and Life-extension ever intersect? : similarities, funding, and the “Narrow AI-Trap“

24:37 Virtual Medical Assistants and Personalized-Medicine

28:28 Can Death-Anxiety lead to self-aware A.I? : Chatbots VS Metacognition

30:34 Is Quantum Computing necessary for AGI? : The “Quantum Supremacy” Grift

33:02 Is there “Moore’s Law” growth in Quantum-Computing? : The Error-Correction problem

35:27 Does consciousness arises at the atomic level? : Penrose-Hammeroff ORCH/OR Theory

41:12 “Being and Time” : Language, grounding concepts, and Voss’s “Hellen-Hawking” theory of A.I

46:32 Voss’ Life-Extension Praxis : Cryonics, Caloric Restriction, Sleep and Longevity Escape Velocity

49:25 Call-to-Action : Business, Marketing, and Financial Escape Velocity

1:02:02 1st Wave A.I (logic trees), 2nd Wave A.I (neural networks), & 3rd-Wave A.I (adaptive architecture)

1:06:31 Elon Musk, Open-AI, and Government regulation of Voss’s approach to A.I (adaptive)

1:10:00 Using A.I based Epidemiology models to prevent Pandemics (Coronavirus/Covid-19)

1:11:51 Where will A.I be in the next 10 years? : Voss VS Kurzweil

1:15:33 Intelligence Explosion : Could AGI ever become ASI? (Artificial Super Intelligence)

1:19:00 Hollywood on AI : Terminator, Ex Machina, Her, Millenial Man

1:19:43 Conclusion : What can we do to help fund AGI?

Moderna’s stock price skyrocketed as much as 30% on Monday after the biotech company announced promising early results for its coronavirus vaccine. As ordinary investors piled in, two insiders were quietly heading for the exits.

Moderna’s chief financial officer and chief medical officer executed options and sold nearly $30 million of shares combined on Monday and Tuesday, SEC filings reviewed by CNN Business show.

The sales occurred after Moderna (MRNA) excited Wall Street before markets opened Monday by announcing encouraging vaccine trial results. Moderna’s market value swelled to $29 billion — even though the company has no marketed products.

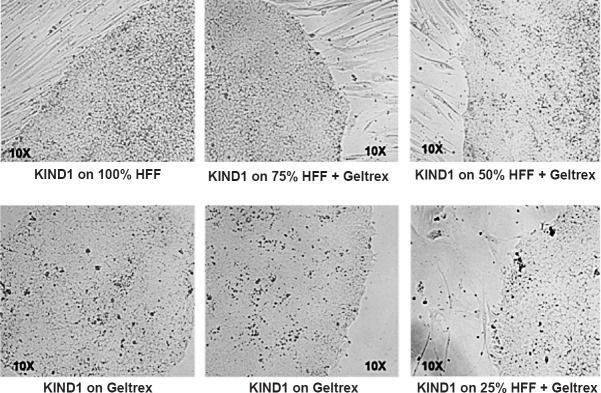

Various stem cell sources are being explored to treat diabetes since the proof-of-concept for cell therapy was laid down by transplanting cadaveric islets as a part of Edmonton protocol in 2000. Human embryonic stem (hES) cells derived pancreatic progenitors have got US-FDA approval to be used in clinical trials to treat type 1 diabetes mellitus (T1DM). However, these progenitors more closely resemble their foetal counterparts and thus whether they will provide long-term regeneration of adult human pancreas remains to be demonstrated. In addition to lifestyle changes and administration of insulin sensitizers, regeneration of islets from endogenous pancreatic stem cells may benefit T2DM patients. The true identity of pancreatic stem cells, whether these exist or not, whether regeneration involves reduplication of existing islets or ductal epithelial cells transdifferentiate, remains a highly controversial area. We have recently demonstrated that a novel population of very small embryonic-like stem cells (VSELs) is involved during regeneration of adult mouse pancreas after partial-pancreatectomy. VSELs (pluripotent stem cells in adult organs) should be appreciated as an alternative for regenerative medicine as these are autologous (thus immune rejection issues do not exist) with no associated risk of teratoma formation. T2DM is a result of VSELs dysfunction with age and uncontrolled proliferation of VSELs possibly results in pancreatic cancer. Extensive brainstorming and financial support are required to exploit the potential of endogenous VSELs to regenerate the pancreas in a patient with diabetes.

Diabetes is one of the major non-communicable diseases in the world with majority of patients belonging to India, China and USA. Along with associated complications like heart disease and stroke, diabetes results in increased morbidity and mortality and it is expected that by the year 2025, India alone will have more than 70 million diabetics1,2. Diabetes is a metabolic disorder associated with progressive loss or dysfunction of β-cells of pancreas. Onset of type 1 diabetes mellitus (T1DM) occurs when the β-cell mass is reduced to less than 20 per cent due to autoimmune effect, whereas the declining β-cell mass is unable to meet the age-related increased insulin demands of the body in type 2 (T2DM) as a result of insulin resistance and in due course the β-cells are lost by apoptosis. Thus, in both T1 and T2DM, restoration of a functional β-cell mass constitutes the central goal of diabetes therapy.

From navigation to remote banking, mobile device users rely on a variety of applications to streamline daily tasks, communicate, and dramatically increase productivity. While exceedingly useful, the ecosystem of third-party applications utilizes a number of sensors – microphones, GPS, pedometers, cameras – and user interactions to collect data used to enable functionality. Troves of sensitive personal data about users are accessible to these applications and as defense and commercial mobile device users become increasingly reliant on the technology, there are growing concerns around the challenge this creates for preserving user privacy.

Under DARPA’s Brandeis program, a team of researchers led by Two Six Labs and Raytheon BBN Technologies have developed a platform called Privacy Enhancements for Android (PE for Android) to explore more expressive concepts in regulating access to private information on mobile devices. PE for Android seeks to create an extensible privacy system that abstracts away the details of various privacy-preserving technologies, allowing application developers to utilize state-of-the-art privacy techniques, such as secure multi-party computation and differential privacy, without knowledge of their underlying esoteric technologies. Importantly, PE for Android allows mobile device users to take ownership of their private information by presenting them with more intuitive controls and permission enforcement options.

The researchers behind PE for Android today released a white paper detailing the platform’s capabilities and functionality, and published an open source release of its code to GitHub. In open sourcing PE for Android, the researchers aim to make it easier for the open-source Android community and researchers to employ enhanced privacy-preserving technologies within Android apps while also encouraging them to help address the platform’s current limitations and build upon its initial efforts.

Bitcoin News.

Visa International has filed for a cryptocurrency system patent that is meant to replace physical currency. The system, which utilizes both central banks and commercial banks, leverages a private blockchain to improve the payment ecosystem.

The United States Patent and Trademark Office (USPTO) published on Thursday a patent application entitled “digital fiat currency,” filed by Visa International Service Association on Nov. 8, 2019.

The filing is for a fiat-linked cryptocurrency system using “a private permissioned distributed ledger platform.” It describes a central computer, its responsibilities, and key roles of the system: central entities, validating entities, redeeming entities, and users. “A central entity may be a central bank, which regulates a monetary supply,” the document details. Validating entities “are blockchain nodes, which may be peers such as banks.” Redeeming entities “may accept physical currency for exchange for digital fiat currency,” such as an ATM or a bank branch location.

As expected, they discovered large fluctuations in the composition and daily changes of the human and mouse gut microbiomes. But strikingly, these apparently chaotic fluctuations followed several elegant ecological laws.

“Similar to many animal ecologies and complex financial markets, a healthy gut microbiome is never truly at equilibrium,” Vitkup says. “For example, the number of a particular bacterial species on day one is never the same on day two, and so on. It constantly fluctuates, like stocks in a financial market or number of animals in a valley, but these fluctuations are not arbitrary. In fact, they follow predictable patterns described by Taylor’s power law, a well-established principle in animal ecology that describe how fluctuations are related to the relative number of bacteria for different species.”

Other discovered laws of the gut microbiome also followed principles frequently observed in animal ecologies and economic systems, including the tendency of gut bacteria abundances to slowly but predictably drift over time and the tendency of species to appear and disappear from the gut microbiome at predictable times.

“It is amazing that microscopic biological communities—which are about six orders of magnitude smaller than macroscopic ecosystems analyzed previously—appear to be governed by a similar set of mathematical and statistical principles,” says Vitkup.

Laws allow identification of abnormal bacterial behavior.

These universal principles should help researchers to better understand what processes govern the microbial dynamics in the gut. Using the statistical laws, the Columbia researchers were able to identify particular bacterial species with abnormal fluctuations. These wildly fluctuating bacteria were associated with documented periods of gut distress or travel to foreign countries in humans providing data for the study. Thus, this approach may immediately allow researchers to understand and identify which specific bacteria are out of line and behave in a potentially harmful fashion.

Using mice data, the researchers also observed that microbiomes associated with unhealthy high fat diets drift in time significantly faster compared with microbiomes feeding on healthier high fiber diets. This demonstrates that ecological laws can be applied to understand how various dietary changes may affect and perhaps alleviate persistent microbiome instabilities.

Gut microbiome as miniature ecological laboratory.

The study by Columbia researchers also opens an exciting opportunity to use the gut microbial communities as a model system for exploring general ecological relationships. “Ecologists have debated for years why and how these natural ecological laws arise, without any clear answers,” says Vitkup. “Previous ecological research has been mostly limited to observational studies, which can take decades to perform for animals and plants. And some key experiments, such as additions or removal of particular species simply cannot be performed.”

The fluctuations of gut microbial communities follow ecological principles developed for animals and financial markets, which may help to predict disease biomarkers and effects of unhealthy diets.