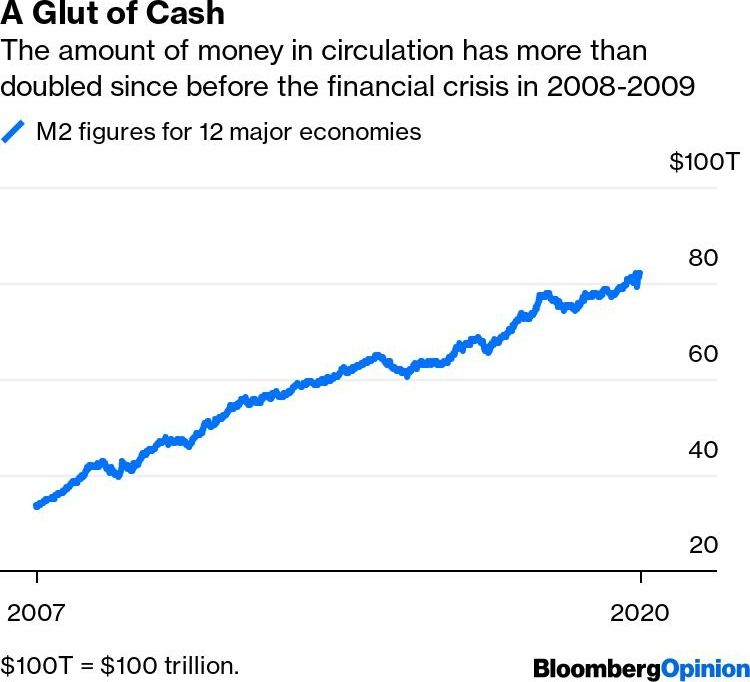

Doing “whatever it takes” to save the global economy from the coronavirus pandemic is going to cost a lot of money. The U.S. government alone is spending a few trillion dollars, and the Federal Reserve is creating another few trillion dollars to keep the financial system from collapsing. A custom Bloomberg index measuring M2 figures for 12 major economies including the U.S., China, euro zone and Japan shows their aggregate money supply had already more than doubled to $80 trillion from before the 2008–2009 financial crisis.

These numbers are so large that they no longer have any meaning; they are simply abstractions. It’s been some time since people thought about the concept of money and its purpose. The broad idea is that money has value, but that value is not arbitrary. Former Fed Chairman Paul Volcker once said in an interview that “it is a governmental responsibility to maintain the value of the currency they issue. And when they fail to do that, it is something that undermines an essential trust in government.”