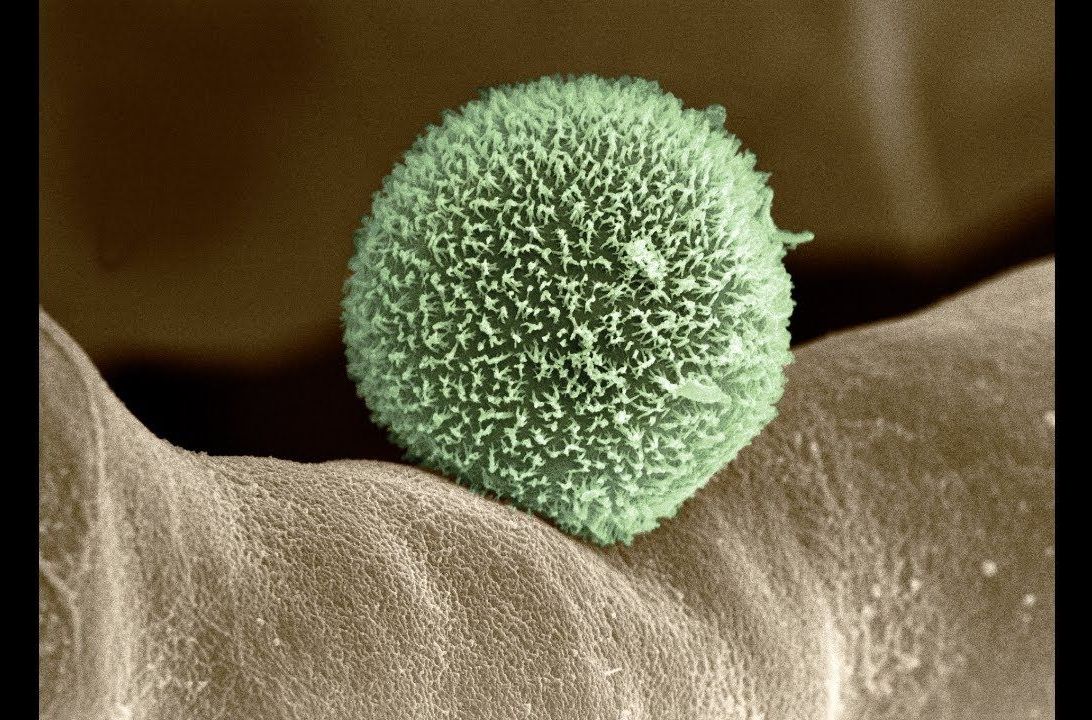

New research has revealed that fisetin – a natural flavonoid found in many fruits and vegetables – functions as an effective senolytic agent by clearing out damaged aging cells, improving health and extending lifespan.

Kudos to WallStreet analyst and advisor, Ric Edelman. He drank the Kool-Aid, he understands a profound sea change, and he sees the ducks starting to line up.

Check out the clearly articulated interview, below, with Bob Pisani at the New York Stock Exchange and legendary Wall Street advisor, Ric Edelman, (Not my term…That’s what CNBC anchor, Melissa Lee, calls him). Read between the lines, especially the last words in the video, below.

Ric Edleman has just joined Bitwise as both investor and advisor. This lends credibility and gravitas to the organization that created the world’s first cryptocurrency index fund. Bitwise benefits from Edelman’s affiliation, because the US has been slow (some would say “cautious”) in recognizing the facts on the ground: Cryptocurrency is already an asset class.

Edelman fully embraces a strong future for Bitcoin—not just as a currency or payment instrument, but as a legal and recognized asset class; one that is at the starting line of a wide open racetrack. He explains that the SEC sets a high bar for offering a Bitcoin ETF, but that this will be achieved. It will pave the way for large institutions, pension funds, etc to allocate a portion of money under management for blockchain products.

At timestamp 3:39, Melissa asks Edelman “Why wait for an ETF?” and “If you believe this strongly, why not advise clients to invest a portion of assets into Bitcoin right now?”

Edelman’s response is stunning. He explains that he is frustrated, because this is what he wants to advise. But, his firm is bound by the Investment Act of 1940—and so, they cannot tell a client “Go to Coinbase” or “Invest in a private fund such as Bitwise—that I am such a big fan of. We don’t have that ability in our practice.” [i.e. until the SEC recognizes Bitcoin as an asset].

In my opinion (and in the opinion of Edleman), SEC recognition of Bitcoin as an asset can’t be far off…

It’s not difficult to read between the lines. Edleman makes a clear recommendation, although he can not yet advise this—certainly not on the record. His personal forecast for long term adoption and appreciation, especially of Bitcoin, matches my own analysis. His new affiliation with Bitwise (a pretty bold move) demonstrates certain commitment.

This ends my analysis of Edelman’s strong endorsement. But it raises another important question:

If large financial institutions are likely to offer Bitcoin products

and services—and if credible analysts & advisors are chomping

at the bit to recommend this new asset class—shouldn’t we

invest in Bitcoin now?!

Ironically, I do not recommend hording or investing in cryptocurrency, even as a collectable. Why?! Because of the big “Investment Catch-22”. I don’t discourage investing in Bitcoin because I fear that its value will lessen. It is for a completely different reason. And so, my advice against investing is half-hearted.

Currently, Bitcoin and altcoins are widely misunderstood. Many people have these false impressions…

All of this is untrue, except the last item—and that one is a tremendous benefit.

Additionally, blockchain currencies fluctuate widely in real market purchasing power, many altcoins and all ICOs are scams, and acceptance is far from being ubiquitous. Clearly, widespread adoption requires stability, infrastructure, trust and ubiquity.

This cannot happen until two things occur:

Things are beginning to change, but for such a positive and transormative mechanism, that change is frustratingly gradual.

A series of falling dominos is already in process. But, the end game is retarded by those of us who invest in Bitcoin, because we are removing a limited resource from circulation and contributing to volatility. We do this, because we realize that—in the long run—Bitcoin can only go up in value. Yet, our investment at such an early stage (before consumer adoption) makes the infant sick.

Philip Raymond co-chairs CRYPSA, hosts the New York Bitcoin Event and is keynote speaker at Cryptocurrency Conferences. He advises The Disruption Experience in Singapore, sits on the New Money Systems board of Lifeboat Foundation and is a top Bitcoin writer at Quora. Book a presentation or consulting engagement.

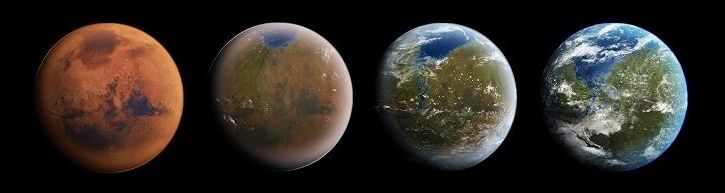

Throughout history, our species have come against great challenges which ultimately determined whether we survived or not. So far, we’ve made it to nearly the start of the third decade of the 21st century. And yet, even greater challenges stand before us today, forcing us, once again, to fight for our very existence.

Grand challenges stand before us that will ultimately determine whether we, as a species, will survive. With the help of science and technology, there may just be hope yet!

This evening, SpaceX is set to launch a used Falcon 9 rocket from California, a flight that will be followed by one of the company’s signature rocket landings. But this time around, SpaceX will attempt to land the vehicle on a concrete landing pad near the launch site — not a drone ship in the ocean. If successful, it’ll be the first time that the company does a ground landing on the West Coast.

Up until now, all of SpaceX’s ground landings have occurred out of Cape Canaveral, Florida, the company’s busiest launch site. SpaceX has two landing pads there, and has managed to touch down 11 Falcon 9 rockets on them. And each time the company has attempted to land on land, it’s been a success.

Elon Musk has had his fair share of questionable headlines recently, but it looks like he’s still out to do a little good in this world. In the midst of July’s rush to save the soccer team trapped in a Thai cave, Musk stated that he wanted to do something about the water contamination problem in Flint, Michigan. Now, according to a tweet made by Flint Community Schools, he’s making good on his promises.