The ups and downs of Bitcoin as an internet currency may be compared to the eventual demise of Google Glass due to its lack of purpose among consumers. While it does not significantly hold true for bitcoins, which apparently have a more supportive and enthusiastic followers, the path that these two have taken and will take may be substantially similar than we like to admit.

For one, Bitcoin’s staggering price decline in the recent days left some people wondering what road it will eventually take in the near future. Is it only taking a detour or is it bound for a dead end?

In the case of Google Glass, it received much attention during its inception a few years ago. It was even named by Time magazine one of the best innovations of 2012. However, despite the ingenuity behind a supposed-to-be groundbreaking invention, Google Glass lacked a tangible sense, its purpose incoherent.

Thus, after much speculation, Google recently announced that it would stop selling Glass and that the product would no longer be developed in their research division.

Will Bitcoin End Up Like Google Glass?

Google Glass and Bitcoin are connected by the revolutionary technology that made them a star in the first place. There was some genius work in each of the piece, there’s no doubt about that, but without a clear purpose of how to integrate each product into the mainstream society, it becomes pointless.

Fortunately, bitcoins may stand a chance. Though there’s a portion of the populace that thinks of bitcoins as the internet currency that’s only best suited for illegal activities, its original function, which is for faster and cheaper way of transacting online, still proves to be prevalent.

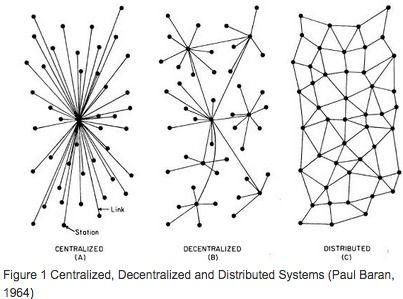

It’s true that bitcoins were way more fun before that they are now, but it cannot be denied that this cryptocurrency has opened doors for a myriad of possibilities and eliminated security vulnerabilities, in which financial institutions such as banks and credit card companies are relatively known for.

Unlike Google Glass, Bitcoin has a tangible sense, a coherent purpose, and a crystal-clear vision. That is to move around the internet with your money free from the control of the government or any institution. Since there’s nothing that precedes this work of art and technology, it has a chance of staying. Thus, Bitcoin’s game is far from over.