The United States Internal Revenue Service has announced a bounty of up to $625,000 to anyone who can crack Monero’s privacy.

Listen to article.

Federal Reserve Governor Lael Brainard provided a broad description of the Fed’s ongoing research and plans in the potential development of a U.S. central bank digital currency (CBDC), also described in the U.S. as a Digital Dollar. Brainard, who has for years led the discussion at the Fed on distributed ledger technology and digital currencies, noted the Fed is active in conducting research and experimentation in these areas.

In her speech to during Federal Reserve ‘Innovation Office Hours’ at the Federal Reserve Bank of San Francisco today, Brainard noted, “Given the dollar’s important role, it is essential that the Federal Reserve remain on the frontier of research and policy development regarding CBDCs. As part of this research, central banks are exploring the potential of innovative technologies to offer a digital equivalent of cash…We are continuing to assess the opportunities and challenges of, as well as the use cases for, a CBDC, as a complement to cash and other payments options.”

Brainard described ‘in-house experiments’ at the ‘Board Technology Lab’, where a multidisciplinary team of application developers from the Federal Reserve Banks of Cleveland, Dallas, and New York helps support a policy team at the Board studying the “implications of digital currencies on the payments ecosystem, monetary policy, financial stability, banking and finance, and consumer protection.”

First Twitter and now YouTube is under attack by hackers promoting Bitcoin scams through live broadcasts using old Elon Musk speeches and a fake broadcast of the launch that SpaceX and NASA made last week. The hackers appear to have compromised several high-profile YouTube channels and today the account of youtuber Jon Prosser was the object of this attack, his channel is broadcasting with 40 thousand viewers and the attackers have already received around 4 thousand dollars in Bitcoins.

It may also interest you: What are cryptocurrencies?

Last week there were several reports that people who wanted to see the launch of the SpaceX clicked on videos that looked official and that they were posted by seemingly legitimate YouTube channels with hundreds of thousands of subscribers and were found with messages from “Bitcoin giveaway” urging them to send Bitcoin for double cash back, a common scam tactic. Today Jon Prosser reports that something similar is happening on his channel.

Victims included Democratic presidential candidate Joe Biden, former President Barack Obama and Tesla CEO Elon Musk. Accounts for those people, and others, posted tweets asking followers to send bitcoin to a specific anonymous address.

For their efforts, the scammers received over 400 payments in bitcoin, with a total value of $121,000 at Thursday’s exchange rate, according to an analysis of the Bitcoin blockchain performed by Elliptic, a cryptocurrency compliance firm.

Elliptic co-founder Tom Robinson said it’s a low sum for what appears to be a historic hack that Twitter said involved an insider.

The Bank of Canada is considering launching a digital currency that would help it combat the “direct threat” of cryptocurrencies and collect more information on how people spend their money, The Logic has learned.

An internal Bank of Canada presentation, prepared for Governor Stephen Poloz and the bank’s board of directors, offers the most detailed public insight yet into the bank’s thinking on a proprietary digital coin. According to the presentation, the currency would be widely available. It would initially coexist with coins and paper money, eventually replacing them completely.

Scammers are everywhere now.

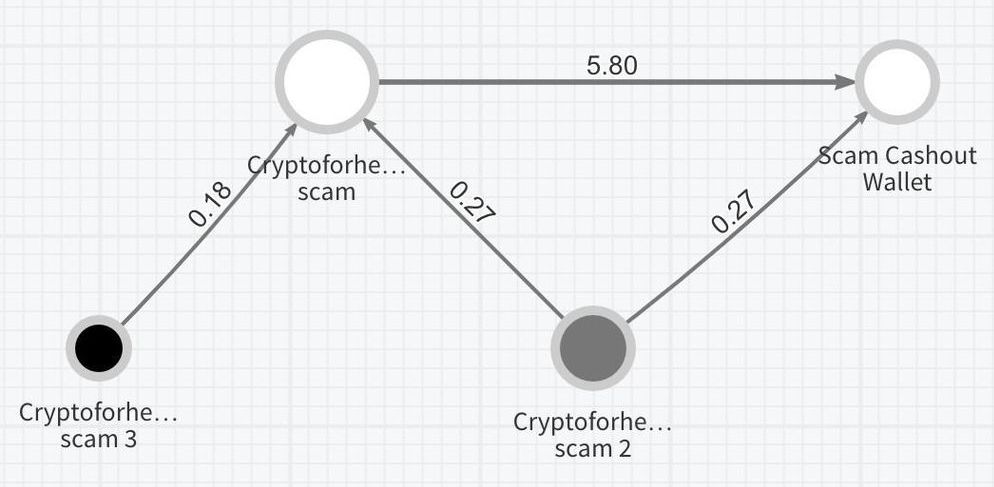

The defrauded bitcoin amassed during Wednesday’s monumental Twitter hack is already “on the move,” according to cryptocurrency tracing firm Chainalysis.

Many consumers may have heard of blockchain technology, especially in relation to cryptocurrency. However, they may not be aware of its full potential and impact across industries. Blockchain has the potential to simplify and add greater security to data management, and since its inception, this technology has quietly been changing business processes.

To get further insights, we asked the members of Forbes Technology Council to share some ways blockchain has changed (or will soon change) business. Their best answers are below.

Photo:

Many economists, however, are sceptical whether the impact of the digital yuan would significantly spread beyond its borders without official reforms to relax the yuan’s exchange rate convertibility.

China’s sovereign digital currency could be launched later this year, with the likes of Alibaba’s Alipay and Tencent’s WeChat Pay already popular payment methods.

Bitcoin News.

Visa International has filed for a cryptocurrency system patent that is meant to replace physical currency. The system, which utilizes both central banks and commercial banks, leverages a private blockchain to improve the payment ecosystem.

The United States Patent and Trademark Office (USPTO) published on Thursday a patent application entitled “digital fiat currency,” filed by Visa International Service Association on Nov. 8, 2019.

The filing is for a fiat-linked cryptocurrency system using “a private permissioned distributed ledger platform.” It describes a central computer, its responsibilities, and key roles of the system: central entities, validating entities, redeeming entities, and users. “A central entity may be a central bank, which regulates a monetary supply,” the document details. Validating entities “are blockchain nodes, which may be peers such as banks.” Redeeming entities “may accept physical currency for exchange for digital fiat currency,” such as an ATM or a bank branch location.