That may not be fair to SpaceX, but it’s a good deal for taxpayers.

Category: economics

James Hughes : “Great convo with Yuval Harari, touching on algorithmic governance, the perils of being a big thinker when democracy is under attack, the need for transnational governance, the threats of automation to the developing world, the practical details of UBI, and a lot more.”

In this episode of the Waking Up podcast, Sam Harris speaks with Yuval Noah Harari about his new book 21 Lessons for the 21st Century. They discuss the importance of meditation for his intellectual life, the primacy of stories, the need to revise our fundamental assumptions about human civilization, the threats to liberal democracy, a world without work, universal basic income, the virtues of nationalism, the implications of AI and automation, and other topics.

Yuval Noah Harari has a PhD in History from the University of Oxford and lectures at the Hebrew University of Jerusalem, specializing in world history. His books have been translated into 50+ languages, with 12+ million copies sold worldwide. Sapiens: A Brief History of Humankind looked deep into our past, Homo Deus: A Brief History of Tomorrow considered far-future scenarios, and 21 Lessons for the 21st Century focuses on the biggest questions of the present moment.

Twitter: @harari_yuval

Want to support the Waking Up podcast?

Please visit: http://www.samharris.org/support

Get Sam’s email newsletter: https://www.samharris.org/email_signup

This thesis has been rolling around like a marble in the bowl of a lot of people’s brains for a while now, and many of those marbles were handed out by Martin Ford, in his 2015 book, “Rise of the Robots: Technology and the Threat of a Jobless Future.” In the book, and in an essay in “Confronting Dystopia: The New Technological Revolution and the Future of Work” (Cornell), Ford acknowledges that all other earlier robot-invasion panics were unfounded. In the nineteenth century, people who worked on farms lost their jobs when agricultural processes were mechanized, but they eventually earned more money working in factories. In the twentieth century, automation of industrial production led to warnings about “unprecedented economic and social disorder.” Instead, displaced factory workers moved into service jobs. Machines eliminate jobs; rising productivity creates new jobs.

Probably, but don’t count yourself out.

With the price of a bitcoin surging to new highs in 2017, the bullish case for investors might seem so obvious it does not need stating. Alternatively it may seem foolish to invest in a digital asset that isn’t backed by any commodity or government and whose price rise has prompted some to compare it to the tulip mania or the dot-com bubble. Neither is true; the bullish case for Bitcoin is compelling but far from obvious. There are significant risks to investing in Bitcoin, but, as I will argue, there is still an immense opportunity.

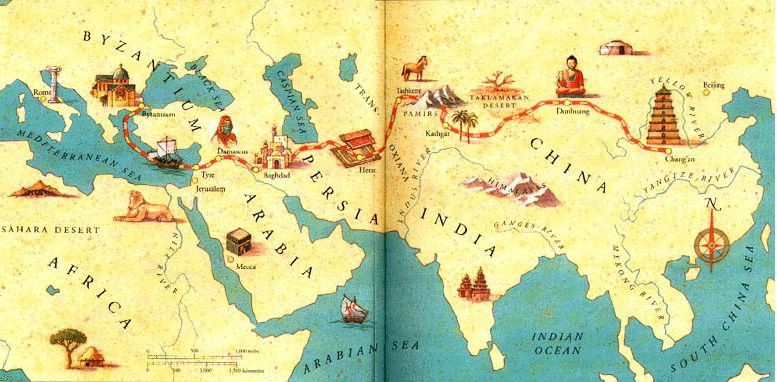

Never in the history of the world had it been possible to transfer value between distant peoples without relying on a trusted intermediary, such as a bank or government. In 2008 Satoshi Nakamoto, whose identity is still unknown, published a 9 page solution to a long-standing problem of computer science known as the Byzantine General’s Problem. Nakamoto’s solution and the system he built from it — Bitcoin — allowed, for the first time ever, value to be quickly transferred, at great distance, in a completely trustless way. The ramifications of the creation of Bitcoin are so profound for both economics and computer science that Nakamoto should rightly be the first person to qualify for both a Nobel prize in Economics and the Turing award.

For an investor the salient fact of the invention of Bitcoin is the creation of a new scarce digital good — bitcoins. Bitcoins are transferable digital tokens that are created on the Bitcoin network in a process known as “mining”. Bitcoin mining is roughly analogous to gold mining except that production follows a designed, predictable schedule. By design, only 21 million bitcoins will ever be mined and most of these already have been — approximately 16.8 million bitcoins have been mined at the time of writing. Every four years the number of bitcoins produced by mining halves and the production of new bitcoins will end completely by the year 2140.

This next wave of automation won’t just be sleek robotic arms on factory floors. It will be ordering kiosks, self-service apps and software smart enough to perfect schedules and cut down on the workers needed to cover a shift. Employers are already testing these systems. A recession will force them into the mainstream.

Robots’ infiltration of the workforce doesn’t happen gradually, at the pace of technology. It happens in surges, when companies are given strong incentives to tackle the difficult task of automation.

Typically, those incentives occur during recessions. Employers slash payrolls going into a downturn and, out of necessity, turn to software or machinery to take over the tasks once performed by their laid-off workers as business begins to recover.

As uncertainty soars, a shutdown drags on, and consumer confidence sputters, economists increasingly predict a recession this year or next. Whenever this long economic expansion ends, the robots will be ready. The human labor market is tight, with the unemployment rate at 3.9 percent, but there’s plenty of slack in the robot labor force.

By Ian Christensen, Ian Lange, George Sowers, Angel Abbud-Madrid, Morgan Bazilian

Space has long captured the human imagination—as a source of wonder, a place of discovery, a realm for aspirations. But increasingly, space is viewed as a frontier of economic opportunity as scientists, technologists, and entrepreneurs invest their ingenuity and wealth to bring the vastness of space within human grasp.

This economic development hinges on an ability to utilize what we term “space resources.” The resources in just the inner solar system are nearly infinite compared with those on Earth. For example, one large metallic asteroid such as 16 Psyche is thought to contain enough metals to last humans for millions of years at current consumption rates. And society has barely scratched the surface in harnessing the energy of the sun. Accessing space resources is increasingly important as the world confronts the finite nature of resources and the increasing environmental and social costs to develop them.

There are 1.4 billion insects for each one of us. Though you often need a microscope to see them, insects are “the lever pullers of the world,” says David MacNeal, author of Bugged. They do everything from feeding us to cleaning up waste to generating $57 billion for the U.S. economy alone.

Today, many species are faced with extinction. When National Geographic caught up with MacNeal in Los Angeles, he explained why this would be catastrophic for life on Earth and why a genetically engineered bee could save hives—and our food supply—worldwide.